Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Great Bakery Plc is a public company. At the end of the financial year in December 2018, financial analysts' forecasts show that the company's

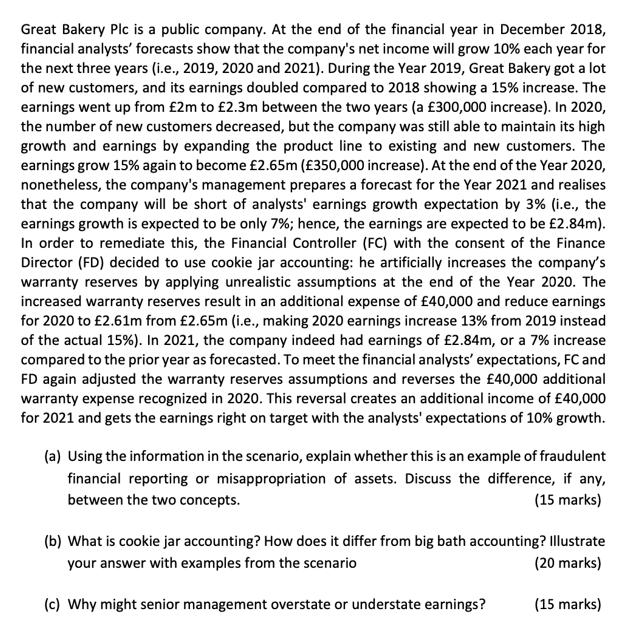

Great Bakery Plc is a public company. At the end of the financial year in December 2018, financial analysts' forecasts show that the company's net income will grow 10% each year for the next three years (i.e., 2019, 2020 and 2021). During the Year 2019, Great Bakery got a lot of new customers, and its earnings doubled compared to 2018 showing a 15% increase. The earnings went up from 2m to 2.3m between the two years (a 300,000 increase). In 2020, the number of new customers decreased, but the company was still able to maintain its high growth and earnings by expanding the product line to existing and new customers. The earnings grow 15% again to become 2.65m (350,000 increase). At the end of the Year 2020, nonetheless, the company's management prepares a forecast for the Year 2021 and realises that the company will be short of analysts' earnings growth expectation by 3% (i.e., the earnings growth is expected to be only 7%; hence, the earnings are expected to be 2.84m). In order to remediate this, the Financial Controller (FC) with the consent of the Finance Director (FD) decided to use cookie jar accounting: he artificially increases the company's warranty reserves by applying unrealistic assumptions at the end of the Year 2020. The increased warranty reserves result in an additional expense of 40,000 and reduce earnings for 2020 to 2.61m from 2.65m (i.e., making 2020 earnings increase 13% from 2019 instead of the actual 15% ). In 2021, the company indeed had earnings of 2.84m, or a 7% increase compared to the prior year as forecasted. To meet the financial analysts' expectations, FC and FD again adjusted the warranty reserves assumptions and reverses the 40,000 additional warranty expense recognized in 2020. This reversal creates an additional income of 40,000 for 2021 and gets the earnings right on target with the analysts' expectations of 10% growth. (a) Using the information in the scenario, explain whether this is an example of fraudulent financial reporting or misappropriation of assets. Discuss the difference, if any, between the two concepts. (15 marks) (b) What is cookie jar accounting? How does it differ from big bath accounting? Illustrate your answer with examples from the scenario (20 marks) (c) Why might senior management overstate or understate earnings? (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Based on the information provided the situation described in the scenario is an example of fraudulent financial reporting Fraudulent financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started