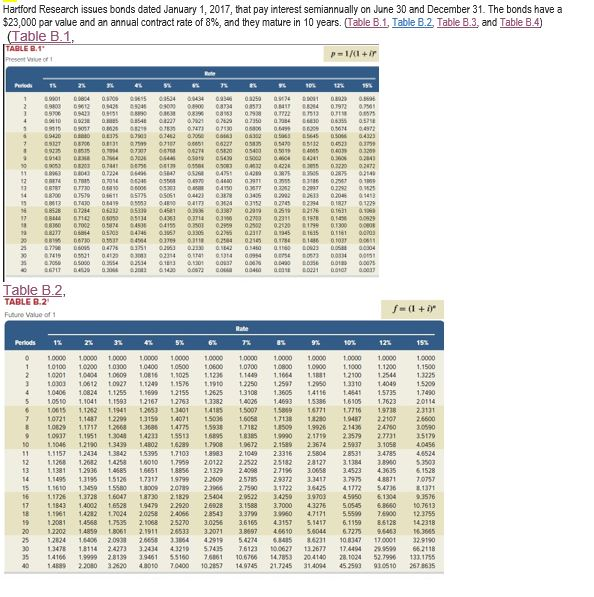

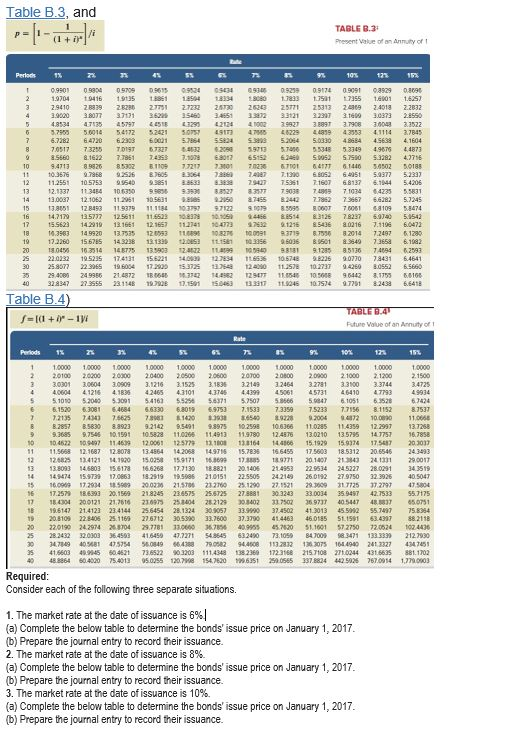

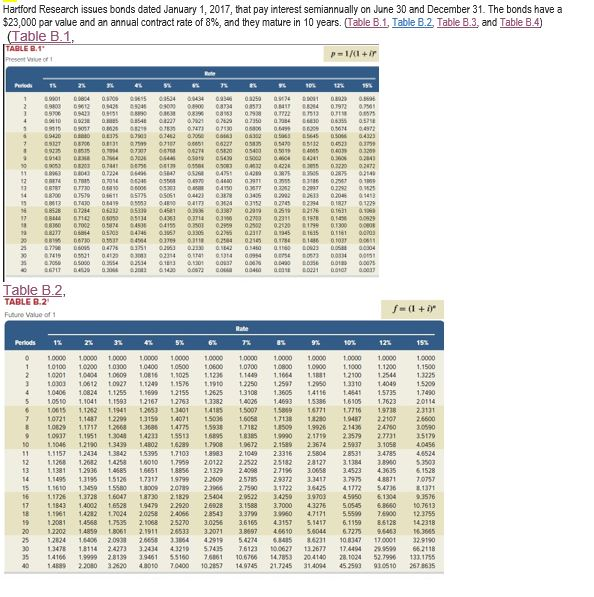

Hartford Research issues bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. The bonds have a $23,000 par value and an annual contract rate of 8%, and they mature in 10 years. (Table B.1, Table B.2, Table B.3, and Table B.4)

Required: Consider each of the following three separate situations.

1. The market rate at the date of issuance is 6%. (a) Complete the below table to determine the bonds' issue price on January 1, 2017. (b) Prepare the journal entry to record their issuance.

2. The market rate at the date of issuance is 8%. (a) Complete the below table to determine the bonds' issue price on January 1, 2017. (b) Prepare the journal entry to record their issuance.

3. The market rate at the date of issuance is 10%. (a) Complete the below table to determine the bonds' issue price on January 1, 2017. (b) Prepare the journal entry to record their issuance.

