Has anyone solves the Ceres Gardening Company questions?

Funding growth in organic products

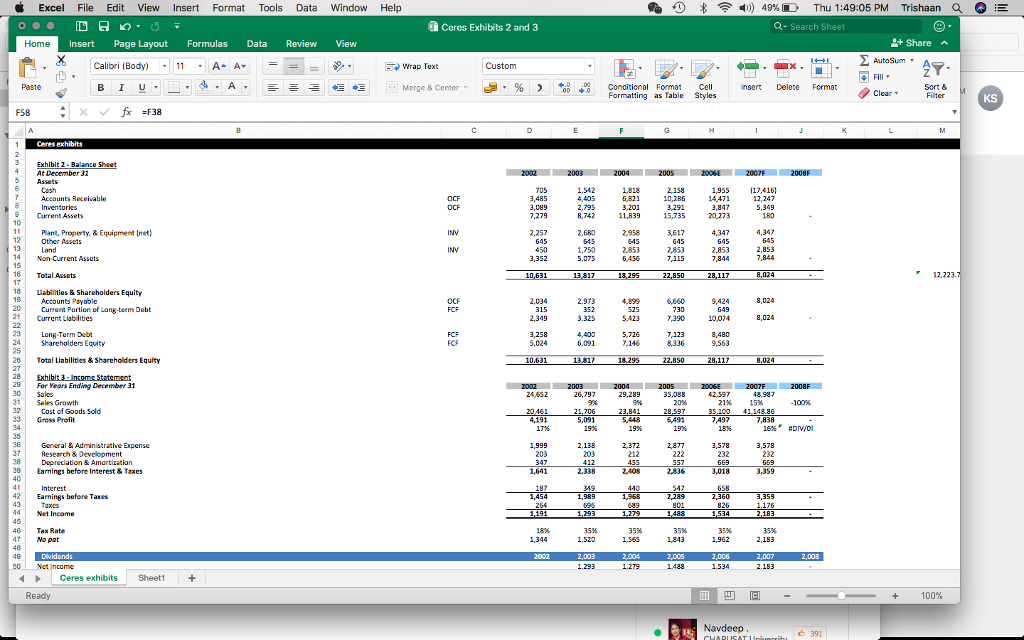

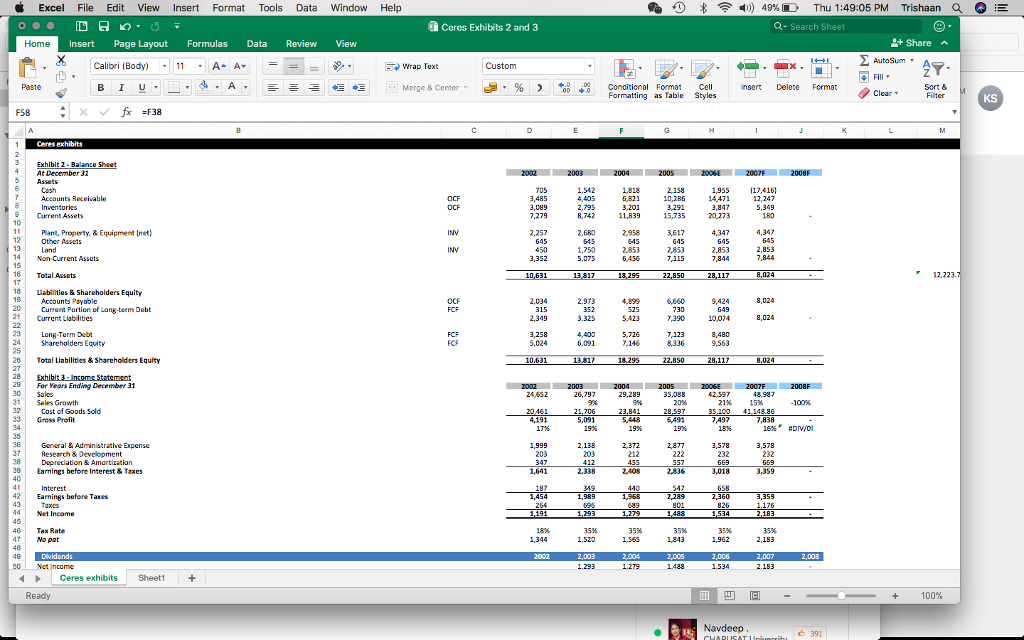

Forecast Ceres sales for 2007 and 2008. For 2007 and beyond, assume dealers sales of Ceres products will grow at 15% per year. In addition, assume that dealers will revert to their traditional ending inventory levels equal to a half-years cost of goods sold. You should assume that dealers inventories at the end of each year can be retained for sale in the next year (assuming proper care) and that dealers will eventually pay Ceres for the products they purchase

Excel File Edit View Insert Format Tools Data Window Help *) 49% D Thu 1:49:05 PM Trishaan d + Ceres Exhibits 2 and 3 Q Search Sheet Insert Page Layout Formulas Data Review View +Share Calibri [Body) , | 11 A- A+ --|- , B 1 u, h. A, Filly % , * o Conditional Format Cell Formatting as Table Styles Merge & Center, insert Delete Format Sort & FS8 -F38 3Exhibit 2- Balance 4 At December 31 Assets 1955 17416 4,405 2.795 6,821 3,089 3,847 Current Assets 15,73520273 Plant, Property& Equipment (net) 2,958 3,617 4,347 4,347 13 Land 14 Non Current Assets 2,853 7,844 1750 7,844 16 Total Assets 12,223 8abilities& Shareholders Equity 19 Accounts Payable 20Current Portion of Long-term Debt 21 Current Liabilities 9,424 7390 10,074 3,258 23 Long.Term Dabt 24 Shareholders Equity 4,400 5,726 ,146 7.123 28 Total Liabilities & Shareholders Equity 29For Years Ending December 31 30 Sales 31 Seles Growth 32 Cost of Goods Sold 33 Gross Profit 2002 2003 2005 2006E 2007F 2008F 26,797 29,289 43, 987 15% 21% 4,191 16% r #DIV/0! 