Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hat change(s). to Ben Waites, Capital will be reported on the statement of owner's equity? Complete this question by entering your answers in the tabs

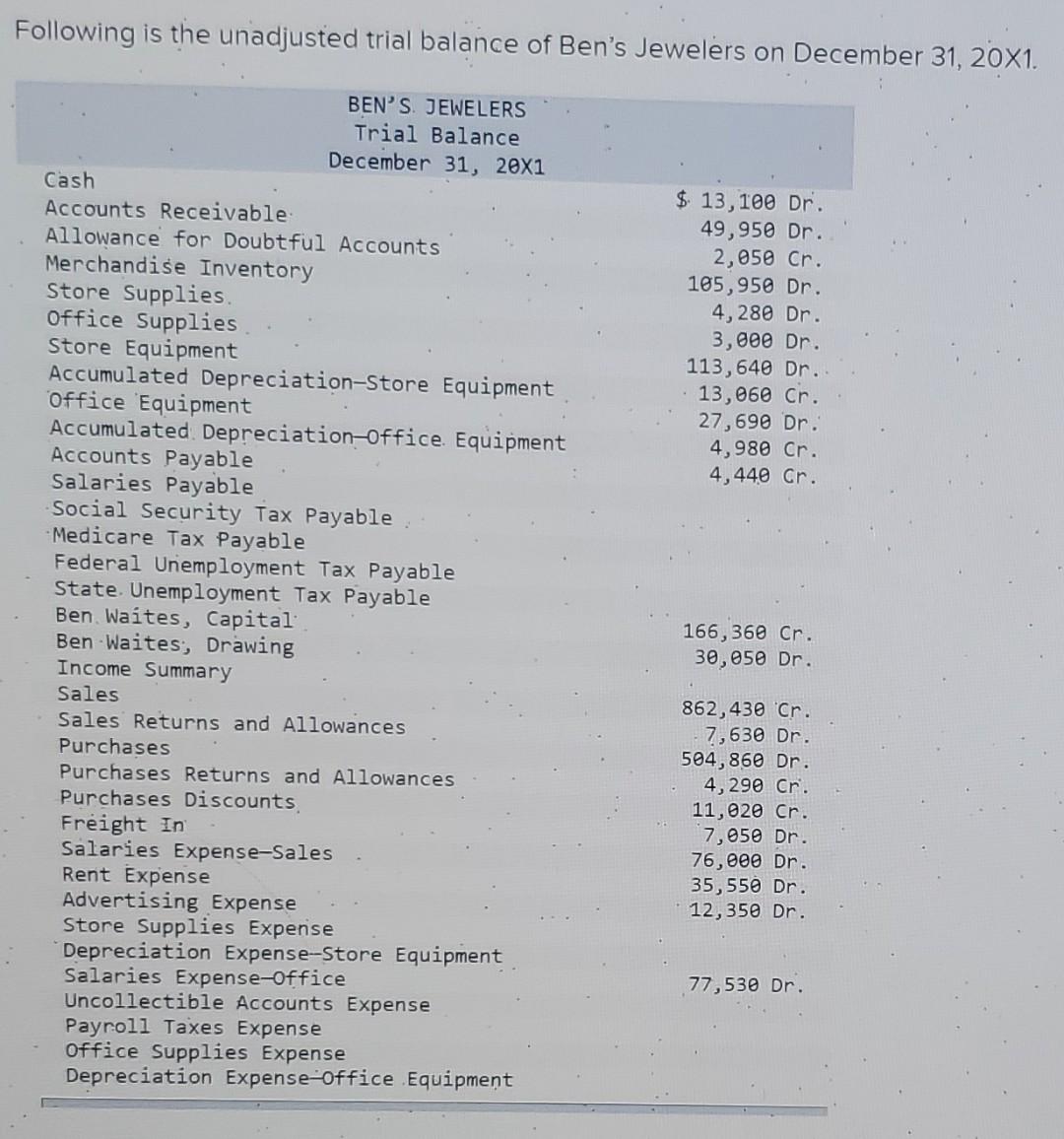

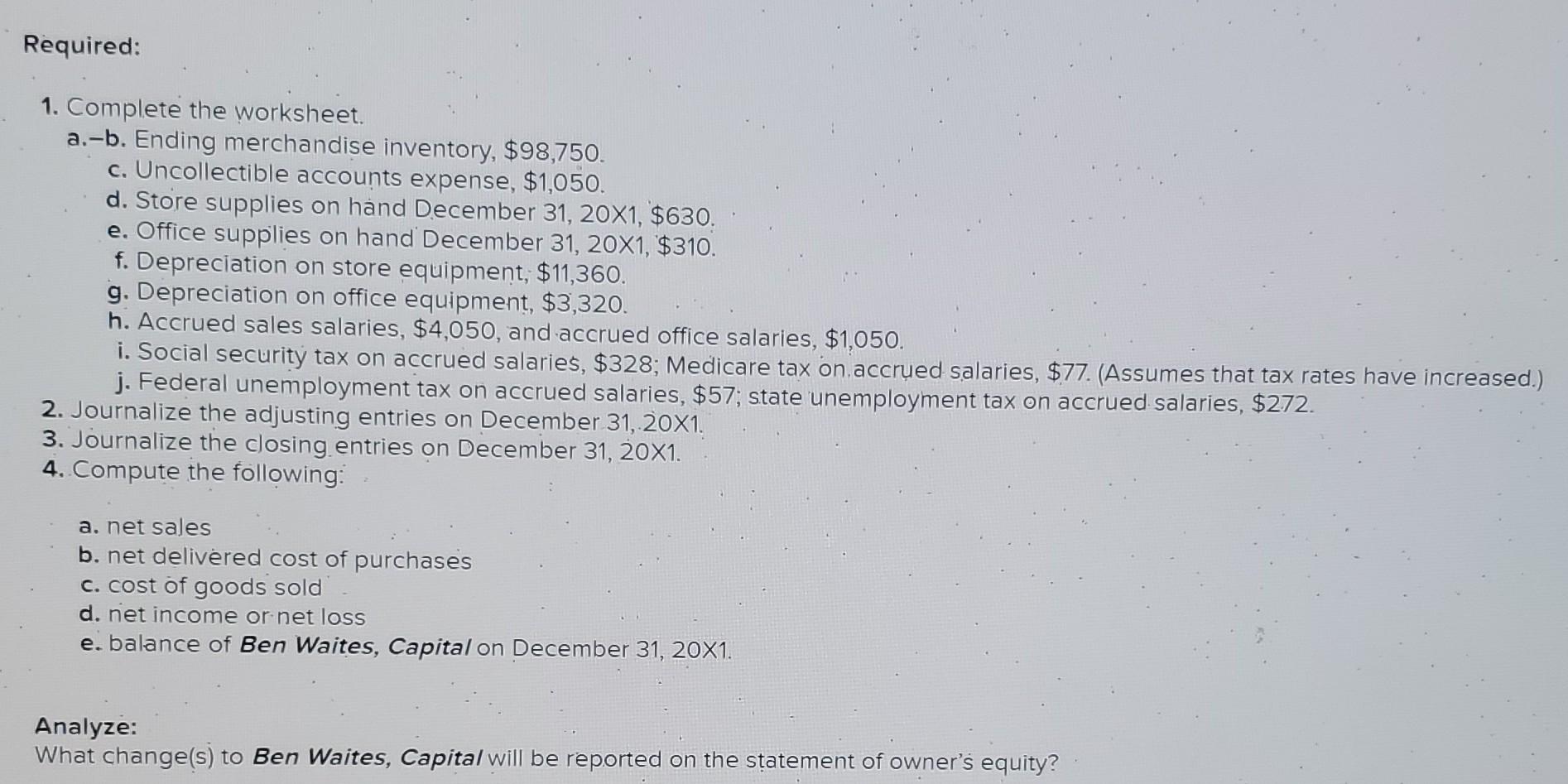