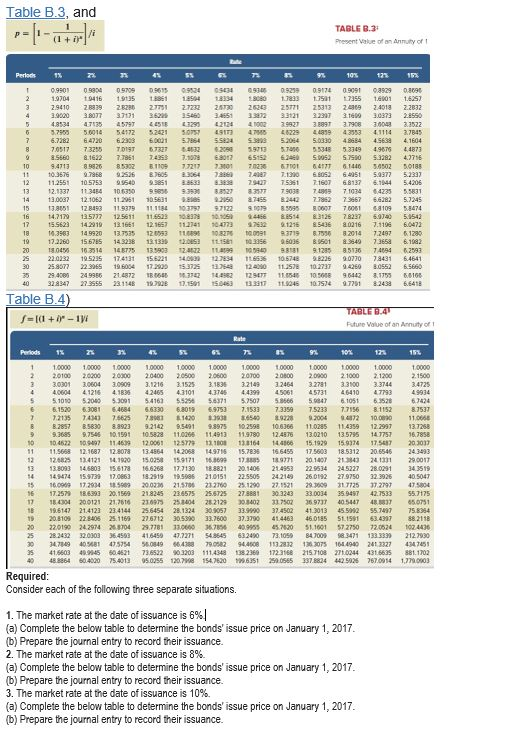

Hartford Research issues bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. The bonds have a $23,000 par value and an annual contract rate of 8%, and they mature in 10 years. TableB.1, Table B 2, Table B.3 and Table B.4 Table B.1 ABLE B.1 1.0201 10404 t0609 10816 1,1025 1.1235 1.1449 1.1664 1,1881 tO30 1.0612 t0927 1.1249 1.1576 1.1910 1.2250 1.2597 1.2950 1.2310 1.4049 5 0510 1.104 593 12167 12763 13382 10 105 1,1262 11941 12653 1.3401 14185 5007 158697 7716 19738 1021 1,14871.229915 4071 150 6058 17138 19487 22107 2 2.6600 093 1,1951 1 30414233 15513 1895 8385 1.9990 279 23579 2.7731 0 1,046 1.2130 1 3439 14802 16239 08 1962 2.1589 23674 25937 3,1058 21268 1.2682 14258 1.7909 20122 22522 25182 2127 31384 890 14 1.1495 1.319515126 7317 19799 22609 25785 29372 33417 3797548871 15 1,5610 13459 t5580 13009 20799 2.3966 27590 1722 3.6425 41772 5.4736 16 1.1726 1.3728 1.6047 1.8730 2.1829 25404 29522 14250 19703 45950 1304 17 11843 1.4002 16528 19479 22920 2.6928 1588 37000 4.3276 5.0545 8660 07613 18 1 1961 14282 1.7024 2.0258 24066 28543 337 960 4.7171 555 ,6900 12.3755 3576 12081 1.4568 1.7535 2.068 2527030256 3.6165 43157 5.1417 61159 86128 142318 12202 14859 18061 2.1911 2533 3.2071 3897 46610 .8044672 93 63665 1,2824 1640620938 2665$ 3.3864 429 5.4274 8485 6231 108347 110001 32.9190 30 13478 18114 24273 32434 4320 57435 76123 100627 13 2677 17.449429959 662118 35 1.4166 1.9999 28139 39461 53160 75561 106766 147853 204140 1024 52.7996 133, 1755 40 1.488922080 32620 4.3010 70400 10257 149745 21.7245 31404 4525 930510 2678635 Table B.3, and TABLE B.3 Present Vakue of an Anmuity of 1.0704 t94 16 1.9t35 1.8861 1 04 ui34 t2080 aas t.)sit t7355 1.6901 1.6S 5660 8 1622 7.3851 7435 7.9 0 65152 2 53052 S7590 .3282 476 4713 89826 832 1109 7721730 7024&7014 61440 502 188 12 112551 105753 gs40 sses1 6 8se zsen 1s361 7.16076.8137 6.1944 54206 18 103963 149920 13.7535 12"53 " 10mg teret u7 R7556 B2014 7.2497 0.1290 20 "04 10.3514 148775 135903 12uzz !ures no.5940 9sw 91285 85 198 74094 2093 S 220232 19 5235 17.4131 156221 40 127834 11.6636 10.574898226 9070 78431 64641 Table B.4 2 20100 20200 20300 20400 20500 20600 200O 20800 20000 21000 1200 2.1500 0301 30604 30909 3.1216 31525 3.1836 32149 32464 3.2781 3300 3.3744 1010 520405.309 5.4163 s5256 58371 5.7507 58666 5 47 61051 6.3528 6 615206.1 4684 66330 6.2019 69753 7.1533 73359 75233 7.7156 8.1152 8.7537 10 10.4622 09497 t1 4639 120061 125779 t21101 133164 144866 15 1929 15.9374 175487 20.3037 8 9771 20 1407 1384 12 12.5825 12.4121 14.79 20 15.0258 15.91 71 taas 99 173335 t35y7t 201407 2843 241331 290017 T$ 16.0909172934 5409 200235 21.sn6 23.2760 25 1290 271521 29,3009317725 372797 475004 6 17.2579 86393 20.1569 21.8245 236575 25.8725 278881 30 3243 33.0034 35 9457 42.7533 $5 7175 17 184304 200121 21.7616 230975 253404 282129 308402 337502 369737 405447 437 650751 20 220190 242974 704 29778, noooo 3578% 4099S5 457520 1001 S72750 720524 t02406 30 7849405681 4,5754 5.0849 6.42 790582 94as e m328321 3075 16 4940 21txaz7 4347451 408864 604020 754013 950255 12071154.7620 1996351 29a0565 337.8824 H2 5026 7670914 1,7790003 Consider each of the following three separate situations. I. The market rate at the date of issuance is 6%) (a) Complete thebelow table to determine the bonds' issue price on January 1, 2017 (b) Prepare the journal entry to record theirissuance. 2. The market rate at the date of issuance is 8%. (a) Complete the below table to determine the bonds' issue price on January 1, 2017 (b) Prepare the journal entry to record their issuance. 3. The market rate at the date of issuance is 10%. (a) Complete the below table to determine the bonds' issue price on January 1, 2017 (b) Prepare the journal entry to record their issuance