Answered step by step

Verified Expert Solution

Question

1 Approved Answer

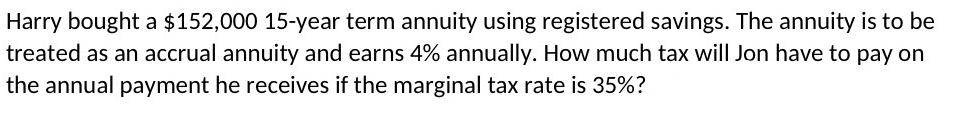

Harry bought a $152,000 15-year term annuity using registered savings. The annuity is to be treated as an accrual annuity and earns 4% annually.

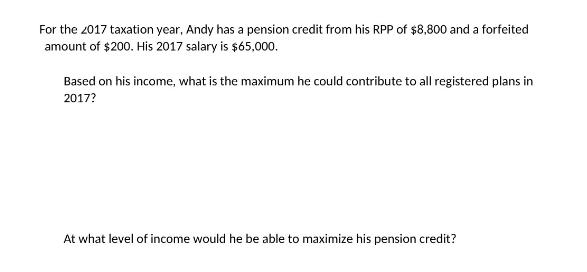

Harry bought a $152,000 15-year term annuity using registered savings. The annuity is to be treated as an accrual annuity and earns 4% annually. How much tax will Jon have to pay on the annual payment he receives if the marginal tax rate is 35%? For the 2017 taxation year, Andy has a pension credit from his RPP of $8,800 and a forfeited amount of $200. His 2017 salary is $65,000. Based on his income, what is the maximum he could contribute to all registered plans in 2017? At what level of income would he be able to maximize his pension credit?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the tax Jon will have to pay on the annual payment he receives from the annuity we first need to determine the annual payment amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started