Answered step by step

Verified Expert Solution

Question

1 Approved Answer

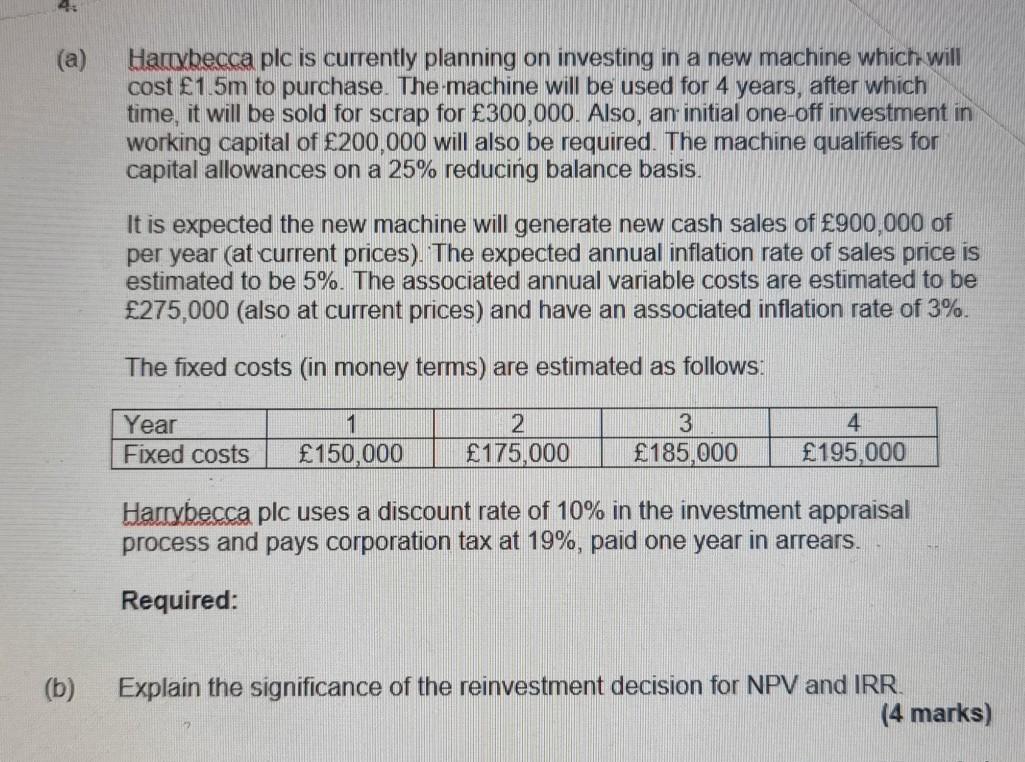

j (a) (b) Harrybecca plc is currently planning on investing in a new machine which will cost 1.5m to purchase. The machine will be

j (a) (b) Harrybecca plc is currently planning on investing in a new machine which will cost 1.5m to purchase. The machine will be used for 4 years, after which time, it will be sold for scrap for 300,000. Also, an initial one-off investment in working capital of 200,000 will also be required. The machine qualifies for capital allowances on a 25% reducing balance basis. It is expected the new machine will generate new cash sales of 900,000 of per year (at current prices). The expected annual inflation rate of sales price is estimated to be 5%. The associated annual variable costs are estimated to be 275,000 (also at current prices) and have an associated inflation rate of 3%. The fixed costs (in money terms) are estimated as follows: 1 Year Fixed costs 150,000 2 175,000 3 185,000 4 195,000 Harrybecca plc uses a discount rate of 10% in the investment appraisal process and pays corporation tax at 19%, paid one year in arrears. Required: Explain the significance of the reinvestment decision for NPV and IRR. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANS WER The reinvest ment decision is significant for both NP V and IR R because it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started