Question

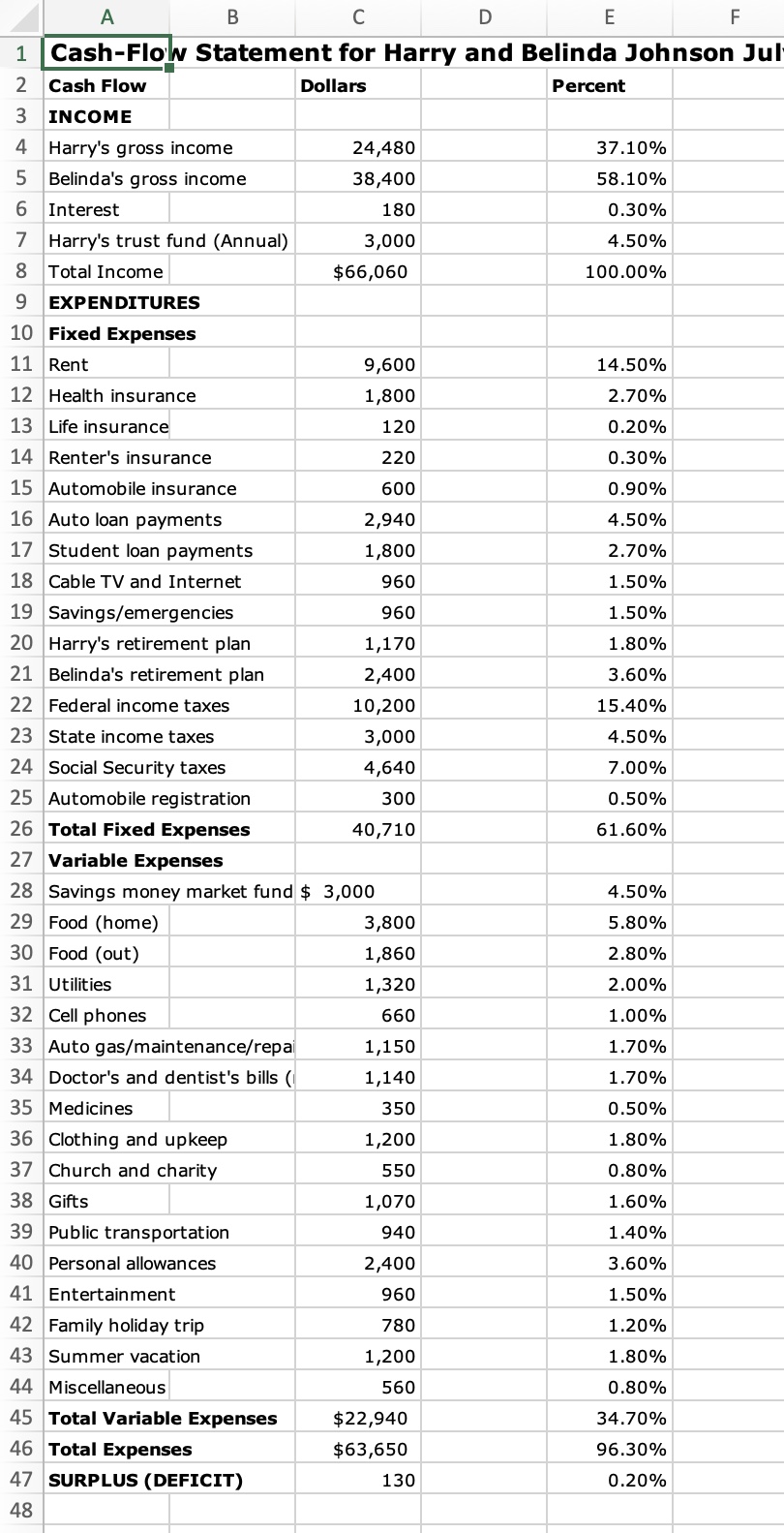

Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in

Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a trust fund set up by his deceased father's estate. Belinda earns a salary of $6,400 per month, and she has many job-related benefits including flexible benefits program, life insurance, health insurance, a 401(k) retirement program, workplace financial education, and a credit union. The Johnsons live in an old apartment located approximately halfway between their places of employment. However, their rent will increase by $100 a month in July. Harry drives about ten minutes to his job, and Belinda travels about 15 minutes via public transportation to reach her downtown job. Harry and Belinda's apartment is very nice, but small, and it is furnished primarily with furniture given to them by some of his friends. Soon after getting married, Harry and Belinda decided to begin their financial planning. Fortunately each had taken a college course in personal finance. After initial discussion, they worked together for three evenings to develop the financial statements presented below. Note that the cash flow statement covered the first six months of their marriage.

