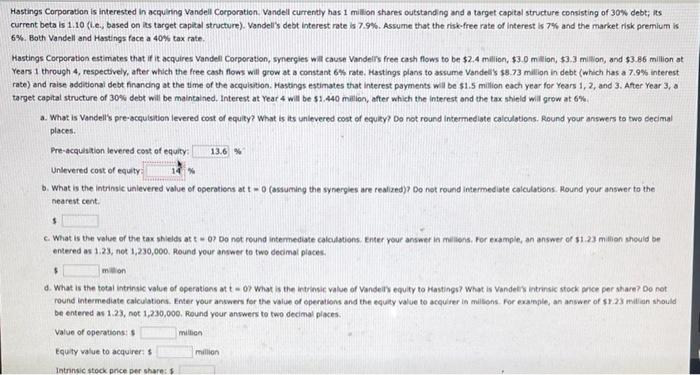

Hastings Corporation is interested in acquiring Vandell Corporation. Vandell currently has 1 million shares outstanding and a target capital structure consisting of 30% debt; its current beta s 1.10 (le, based on ts target capital structure). Vandel's debt interest rate 67.9%. Assume that the riskefree rate of interest is 7% and the market risk premium is 6%. Both Vandell and Hastings face a 40% tax rate Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandells free cash flows to be $2.4 million, $3.0 million $3.3 million, and $3.86 million at Years 1 through 4, respectively, after which the free cash flows will grow at a constant 6% rate. Hastings plans to assume Vandells $8.73 milion in debt (which has a 7.9% interest rate) and raise additional debt financing at the time of the acquisition. Hastings estimates that interest payments will be $1.5 million each year for Years 1, 2, and 3. After Year 3, target capital structure of 30% debt will be maintained. Interest at Year 4 will be 51.440 milion, after which the interest and the tax shield will grow at 6% .. What is Vandell's pre-acquisition levered cost of equity? What is its unlevered cost of equity? Do not round Intermediate calculations. Round your answers to two decimal places Pre-acquisition levered cost of equity 13.6 % Unlevered cost of equity 14% 6. What is the intrinsic unlevered value of operations at t-0 (assuming the synergies are realized)? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. What is the value of the tax shields at t - 0? Do not round Intermediate calculations. Enter your answer in millions. For example, an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Round your answer to two decimal places million d. What is the total intrinsic value of operations to what is the intrinsic value of Vandelly equity to Hastings? What is Vandets intrinsic stock price per share? Do not round Intermediate calculations. Enter your answers for the value of operations and the equity value to acquirer in million. For example, an answer of $1.23 milion should be entered a 1.23, not 1,230,000. Round your answers to two decimal places Value of operations! million million Equity value to acquirer: $ Intrinsic stock price per share