Question

Haslam Homes is considering designing and marketing a concrete, yurt-based pre-fabricated home to compete in the doomsday prepper market. Development will cost $1,000,000 and will

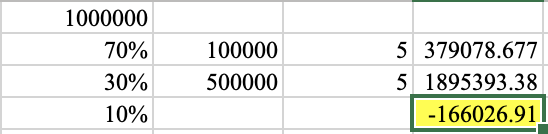

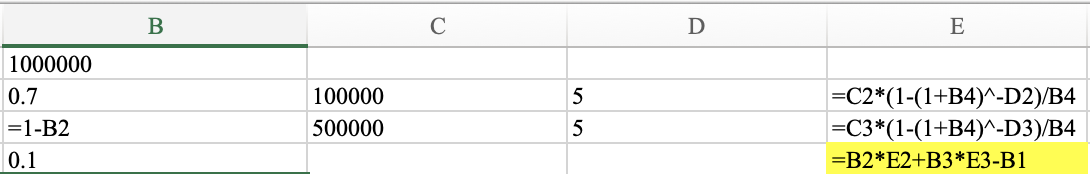

Haslam Homes is considering designing and marketing a concrete, yurt-based pre-fabricated home to compete in the doomsday prepper market. Development will cost $1,000,000 and will take one year. If the yurts are popular (30% probability) the cash flows will be $500,000 per year for 5 years starting in Year 1. If the yurts are not a hit (70% probability) the cash flows will be $100,000 per year for 5 years. Calculate the ENPV of the project. Haslam's cost of capital is 10%.

Haslam realzes that if the yurts are popular, they can expand their markets into Eastern Europe by making an investment of $1 million in bribes and licenses in Year 5 after the yurt's success has been established. If Haslam makes this investment, they can expect 5 years of the same cash flows they received in Years 1-5 in the U.S. market arriving in Years 6-10. Of course, if Haslam chooses not to make the investment in Year 5, they will receive zero cash flows in Years 6-10. What is the expected NPV of the Yurt project now, considering this additional source of cash flows? Assume all cash flows are discounted at the 10% WACC.

The answer to the first question above is given. How is the second question calculated?

Original file

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started