Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harum Halia Sdn. Bhd., a manufacturing company wholly owned by Mr. Hashim, was incorporated on 28 January 2013. The company commenced its operation on 17

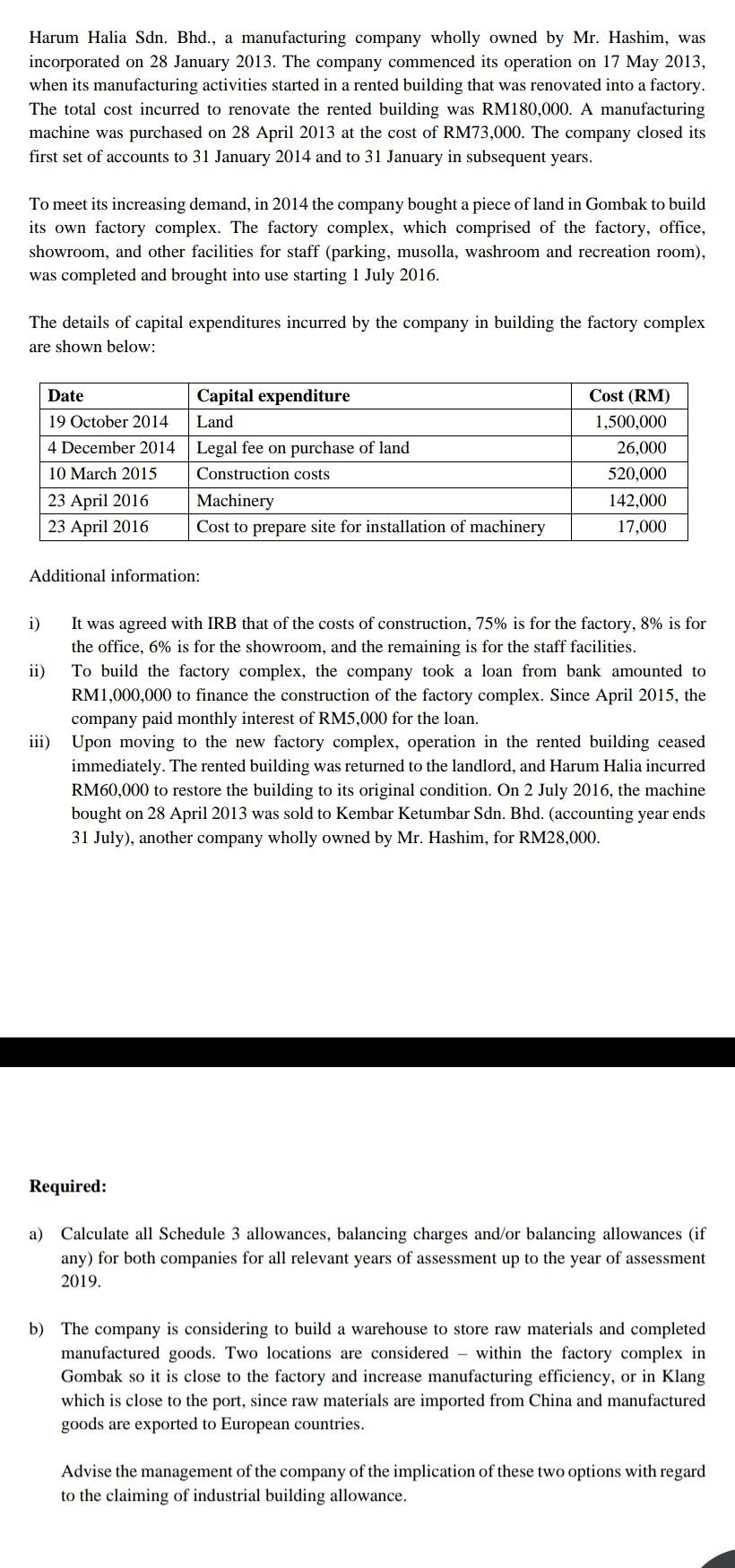

Harum Halia Sdn. Bhd., a manufacturing company wholly owned by Mr. Hashim, was incorporated on 28 January 2013. The company commenced its operation on 17 May 2013, when its manufacturing activities started in a rented building that was renovated into a factory. The total cost incurred to renovate the rented building was RM180,000. A manufacturing machine was purchased on 28 April 2013 at the cost of RM73,000. The company closed its first set of accounts to 31 January 2014 and to 31 January in subsequent years. To meet its increasing demand, in 2014 the company bought a piece of land in Gombak to build its own factory complex. The factory complex, which comprised of the factory, office, showroom, and other facilities for staff (parking, musolla, washroom and recreation room), was completed and brought into use starting 1 July 2016. The details of capital expenditures incurred by the company in building the factory complex are shown below: Date Capital expenditure 19 October 2014 Land 4 December 2014 Legal fee on purchase of land 10 March 2015 Construction costs 23 April 2016 Machinery 23 April 2016 Cost to prepare site for installation of machinery Cost (RM) 1,500,000 26,000 520,000 142,000 17,000 Additional information: i) It was agreed with IRB that of the costs of construction, 75% is for the factory, 8% is for the office, 6% is for the showroom, and the remaining is for the staff facilities. ii) To build the factory complex, the company took a loan from bank amounted to RM1,000,000 to finance the construction of the factory complex. Since April 2015, the company paid monthly interest of RM5,000 for the loan. iii) Upon moving to the new factory complex, operation in the rented building ceased immediately. The rented building was returned to the landlord, and Harum Halia incurred RM60,000 to restore the building to its original condition. On 2 July 2016, the machine bought on 28 April 2013 was sold to Kembar Ketumbar Sdn. Bhd. (accounting year ends 31 July), another company wholly owned by Mr. Hashim, for RM28,000. Required: a) Calculate all Schedule 3 allowances, balancing charges and/or balancing allowances (if any) for both companies for all relevant years of assessment up to the year of assessment 2019. b) The company is considering to build a warehouse to store raw materials and completed manufactured goods. Two locations are considered - within the factory complex in Gombak so it is close to the factory and increase manufacturing efficiency, or in Klang which is close to the port, since raw materials are imported from China and manufactured goods are exported to European countries. Advise the management of the company of the