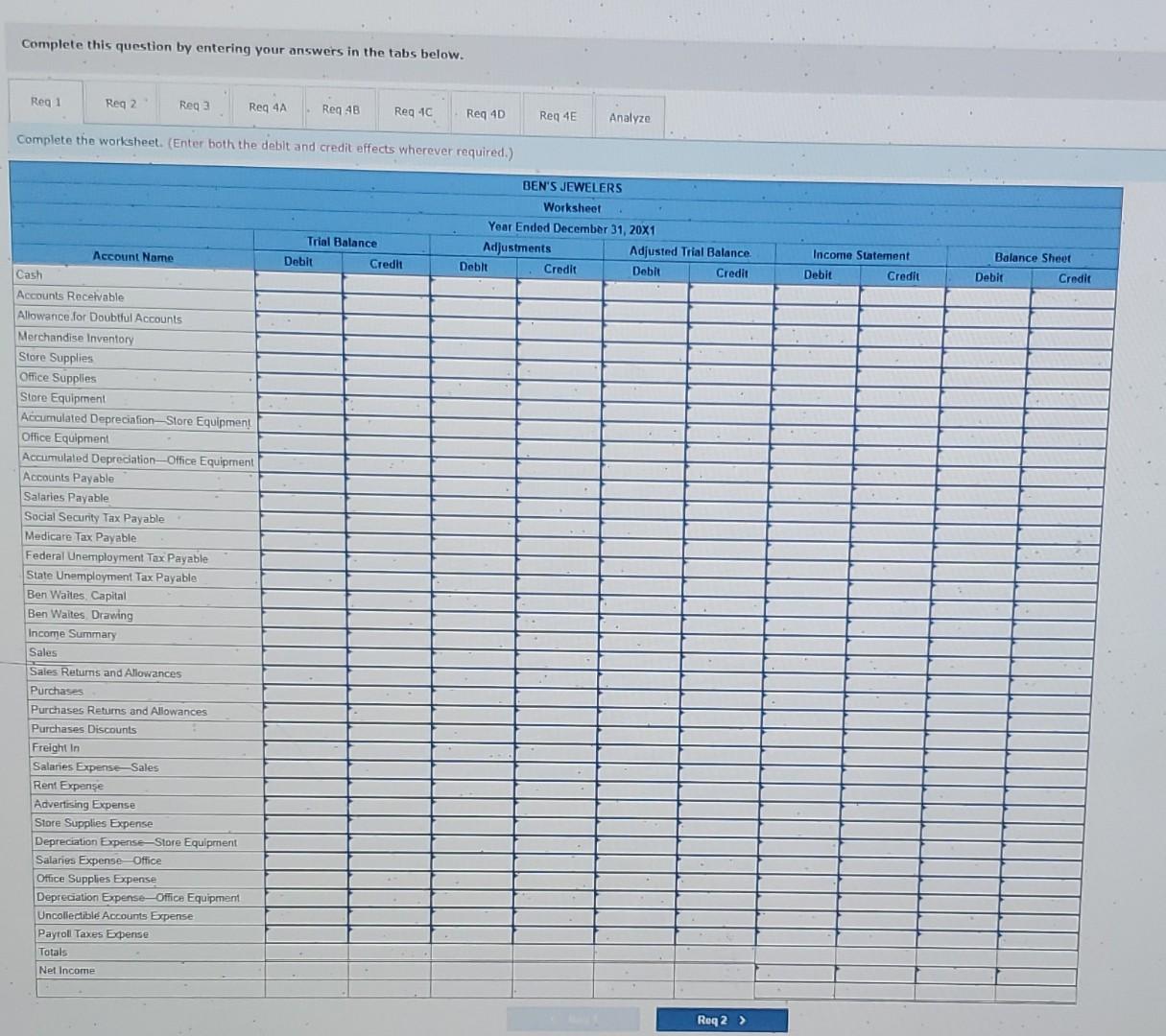

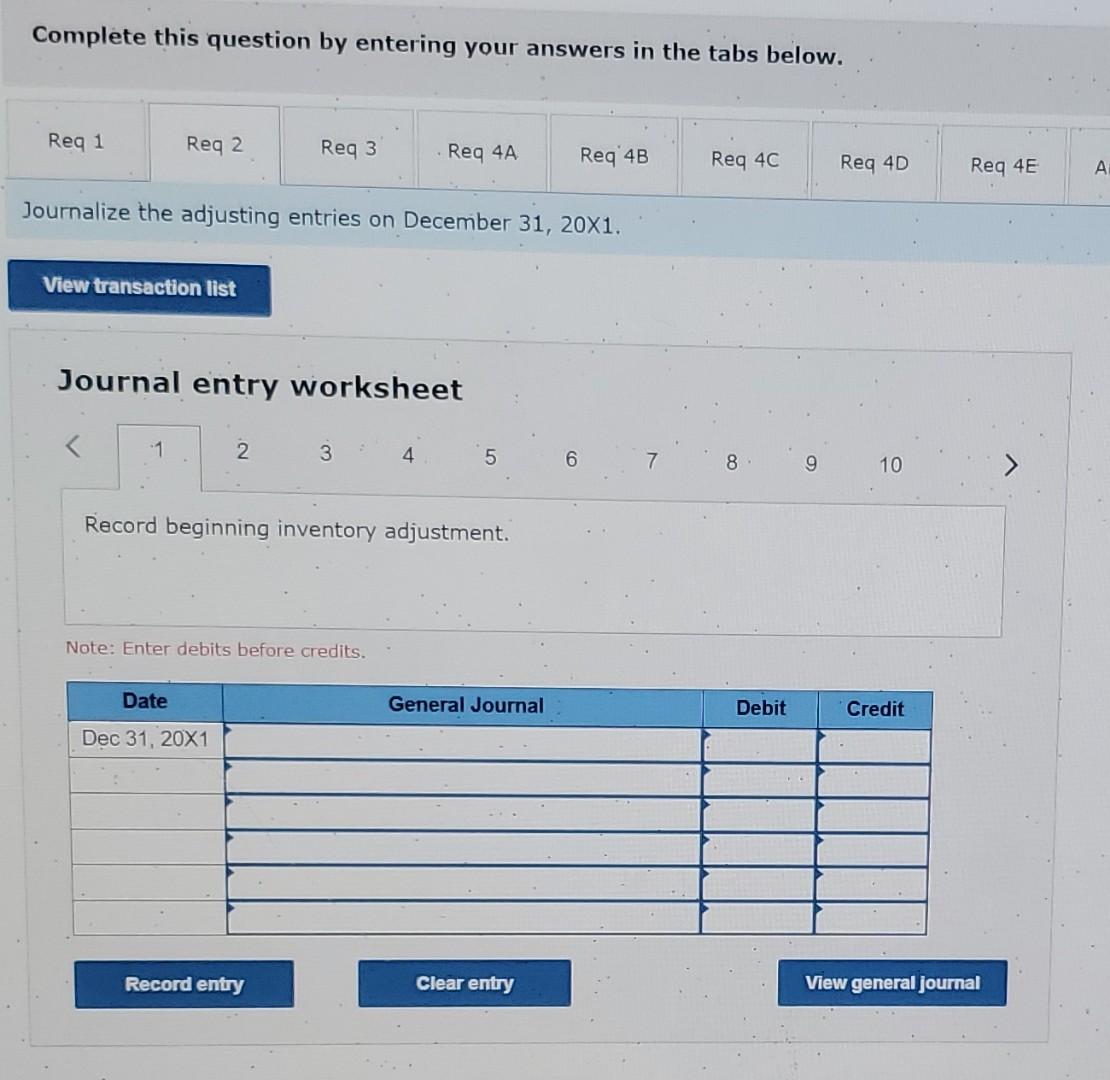

