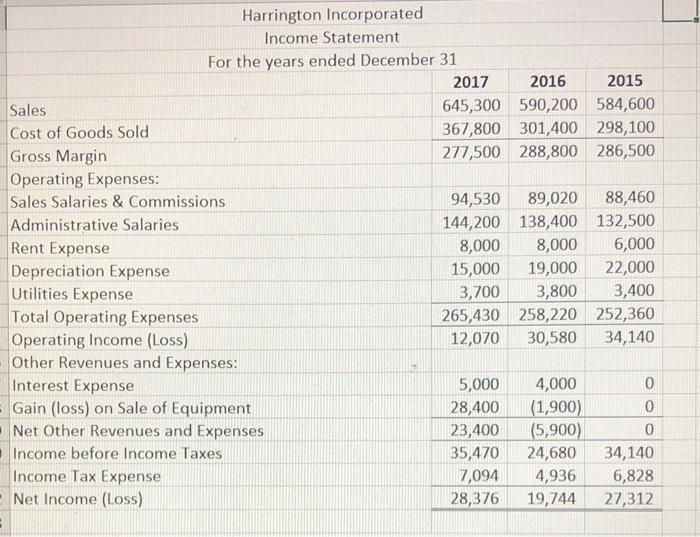

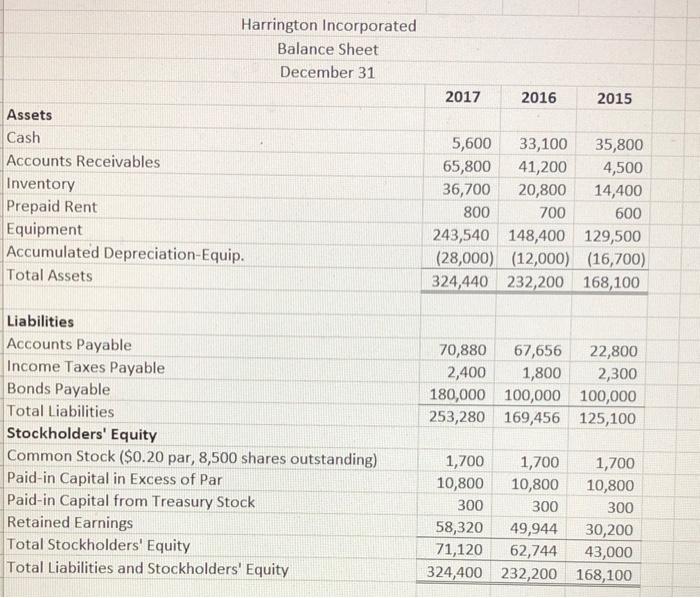

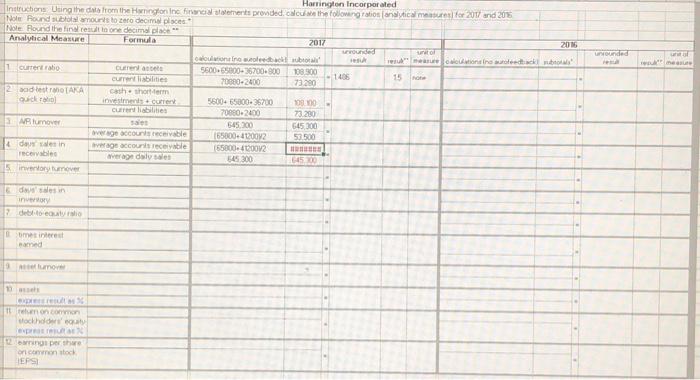

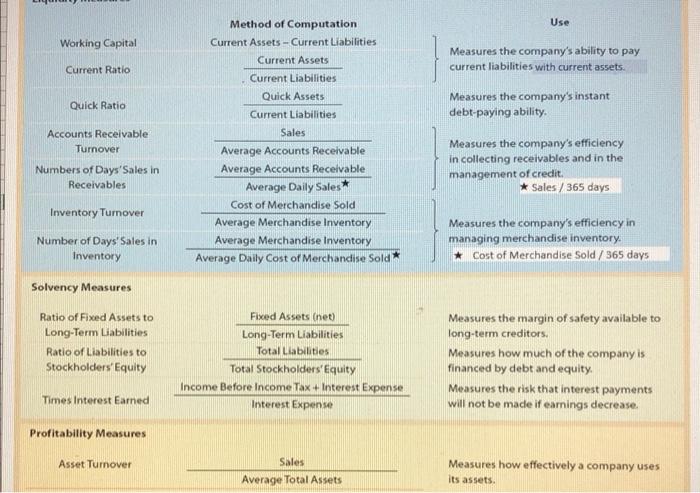

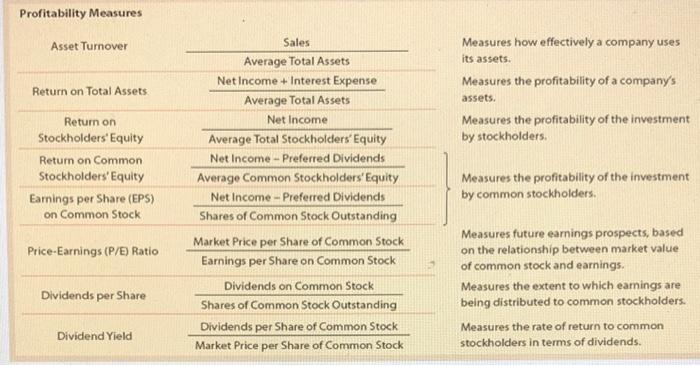

Harrington Incorporated Income Statement For the years ended December 31 2017 2016 2015 Sales 645,300 590,200 584,600 Cost of Goods Sold 367,800 301,400 298,100 Gross Margin 277,500 288,800 286,500 Operating Expenses: Sales Salaries & Commissions 94,530 89,020 88,460 Administrative Salaries 144,200 138,400 132,500 Rent Expense 8,000 8,000 6,000 Depreciation Expense 15,000 19,000 22,000 Utilities Expense 3,700 3,800 3,400 Total Operating Expenses 265,430 258,220 252,360 Operating Income (Loss) 12,070 30,580 34,140 Other Revenues and Expenses: Interest Expense 5,000 4,000 0 - Gain (loss) on Sale of Equipment 28,400 (1,900) 0 - Net Other Revenues and Expenses 23,400 (5,900) 0 Income before Income Taxes 35,470 24,680 34,140 Income Tax Expense 7,094 4,936 6,828 Net Income (Loss) 28,376 19,744 27,312 Harrington Incorporated Balance Sheet December 31 2017 2016 2015 Assets Cash Accounts Receivables Inventory Prepaid Rent Equipment Accumulated Depreciation-Equip. Total Assets 5,600 33,100 35,800 65,800 41,200 4,500 36,700 20,800 14,400 800 700 600 243,540 148,400 129,500 (28,000) (12,000) (16,700) 324,440 232,200 168,100 70,880 67,656 22,800 2,400 1,800 2,300 180,000 100,000 100,000 253,280 169,456 125,100 Liabilities Accounts Payable Income Taxes Payable Bonds Payable Total Liabilities Stockholders' Equity Common Stock ($0.20 par, 8,500 shares outstanding) Paid-in Capital in Excess of Par Paid-in Capital from Treasury Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 1,700 1,700 1,700 10,800 10,800 10,800 300 300 300 58,320 49,944 30,200 71,120 62,744 43,000 324,400 232,200 168,100 unrounded - 1405 Harrington Incorporated Instructions Using the data from the Hangon Inc financements provided. calcune the following rational care for 2017 and 20% Not Found substmounts to 2010 decimales Nole Round the final result in one decimal Analytical Measure Formula 2017 2016 rounde Olonne sowo caters the audio 1 currento Create 5600.6500036700-900 108.900 15 NO current abilities 70993-2000 73.290 2 adet LANA Cathshort-term Quick 5600.6580036700 90 Curabilities 70980200 73.200 Numover Sait 545.200 G45300 we accounts receivable 165000:1120012 53.500 4 dowwe in verage accounts receivable 155000 420012 recevable average dalle 545300 14500 5 inventory over deve in inve debout Dimenes tumore AUDI non common Istockholders' equity) EN 2non perhe or common stock EPS Use Working Capital Measures the