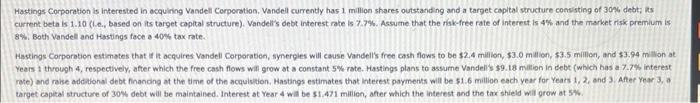

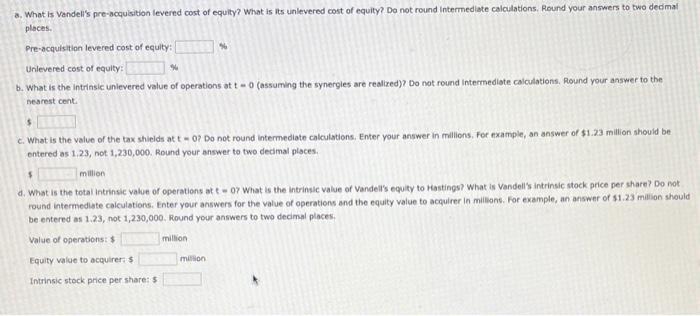

Hastings Corporation is interested in acquiring Vandell Corporation. Vandell currently has 1 million shares outstanding and a target capital structure convisting of 30 f, debt; zs current beta is 1.10 (L.e., based on its target copital structure). Vandeli's debt interest rate is 7.7\%. Assume that the risk-free rate of interest is 4% and the market risk premium is 8\%. Both Vandell and Hostings foce a 40% tax rate. Hastings Corporation estimates that if it acquires Vandell Corporation, synerpies will cause Vandells free cash flows to be 32.4 mililon, $3.0milli, 53.5 mililion, and 53.94m illon at Years 1 through 4, respectively, after which the free cash flows will grow at a constant 5% rate. Hastings plans to assume Vandeli's $9.18 milian in debt (which has a 7.7% interest rate) and rake additonal debt finanding at the time of the acquistion. Hastings estimates that interest payments will be s1.6 million each year for Years 1, 2, and 3. After year 3, a target capital structure of 30% debt will be maintained. Interest at Year 4 wit be 51,471 millien, after which the interest and the tax shield will grow at 5%. a. What is vandeli's pre-scquisition levered cost of equity? What is its unlevered cost of equity? Da not round intermediate calculations. Round your answers to two dedmai pleces. Pre-acquisition levered cost of equity: Unlevered cost of equity: b. What is the intrinsic unievered value of operations at t=0 (assuming the synergies are realixed)? Do not round intermediate calculations. Round your answer to the nearest cent. 5 c. What is the value of the tax shields at t=0 ? Do not round intermediate calculations. Enter your answer in millions, For example, an answer of $1.23 million should be entered as 1,23, not 1,230,000. Round your answer to two dedmal places. 5. million d. What is the total intrinsic value of operations at C=0 ? What is the intrinsic value of Vandell's equity to Hastings? What is Vandell's intrinsic stock price per share? Do not. round intermediate calculations. Enter your answers for the value of operations and the equity value to acquirer in milisons. For example, an answar of 11 . 23 milision should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Value of operations: $ million Equity value to acquirer: $ mistion Intrinsic stock price per share: 5