Question

Harper Industry is evaluating the replacement of an old machine. The old machine was purchased five years ago for RM1,750,000 and was depreciated using heavy

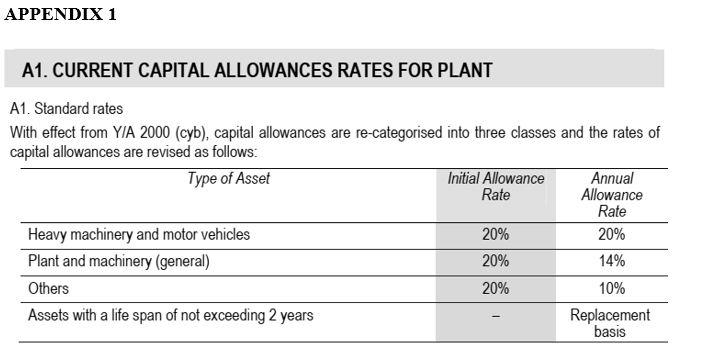

Harper Industry is evaluating the replacement of an old machine. The old machine was purchased five years ago for RM1,750,000 and was depreciated using heavy machinery criterion as provided in Appendix 1. The machine if replaced, could be sold for RM250,000. If not replaced, the machine's production capacity over the next several years will decline as it experiences increasing downtime. Since the company can sell all the product it can produce on the machine, downtime translates into lost sales. The vice president for operations estimates that the machine will produce products worth RM3,000,000 in 20x6. Beginning in 20x7, the sales from the machine is estimated to decline by 3 percent per year. If handled properly, the machine can be used for another five years. Fixed costs associated with this machine are RM750,000 for each of the five years and variable costs are estimated at 40 percent of sales for each of the five years. The machine is worthless five years from now.

Harper Industry is considering two alternative replacement machines. The first is a H20. The H20 will cost RM1,250,000, with an additional cost of RM20,000 for installation. H20 has a useful life of five years. The equipment is depreciated as heavy machinery where the depreciation rates are attached in Appendix 1. The H20 will have the same production capacity as the old one. Thus, in the first year of operation, 20x6, the H20 will produce RM3,000,000 in sales. In each of the following four years of operation, it will increase sales by 4.5 percent per year. Fixed costs will only be RM500,000 (excluding depreciation) for each year and variable costs are estimated at 41 percent of sales per year. At the end of five years, the machine will be worth RM500,000.

The alternative machine under consideration, a H30, will cost RM1,625,000 with RM25,000 installation costs. This machine is assumed to have a useful life of five years. The equipment is depreciated as heavy machinery where the depreciation rates are attached in Appendix 1. This machine will increase production capacity in 20x6 to RM3,250,000 and all produced product can be sold. For the remaining four years, sales will increase by 4.5 percent per year. Fixed costs are RM725,000 per year but variable costs are estimated to decline to 36 percent of sales. At the end of five years, the H30 is expected to be worth RM625,000.

Since both new machines will increase sales, an investment in net working capital is required. The H20 will require a RM150,000 investment in net working capital in 20x5 and the H30 will require a RM250,000 investment in the same year. Harper Industry estimates that this working capital investment can be recovered in the final year of operation.

Evaluate the attractiveness of both projects as compared to the old machine by using the net present value method. Use a cost of capital of 10% and a tax rate of 24%. What is your recommendation to Harper Industry management?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started