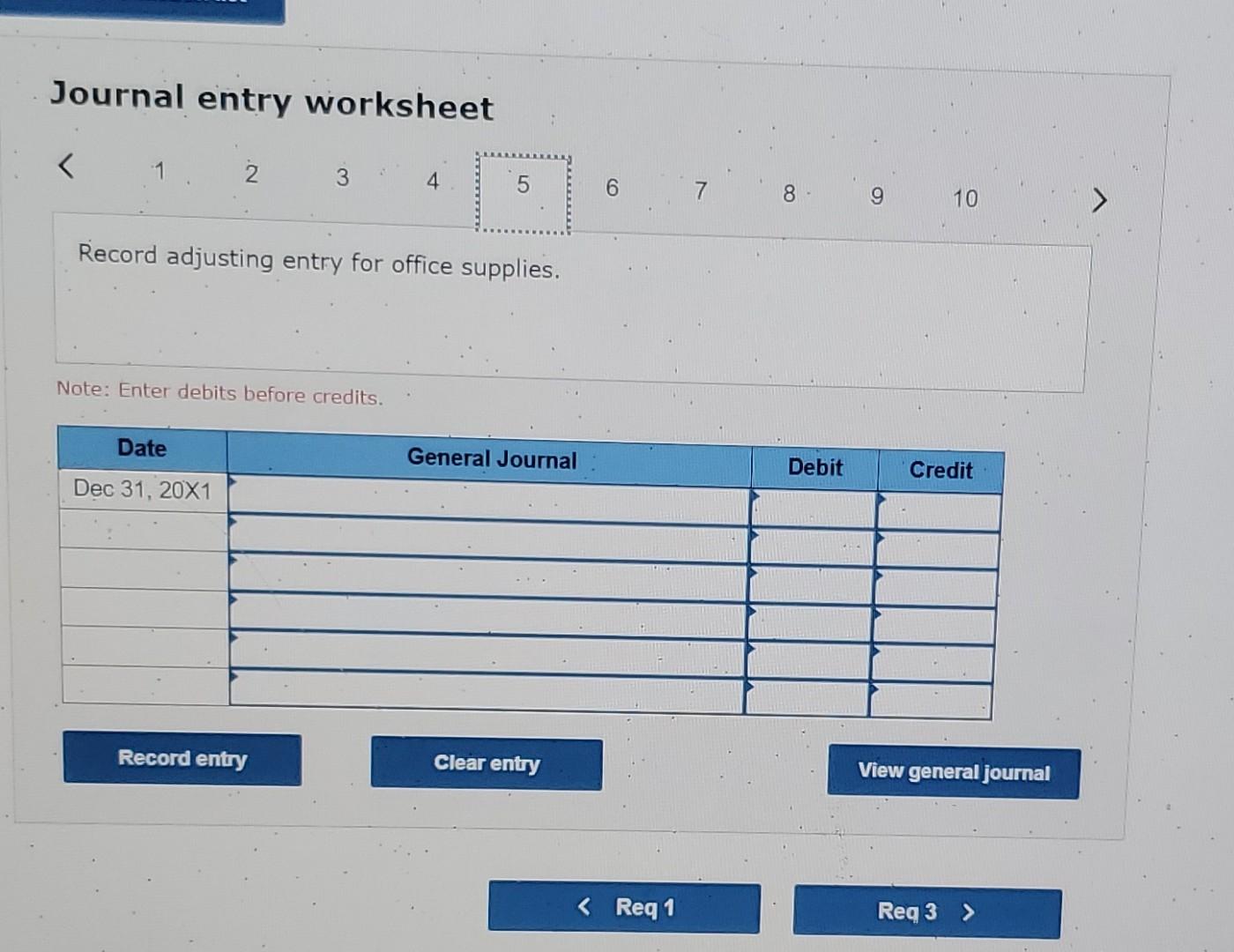

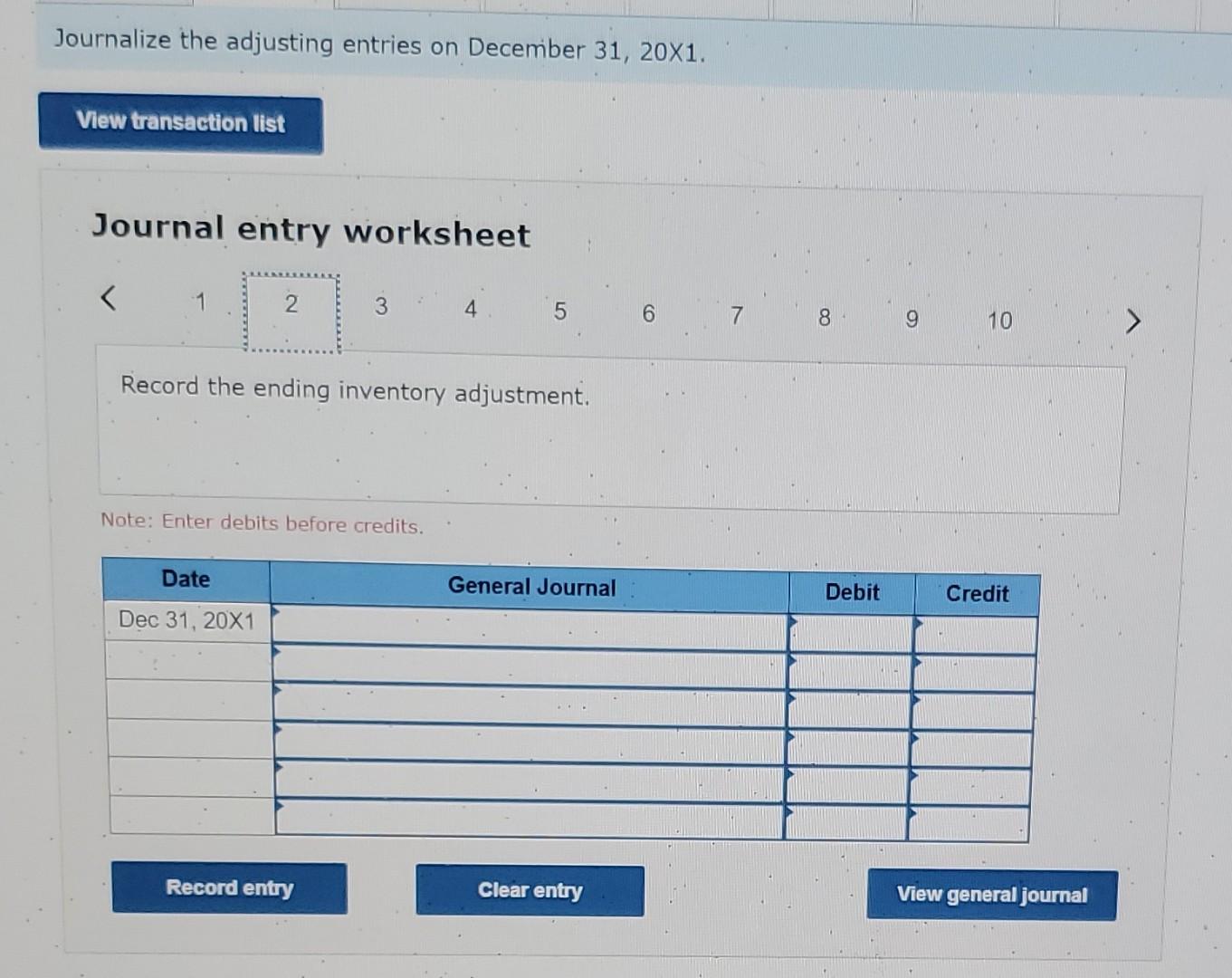

