Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harvey, Inc., a home healthcare firm, has been using.a single predetermined overhead allocation rate with direct labor hours as the allocation base to allocate overhead

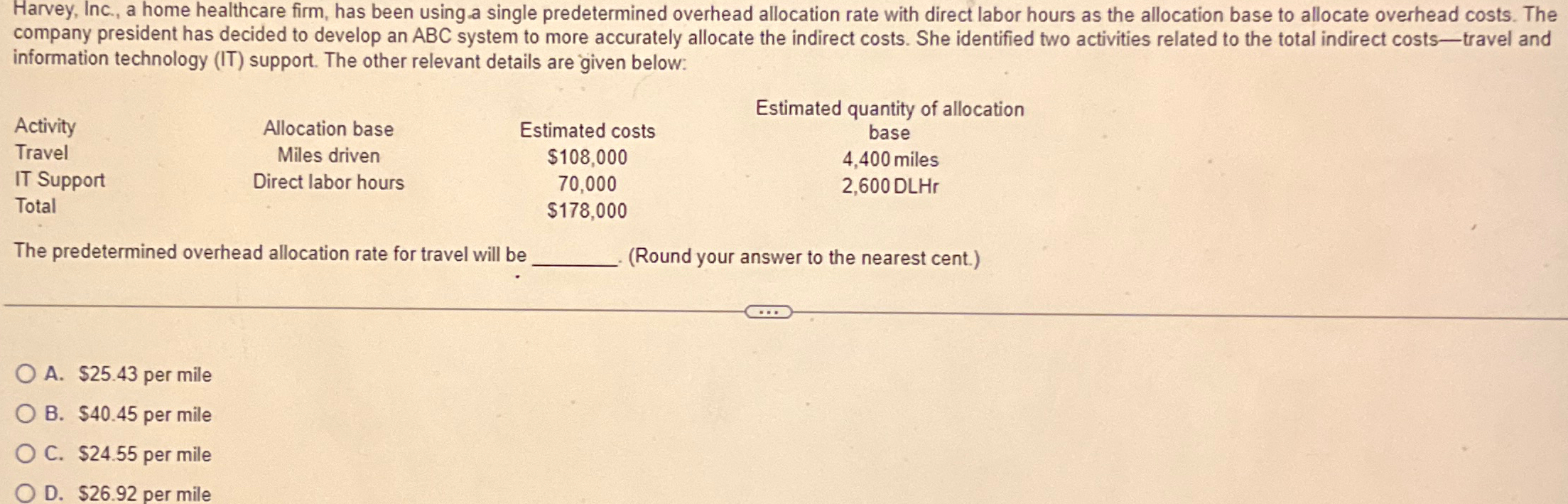

Harvey, Inc., a home healthcare firm, has been using.a single predetermined overhead allocation rate with direct labor hours as the allocation base to allocate overhead costs. The company president has decided to develop an ABC system to more accurately allocate the indirect costs. She identified two activities related to the total indirect coststravel and information technology IT support. The other relevant details are given below:

tableEstimated quantity of allocationActivityAllocation base,Estimated costs,baseTravelMiles driven,$ milesIT Support,Direct labor hours,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started