Answered step by step

Verified Expert Solution

Question

1 Approved Answer

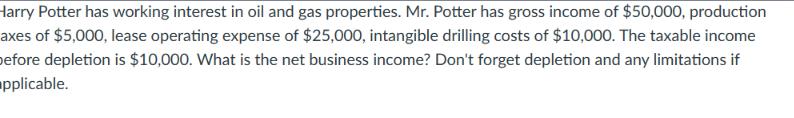

Harry Potter has working interest in oil and gas properties. Mr. Potter has gross income of $50,000, production axes of $5,000, lease operating expense

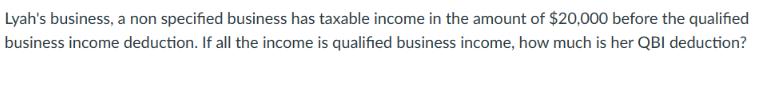

Harry Potter has working interest in oil and gas properties. Mr. Potter has gross income of $50,000, production axes of $5,000, lease operating expense of $25,000, intangible drilling costs of $10,000. The taxable income before depletion is $10,000. What is the net business income? Don't forget depletion and any limitations if applicable. Lyah's business, a non specified business has taxable income in the amount of $20,000 before the qualified business income deduction. If all the income is qualified business income, how much is her QBI deduction?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net business income for Harry Potter we need to consider the relevant expenses and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started