Answered step by step

Verified Expert Solution

Question

1 Approved Answer

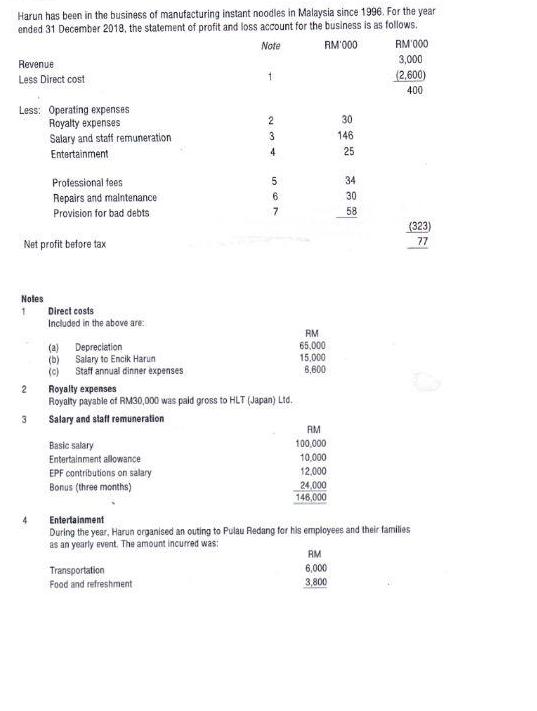

Harun has been in the business of manufacturing instant noodles in Malaysia since 1996. For the year ended 31 December 2018, the statement of

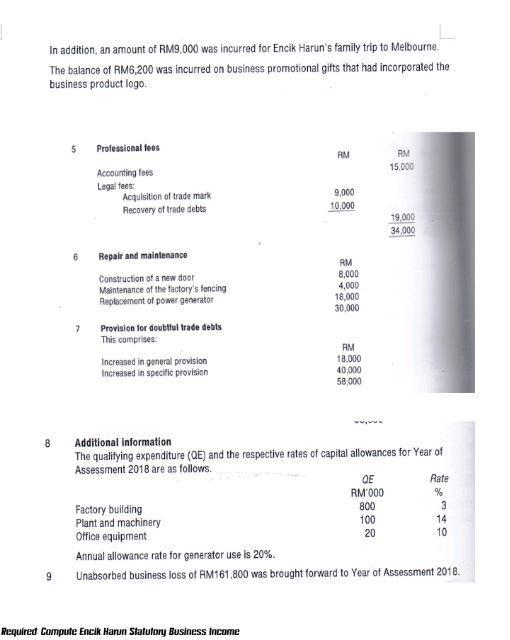

Harun has been in the business of manufacturing instant noodles in Malaysia since 1996. For the year ended 31 December 2018, the statement of profit and loss account for the business is as follows. Note RM'000 Revenue Less Direct cost Less: Operating expenses Royalty expenses Notes 1 Net profit before tax 2 3 Salary and staff remuneration Entertainment 4 Professional fees Repairs and maintenance Provision for bad debts Direct costs Included in the above are: (a) Depreciation (b) Salary to Encik Harun (c) Staff annual dinner expenses Basic salary Entertainment allowance EPF contributions on salary Bonus (three months) 1 234 Transportation Food and refreshment 4 Royalty expenses Royalty payable of RM30,000 was paid gross to HLT (Japan) Ltd. Salary and staff remuneration 567 RM 65,000 15,000 8,600 RM 100,000 10,000 12,000 24,000 146,000 30 146 25 RM 6,000 3,800 34 30 58 RM 000 3,000 (2,600) 400 Entertainment During the year, Harun organised an outing to Pulau Redang for his employees and their families as an yearly event. The amount incurred was: (323) 77 In addition, an amount of RM9,000 was incurred for Encik Harun's family trip to Melbourne. The balance of RM6,200 was incurred on business promotional gifts that had incorporated the business product logo. 8 9 5 6 7 Professional fees Accounting fees Legal fees: Acquisition of trade mark Recovery of trade debts Repair and maintenance Construction of a new door Maintenance of the factory's fencing Replacement of power generator Provision for doubtful trade debts This comprises: Increased in general provision Increased in specific provision RM 9,000 10,000 Required Compute Encik Harun Statutory Business Income RM 8,000 4,000 18,000 30,000 RM 18.000 40,000 58,000 RM 15.000 Additional information The qualifying expenditure (QE) and the respective rates of capital allowances for Year of Assessment 2018 are as follows. QE RM'000 800 100 20 19,000 34,000 Rate % 3 14 10 Factory building Plant and machinery Office equipment Annual allowance rate for generator use is 20%. Unabsorbed business loss of RM161,800 was brought forward to Year of Assessment 2018.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Encik Harun Statutory Business Income RM000 Revenue 3000 Less Direct Costs 2600 Operating Expenses 234 Royalty Expenses 146 Salary and Staff Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started