Question

Harris Corp. is a technology start-up and is in its second year of operations. The company didnt purchase any assets this year but purchased the

Harris Corp. is a technology start-up and is in its second year of operations. The company didnt purchase any assets this year but purchased the following assets in the prior year:

| Asset | Placed in Service | Basis | |

| Office equipment | August 14 | $ | 10,000 |

| Manufacturing equipment | April 15 | 68,000 | |

| Computer system | June 1 | 16,000 | |

| Total | $ | 94,000 | |

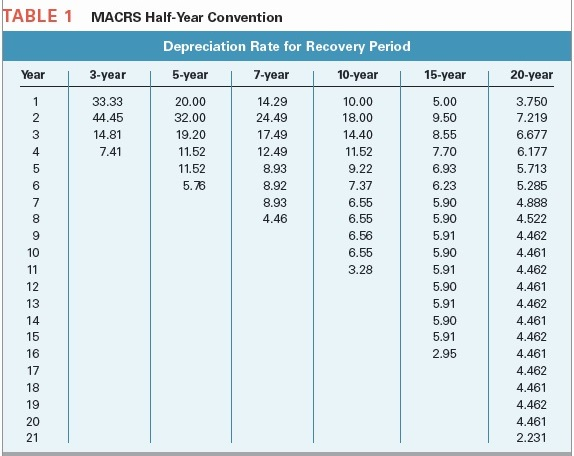

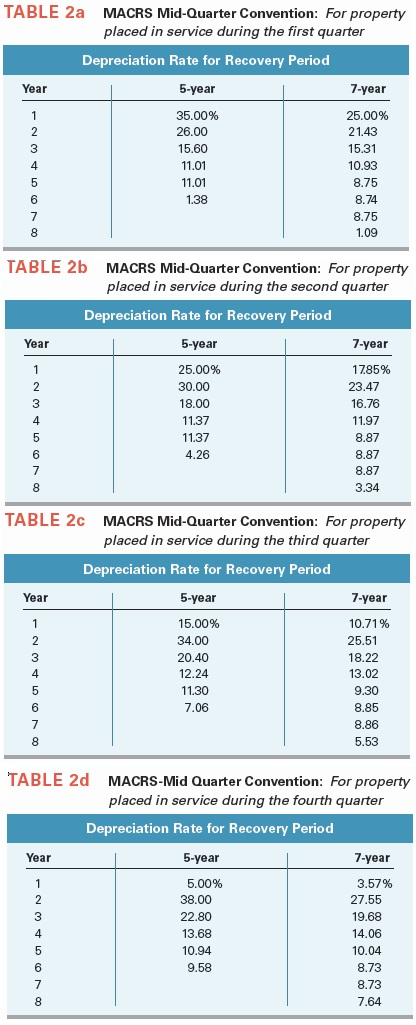

| Harris did not know depreciation was tax deductible until it hired an accountant this year and didnt claim any depreciation expense in its first year of operation. (Use MACRS Table 1 and Table 2.) Hint: It is asking for the maximum cost recovery, so all of the assets except the Luxury auto could take the 179 deduction. On the luxury auto they could take 20% bonus and the 3,160 limit on autos. |

| a. | What is the maximum amount of depreciation expense Harris Corp. can deduct in its second year of operation (ignore bonus and 179 expense)? |

b. What is the basis of the office equipment at the end of the second year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started