Answered step by step

Verified Expert Solution

Question

1 Approved Answer

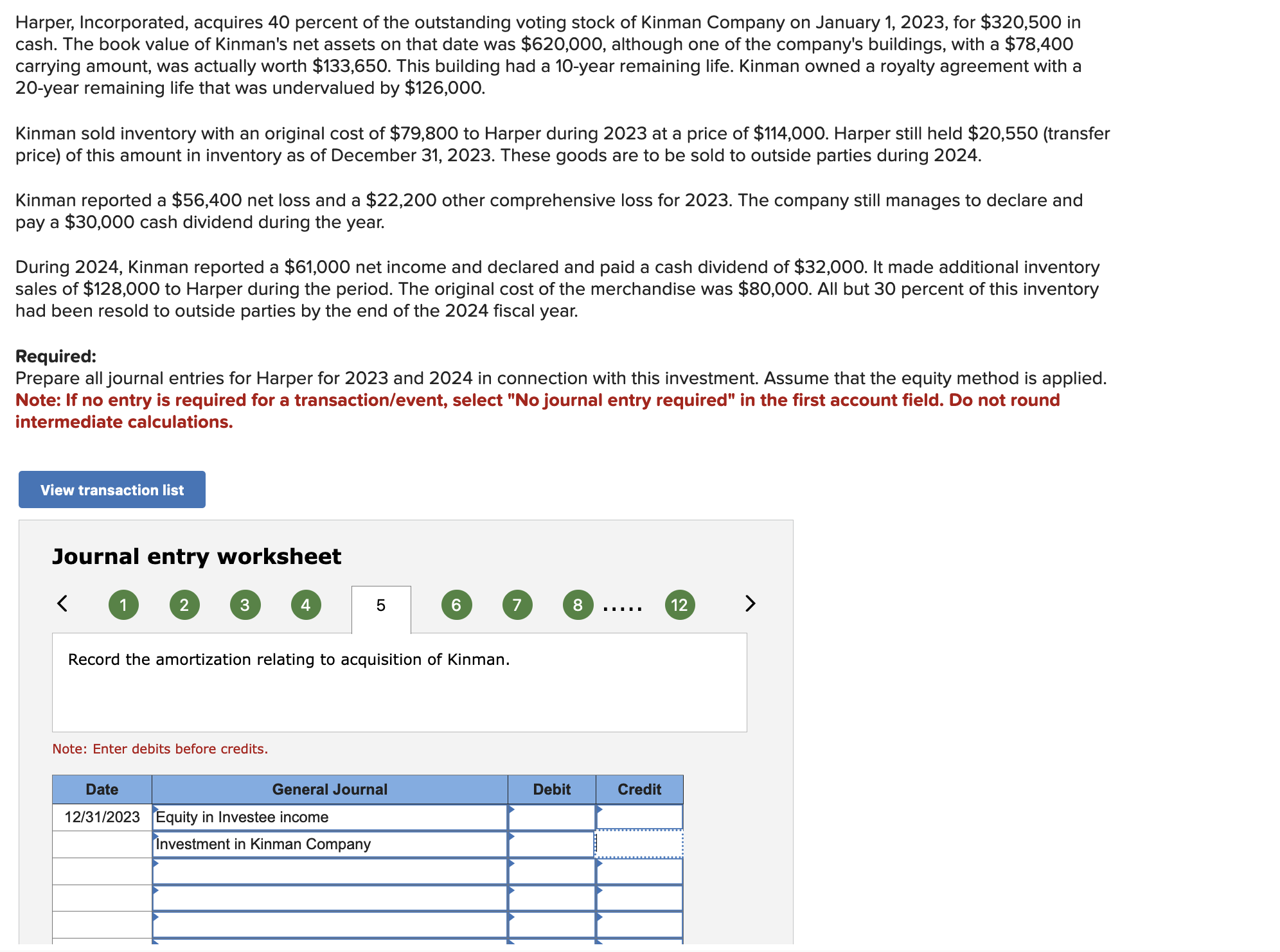

Harper, Incorporated, acquires 4 0 percent of the outstanding voting stock of Kinman Company on January 1 , 2 0 2 3 , for $

Harper, Incorporated, acquires percent of the outstanding voting stock of Kinman Company on January for $ in

cash. The book value of Kinman's net assets on that date was $ although one of the company's buildings, with a $

carrying amount, was actually worth $ This building had a year remaining life. Kinman owned a royalty agreement with a

year remaining life that was undervalued by $

Kinman sold inventory with an original cost of $ to Harper during at a price of $ Harper still held $transfer

price of this amount in inventory as of December These goods are to be sold to outside parties during

Kinman reported a $ net loss and a $ other comprehensive loss for The company still manages to declare and

pay a $ cash dividend during the year.

During Kinman reported a $ net income and declared and paid a cash dividend of $ It made additional inventory

sales of $ to Harper during the period. The original cost of the merchandise was $ All but percent of this inventory

had been resold to outside parties by the end of the fiscal year.

Required:

Prepare all journal entries for Harper for and in connection with this investment. Assume that the equity method is applied.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round

intermediate calculations.

Journal entry worksheet

Record the amortization relating to acquisition of Kinman.

Note: Enter debits before credits.

Please solve. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started