company's ability to pay current liabilities with current assets. Current Ratio Quick Ratio Measures the company's instant debt-paying ability. Accounts Receivable Turnover Method of Computation Current Assets - Current Liabilities Current Assets Current Liabilities Quick Assets Current Liabilities Sales Average Accounts Receivable Average Accounts Receivable Average Daily Sales* Cost of Merchandise Sold Average Merchandise Inventory Average Merchandise Inventory Average Daily Cost of Merchandise Sold Numbers of Days' Sales in Receivables Measures the company's efficiency in collecting receivables and in the management of credit. Sales / 365 days Inventory Turnover Number of Days' Sales in Inventory Measures the company's efficiency in managing merchandise inventory. * Cost of Merchandise Sold / 365 days Solvency Measures Ratio of Fixed Assets to Long-Term Liabilities Ratio of Liabilities to Stockholders'Equity Fixed Assets (net) Long-Term Liabilities Total Liabilities Total Stockholders'Equity Income Before Income Tax + Interest Expenses Interest Expense Measures the margin of safety available to long-term creditors. Measures how much of the company is financed by debt and equity Measures the risk that interest payments will not be made if earnings decrease. Times Interest Earned Profitability Measures Asset Turnover Sales Average Total Assets Measures how effectively a company uses its assets Profitability Measures Asset Turnover Return on Total Assets Measures how effectively a company uses its assets. Measures the profitability of a company's assets. Measures the profitability of the investment by stockholders Return on Stockholders' Equity Return on Common Stockholders' Equity Earnings per Share (EPS) on Common Stock Sales Average Total Assets Net Income + Interest Expense Average Total Assets Net Income Average Total Stockholders' Equity Net Income - Preferred Dividends Average Common Stockholders' Equity Net Income - Preferred Dividends Shares of Common Stock Outstanding Market Price per Share of Common Stock Earnings per Share on Common Stock Dividends on Common Stock Shares of Common Stock Outstanding Dividends per Share of Common Stock Market Price per Share of Common Stock Measures the profitability of the investment by common stockholders. - Price-Earnings (P/E) Ratio Dividends per Share Measures future earnings prospects, based on the relationship between market value of common stock and earnings. Measures the extent to which earings are being distributed to common stockholders. Measures the rate of return to common stockholders in terms of dividends. Dividend Yield