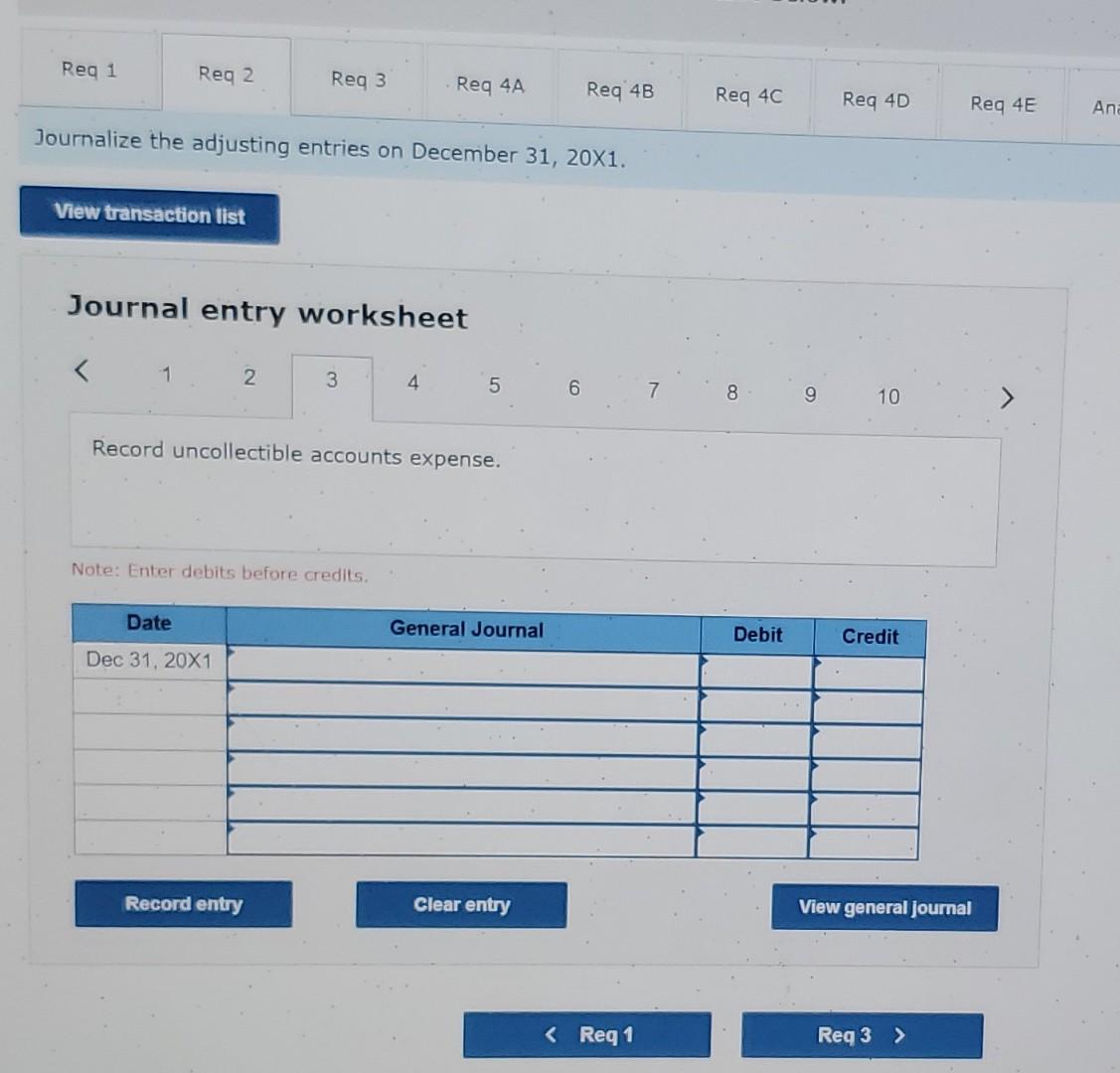

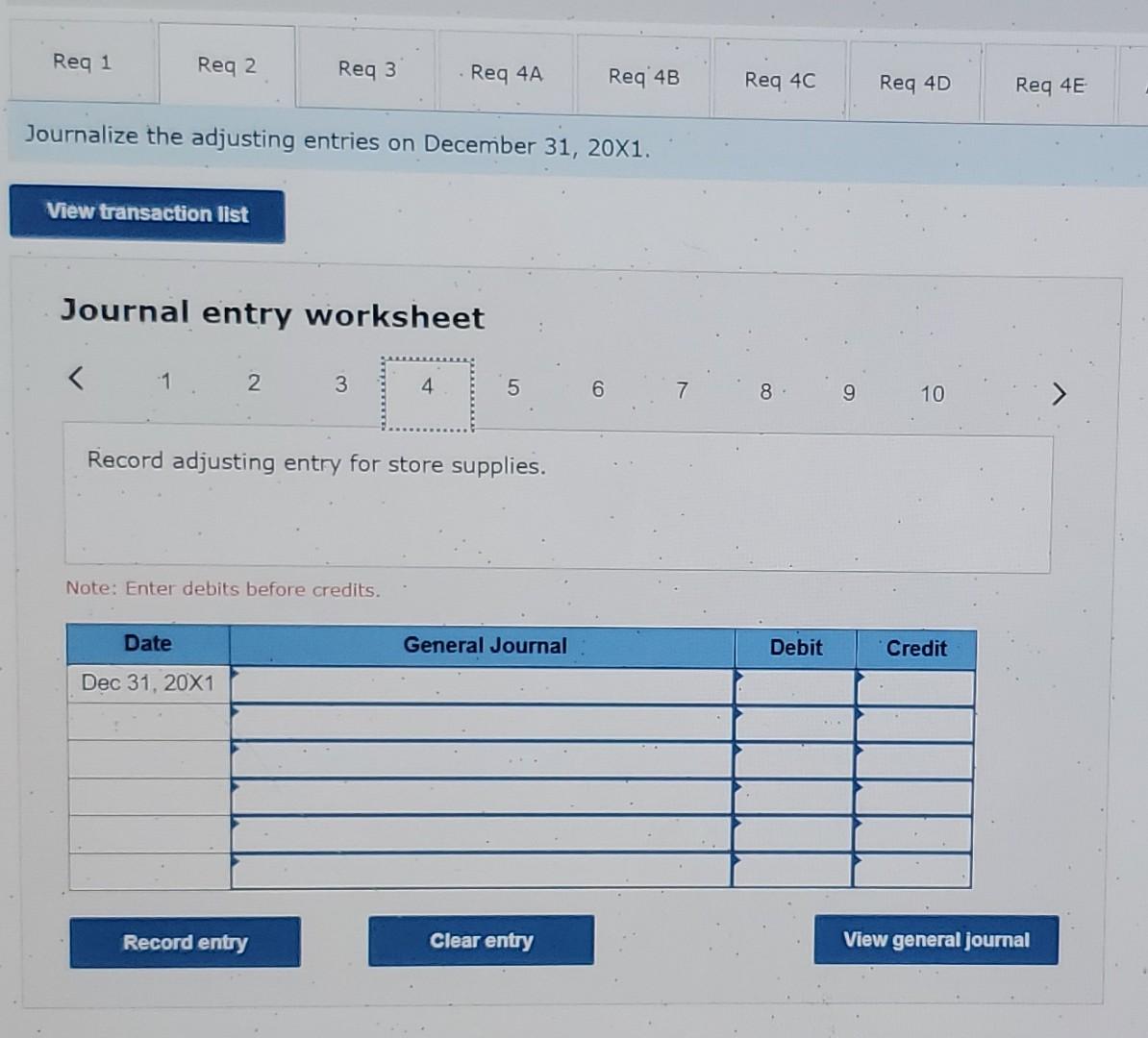

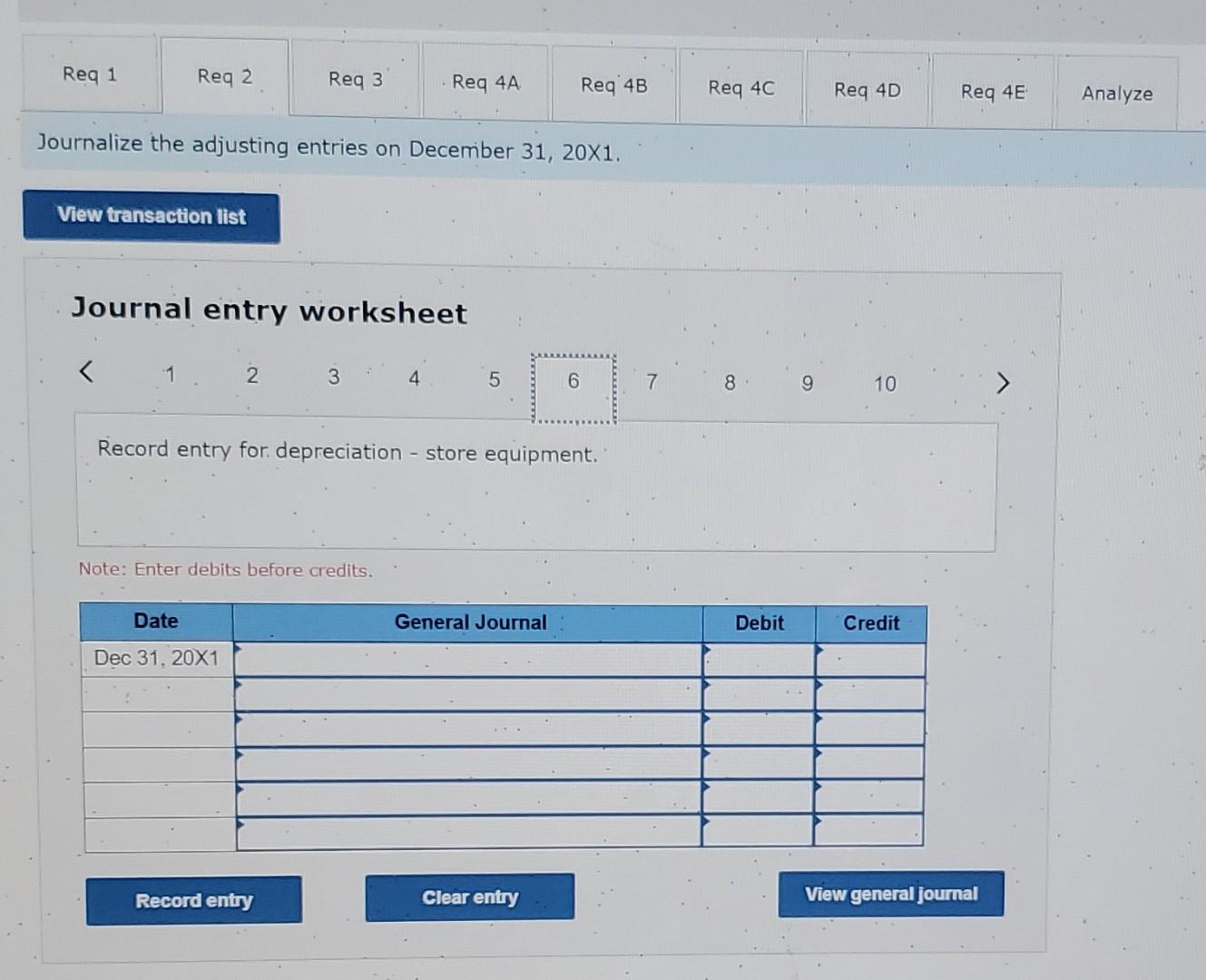

