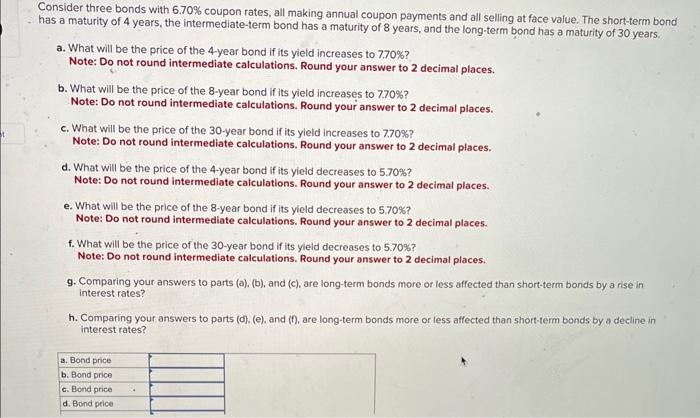

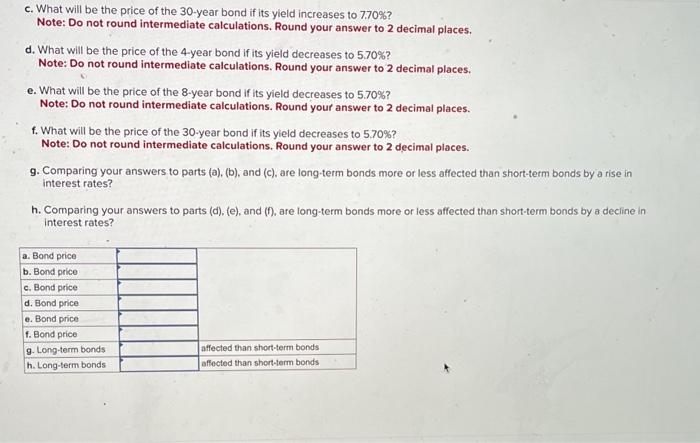

has a mer three bonds with 6.70% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. a. What will be the price of the 4 year bond if its yield increases to 7.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What will be the price of the 8 -year bond if its yieid increases to 7.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. What will be the price of the 30 -year bond if its yield increases to 7.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. d. What will be the price of the 4-year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. e. What will be the price of the 8 -year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. f. What will be the price of the 30 -year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. 9. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates? h. Comparing your answers to parts (d), (e), and (f), are long-term bonds more or less affected than short-term bonds by a decline in interest rates? c. What will be the price of the 30 -year bond if its yield increases to 7.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. d. What will be the price of the 4-year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. e. What will be the price of the 8 -year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. f. What will be the price of the 30 -year bond if its yield decreases to 5.70% ? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. g. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates? h. Comparing your answers to parts (d), (e), and ( f ), are long-term bonds more or less affected than short-term bonds by a decline in interest rates