implication of these two options with regard to the claiming of industrial building allowance. Harum Halia Sdn. Bhd., a manufacturing company wholly owned by Mr. Hashim, was incorporated on 28 January 2013. The company commenced its operation on 17 May 2013, when its manufacturing activities started in a rented building that was renovated into a factory. The total cost incurred to renovate the rented building was RM180,000. A manufacturing machine was purchased on 28 April 2013 at the cost of RM73,000. The company closed its first set of accounts to 31 January 2014 and to 31 January in subsequent years. To meet its increasing demand, in 2014 the company bought a piece of land in Gombak to build its own factory complex. The factory complex, which comprised of the factory, office, showroom, and other facilities for staff (parking, musolla, washroom and recreation room), was completed and brought into use starting 1 July 2016. The details of capital expenditures incurred by the company in building the factory complex are shown below: Date Capital expenditure 19 October 2014 Land 4 December 2014 Legal fee on purchase of land 10 March 2015 Construction costs 23 April 2016 Machinery 23 April 2016 Cost to prepare site for installation of machinery Cost (RM) 1,500,000 26,000 520,000 142,000 17,000 Additional information: i) It was agreed with IRB that of the costs of construction, 75% is for the factory, 8% is for the office, 6% is for the showroom, and the remaining is for the staff facilities. ii) To build the factory complex, the company took a loan from bank amounted to RM1,000,000 to finance the construction of the factory complex. Since April 2015, the company paid monthly interest of RM5,000 for the loan. iii) Upon moving to the new factory complex, operation in the rented building ceased immediately. The rented building was returned to the landlord, and Harum Halia incurred RM60,000 to restore the building to its original condition. On 2 July 2016, the machine bought on 28 April 2013 was sold to Kembar Ketumbar Sdn. Bhd. (accounting year ends 31 July), another company wholly owned by Mr. Hashim, for RM28,000. Required: a) Calculate all Schedule 3 allowances, balancing charges and/or balancing allowances (if any) for both companies for all relevant years of assessment up to the year of assessment 2019. b) The company is considering to build a warehouse to store raw materials and completed manufactured goods. Two locations are considered - within the factory complex in Gombak so it is close to the factory and increase manufacturing efficiency, or in Klang which is close to the port, since raw materials are imported from China and manufactured goods are exported to European countries. Advise the management of the company of the implication of these two options with regard to the claiming of industrial building allowance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started