3 General&Administrate Expense 2,133 Research & Development 232 232 Earnings before Interest &Taxe 3,018 42Earnings before Taxes TaxCS 4 Net Incame 35% 47 No pat oNetIncome Ceres exhis Sheet+ Ready 100% 6 391 2 Excel File Edit View Insert Format Tools Data Window Help *) 49% D Thu 1:49:05 PM Trishaan d + Ceres Exhibits 2 and 3 Q Search Sheet Insert Page Layout Formulas Data Review View +Share Calibri [Body) , | 11 A- A+ --|- , B 1 u, h. A, Filly % , * o Conditional Format Cell Formatting as Table Styles Merge & Center, insert Delete Format Sort & FS8 -F38 3Exhibit 2- Balance 4 At December 31 Assets 1955 17416 4,405 2.795 6,821 3,089 3,847 Current Assets 15,73520273 Plant, Property& Equipment (net) 2,958 3,617 4,347 4,347 13 Land 14 Non Current Assets 2,853 7,844 1750 7,844 16 Total Assets 12,223 8abilities& Shareholders Equity 19 Accounts Payable 20Current Portion of Long-term Debt 21 Current Liabilities 9,424 7390 10,074 3,258 23 Long.Term Dabt 24 Shareholders Equity 4,400 5,726 ,146 7.123 28 Total Liabilities & Shareholders Equity 29For Years Ending December 31 30 Sales 31 Seles Growth 32 Cost of Goods Sold 33 Gross Profit 2002 2003 2005 2006E 2007F 2008F 26,797 29,289 43, 987 15% 21% 4,191 16% r #DIV/0! 3 General&Administrate Expense 2,133 Research & Development 232 232 Earnings before Interest &Taxe 3,018 42Earnings before Taxes TaxCS 4 Net Incame 35% 47 No pat oNetIncome Ceres exhis Sheet+ Ready 100% 6 391 2