Question

Harper Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and

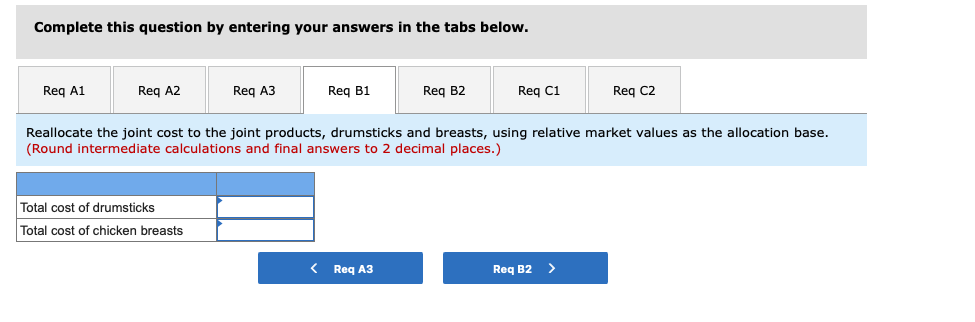

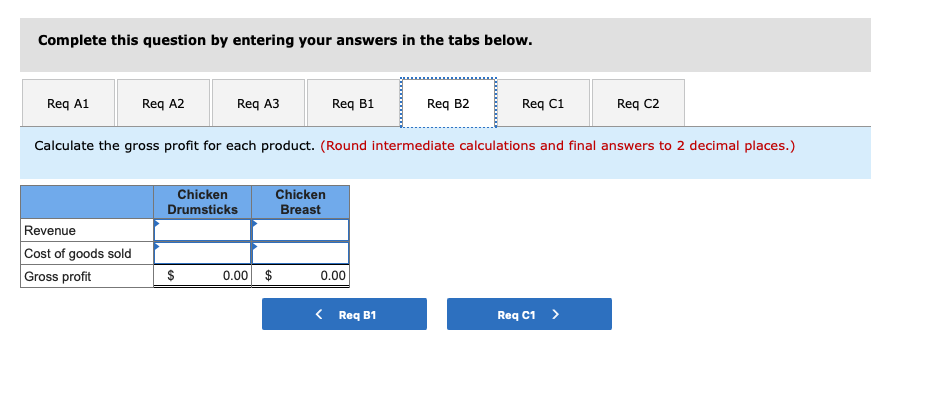

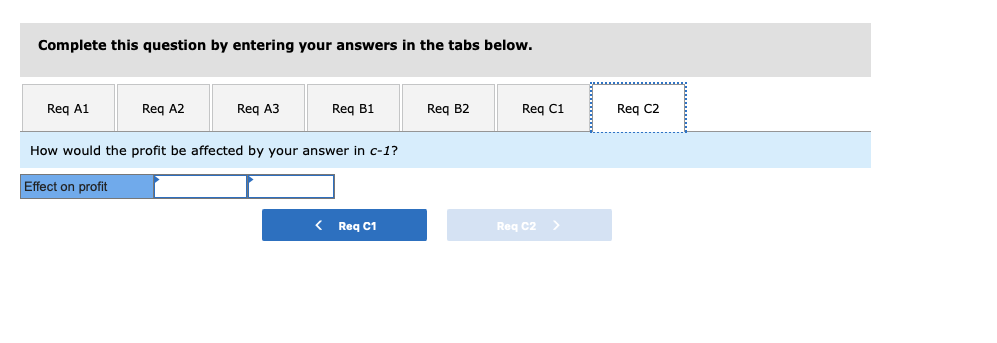

Harper Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,000. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Harper decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started