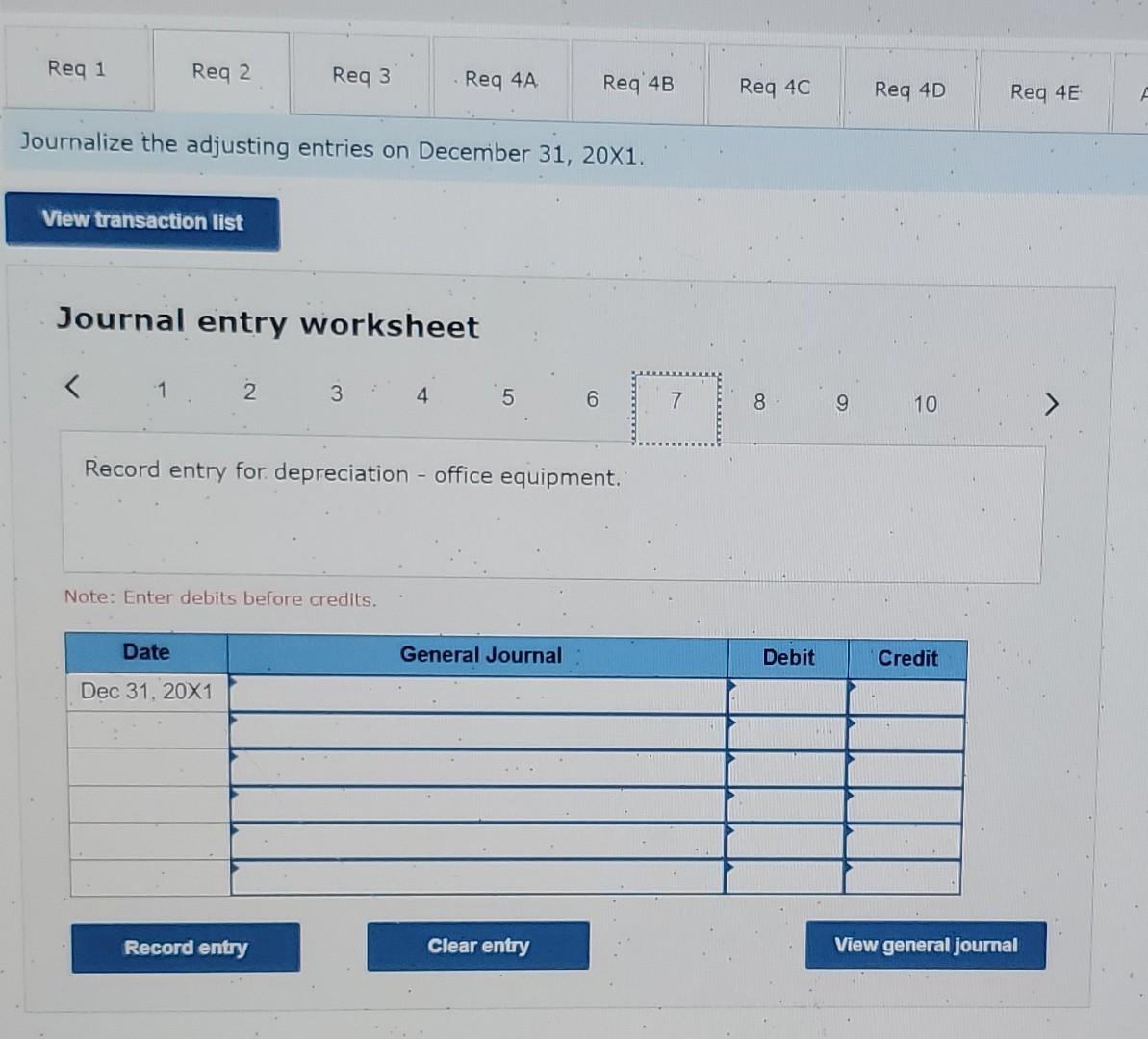

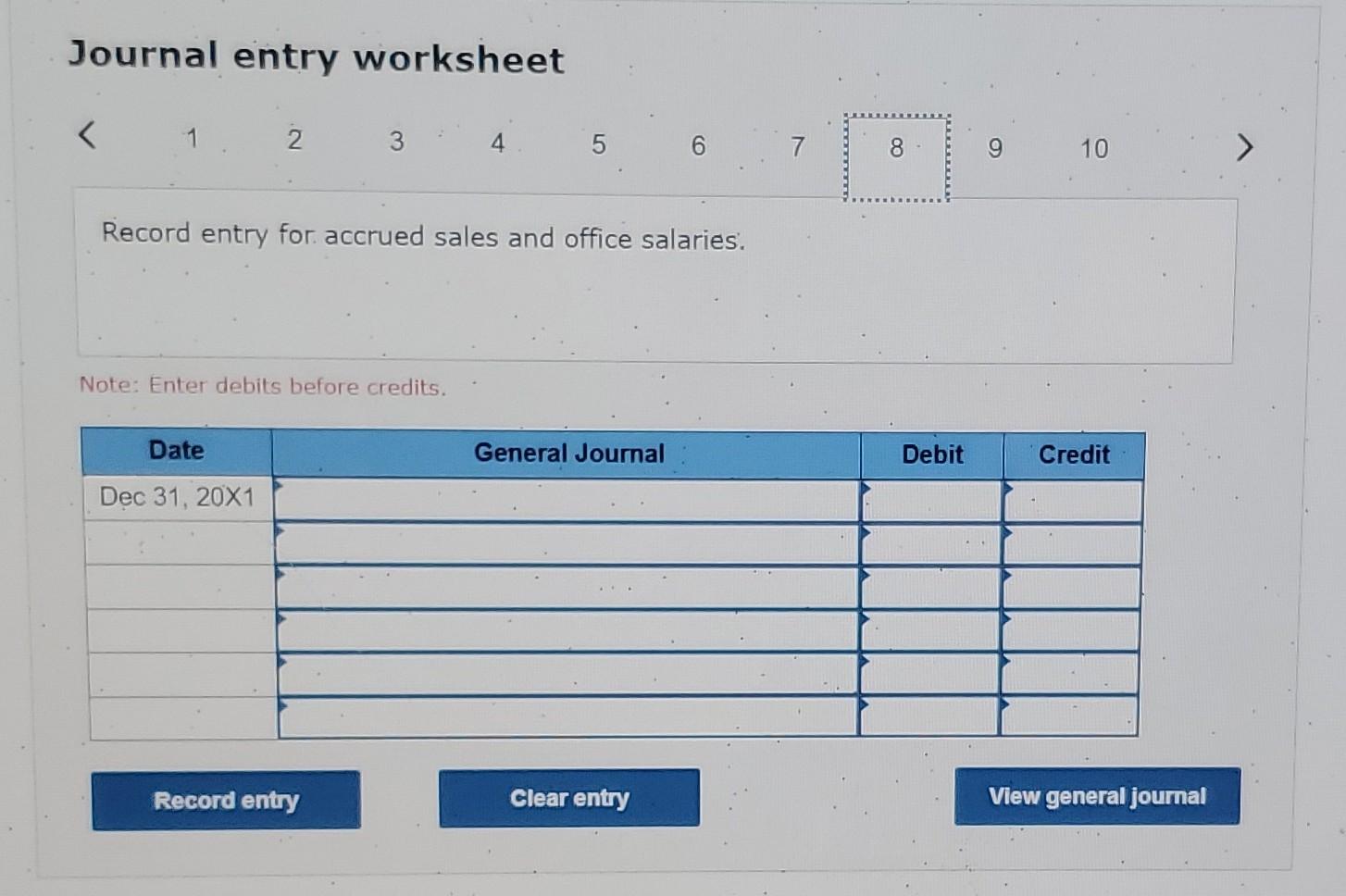