- Briefly describe how Harry and Belinda probably determined the fair market prices for each of their tangible and investment asset

- Using the data from the cash-flow statement developed by Harry and Belinda, calculate the following financial ratios. Round your answers to two decimal places.

| Liquidity ratio | % |

| Asset-to-debt ratio | % |

| Debt-to-income ratio | % |

| Debt payments-to-disposable income ratio Hint: For disposable income, take into consideration health life insurance, as well as federal, state, and social security taxes. | % |

| Investment assets-to-total assets ratio | % |

What do these ratios tell you about the Johnsons' financial situation? Should Harry and Belinda incur more debt, such as credit cards or a new vehicle loan?

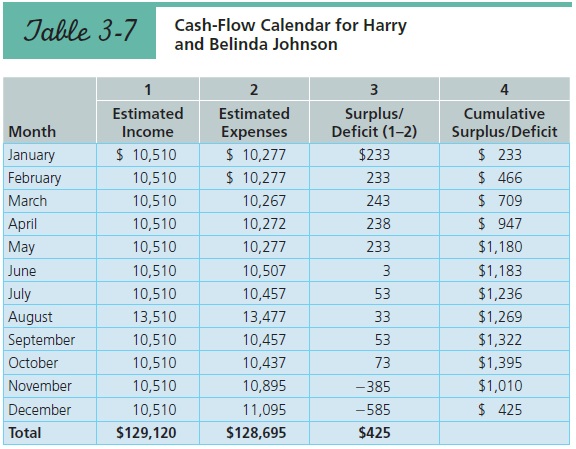

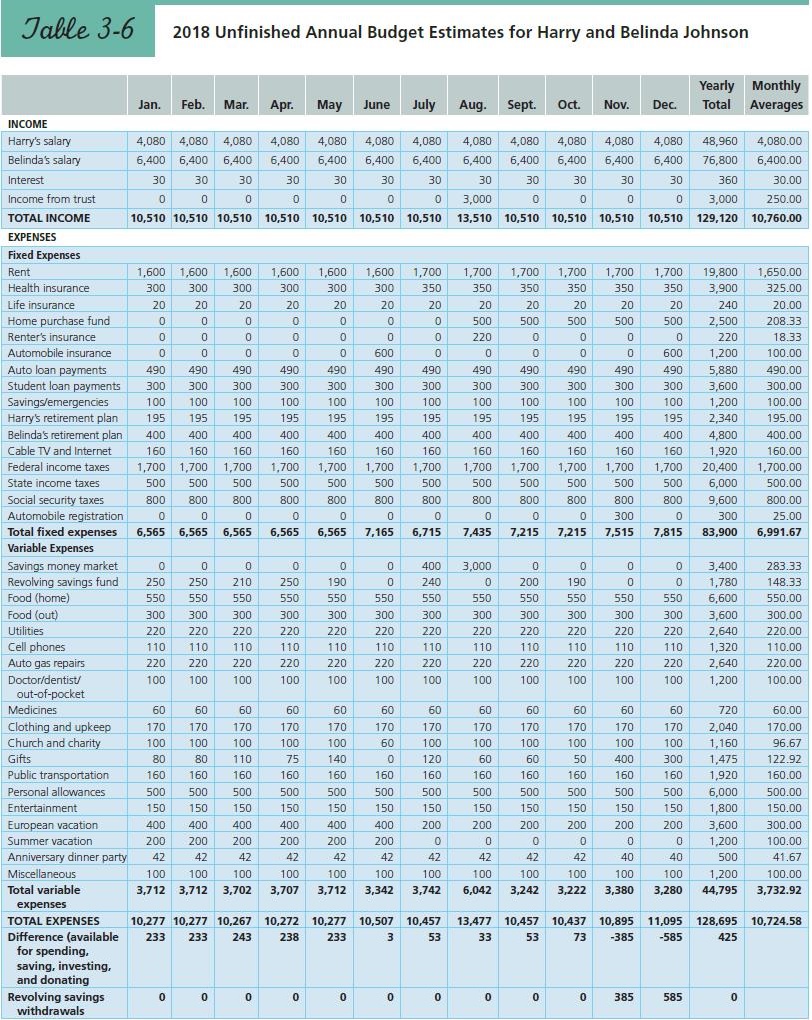

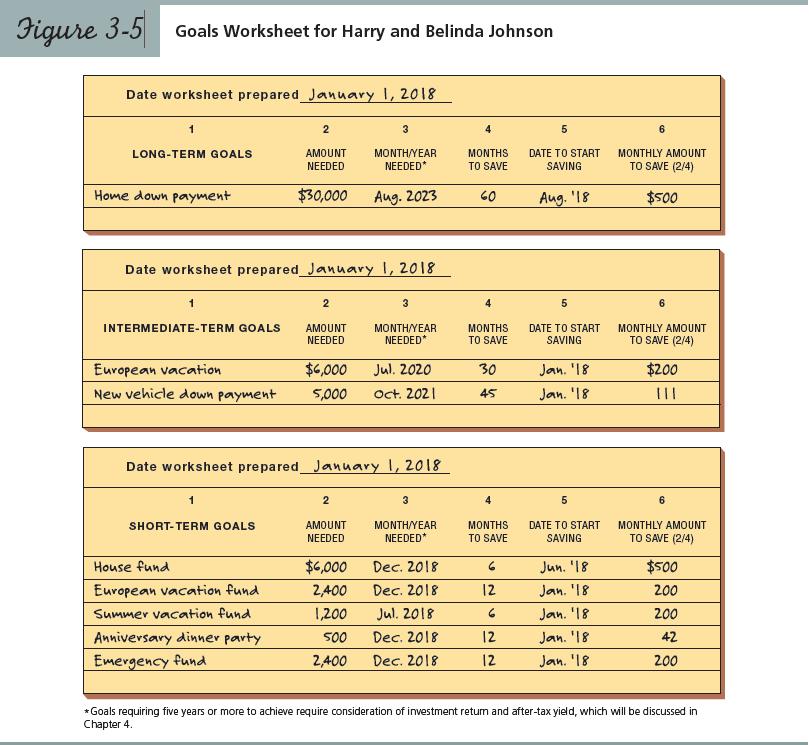

3) he Johnsons enjoy a high income because both work at well-paying jobs. They have spent parts of three evenings over the past several days discussing their financial values and goals together. As shown in the upper portion of Figure 3-5, they have established three long-term goals: $6,000 for a European vacation to be taken in 2020, $5,000 needed in October 2021 for a down payment on a new automobile, and $30,000 for a down payment on a home to be purchased in December 2023. As shown in the lower portion of the figure the Johnsons did some calculations to determine how much they had to save for each goalover the near termto stay on schedule to reach their long-term goals as well as pay for two vacations and an anniversary party. After developing their balance sheet and cash-flow statement (shown above), the Johnsons made a budget for the year (shown in Table 3-6). They then reconciled various conflicting needs and wants until they found that total annual income was close to the total of planned expenses. Next, they created a revolving savings fund (Table 3-8) in which they were careful to include enough money each month to meet all of their short-term goals. When developing their cash-flow calendar for the year (Table 3-7), they noticed a problem: substantial cash deficits in November and December. Make specific recommendations to the Johnsons on how they could make reductions in their budget estimates. Do not offer suggestions that would alter their new lifestyle drastically, as the couple would reject such ideas.

2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Cash-Flow Calendar for Harry and Belinda Johnson Goals Worksheet for Harry and Belinda Johnson * Goals requiring five years or more to achieve require consideration of investment return and after-tax yield, which will be discussed in Chapter 4. 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Cash-Flow Calendar for Harry and Belinda Johnson Goals Worksheet for Harry and Belinda Johnson * Goals requiring five years or more to achieve require consideration of investment return and after-tax yield, which will be discussed in Chapter 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started