Answered step by step

Verified Expert Solution

Question

1 Approved Answer

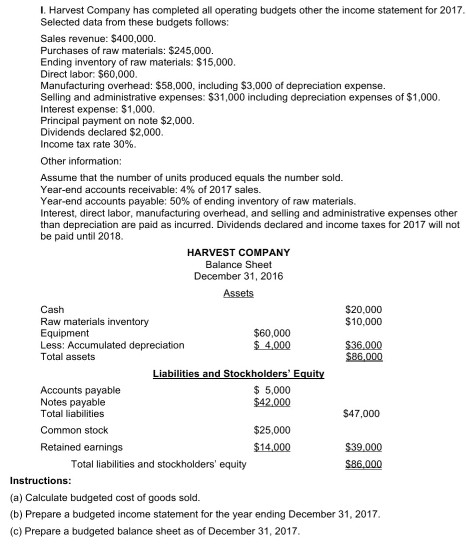

. Harvest Company has completed all operating budgets other the income statement for 2017, Selected data from these budgets follows: Sales revenue: $400,000 Purchases of

. Harvest Company has completed all operating budgets other the income statement for 2017, Selected data from these budgets follows: Sales revenue: $400,000 Purchases of raw materials: $245,000. Ending inventory of raw materials: $15,000 Direct labor: $60,000. Manufacturing overhead: $58,000, including $3,000 of depreciation expense. Selling and administrative expenses: $31,000 including depreciation expenses of $1,000. Interest expense: S1,000 Principal payment on note $2,000. Dividends declared $2,000. Income tax rate 30%. Other information: Assume that the number of units produced equals the number sold. Year-end accounts receivable: 4% of 2017 sales. Year-end accounts payable: 50% of ending inventory of raw materials. Interest, direct labor, manufacturing overhead, and selling and administrative expenses other than depreciation are paid as incurred. Dividends declared and income taxes for 2017 will not be paid until 2018. HARVEST COMPANY Balance Sheet December 31, 2016 Assets Cash Raw materials inventory Equipment $20,000 $10,000 $60,000 $4,000 $36.000 $86,000 Total assets Accounts payable Notes payable Total liabilities Common stock 5,000 $42,000 $47,000 $25,000 $14,000 $39.000 $86,000 Retained earnings Total labilities and stockholders' equity Instructions (a) Calculate budgeted cost of goods sold. (b) Prepare a budgeted income statement for the year ending December 31, 2017 (c) Prepare a budgeted balance sheet as of December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started