Question

Harry and Meghans (H&Ms) is Canadas largest producer and exporter of maple syrup. Their operations are expanded, so they need to invest in more bottling

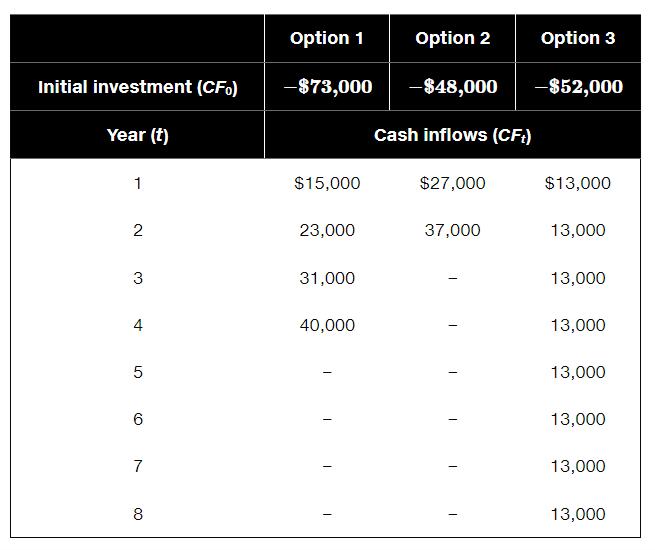

Harry and Meghan’s (H&Ms) is Canada’s largest producer and exporter of maple syrup. Their operations are expanded, so they need to invest in more bottling equipment. Three different models are available, each of which differs in terms of cost, capacity, and useful life. For now, H&Ms plans to invest in only one of the three options, and their cost of capital is 8%. H&M intends to operate far into the future and will replace bottling equipment as it wears out. The initial investment and annual cash inflows over the life of each project are given in the following table.

a - Calculate the NPV for each option over its life. Rank the options in descending order on the basis of NPV.

b - Use the annualized net present value (ANPV) approach to evaluate and rank the options in descending order on the basis of ANPV.

c - Compare and contrast your findings in parts a and b. Which option would you recommend that the firm purchase? Why?

Initial investment (CFD) Year (t) 1 2 3 4 5 6 7 8 Option 1 -$73,000 $15,000 23,000 31,000 40,000 Option 2 -$48,000 Cash inflows (CFt) $27,000 Option 3 -$52,000 37,000 $13,000 13,000 13,000 13,000 13,000 13,000 13,000 13,000

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer a b cIn parts a and b we evaluated the three options for purchasing bottling equipment using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started