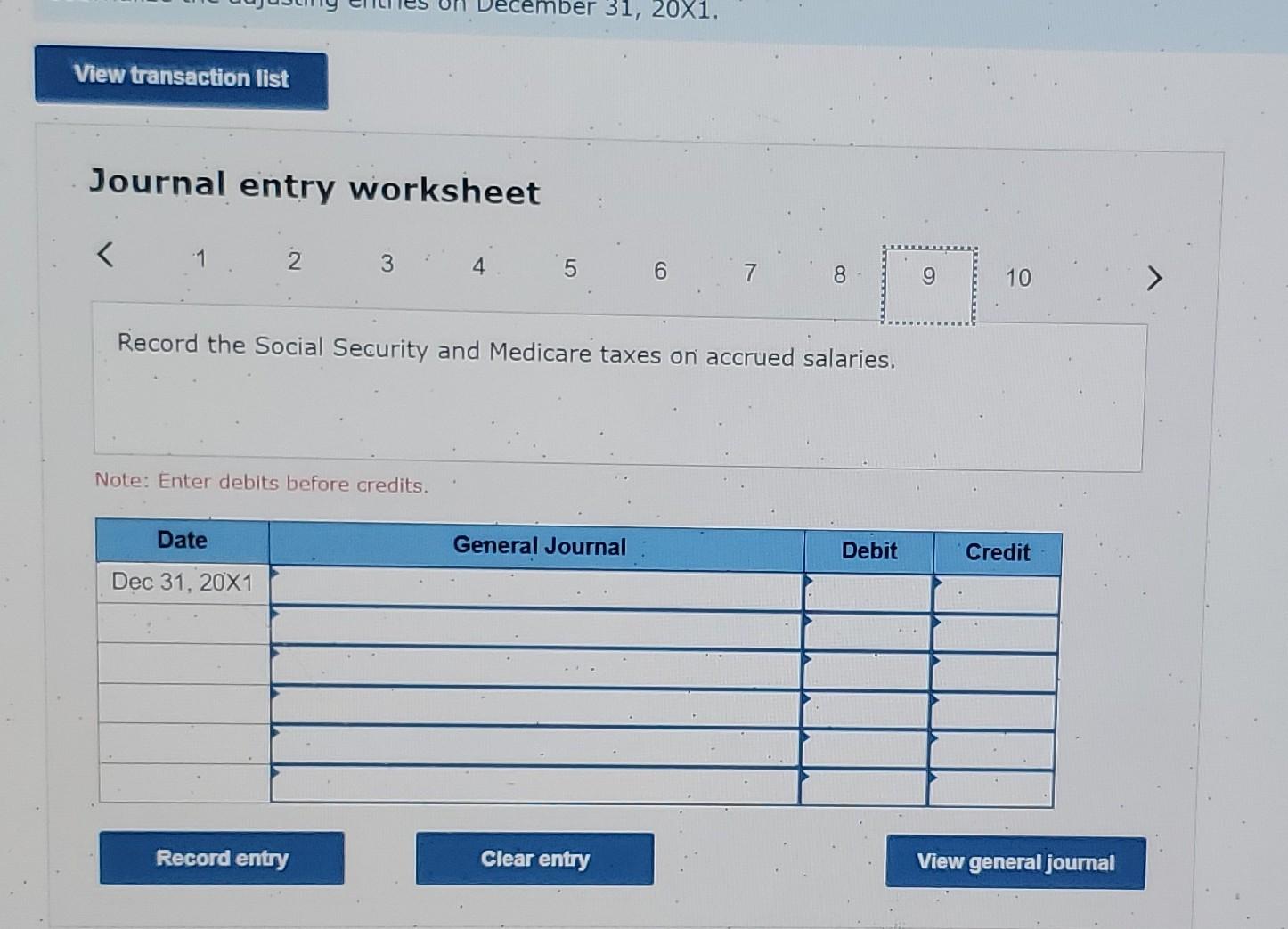

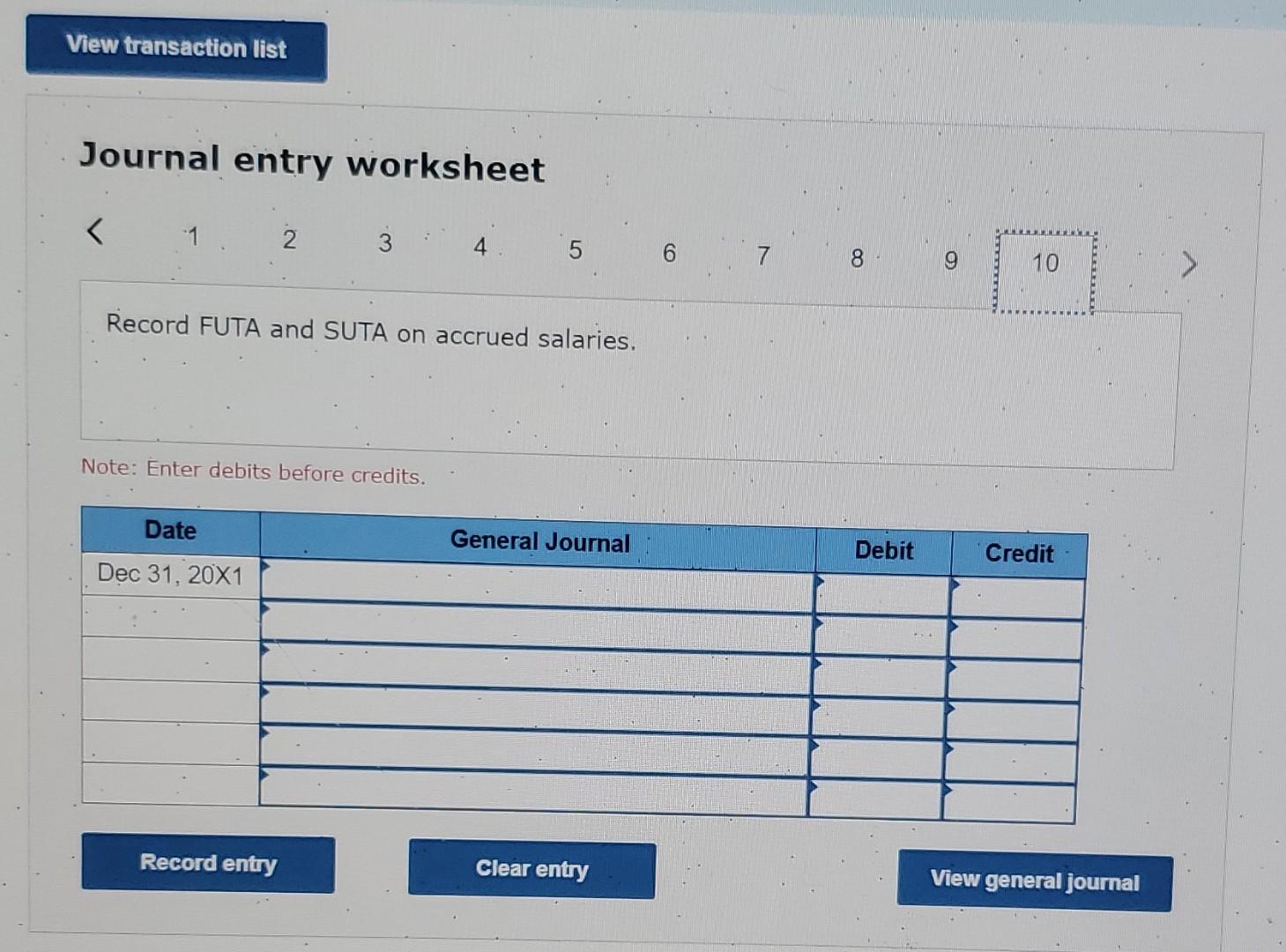

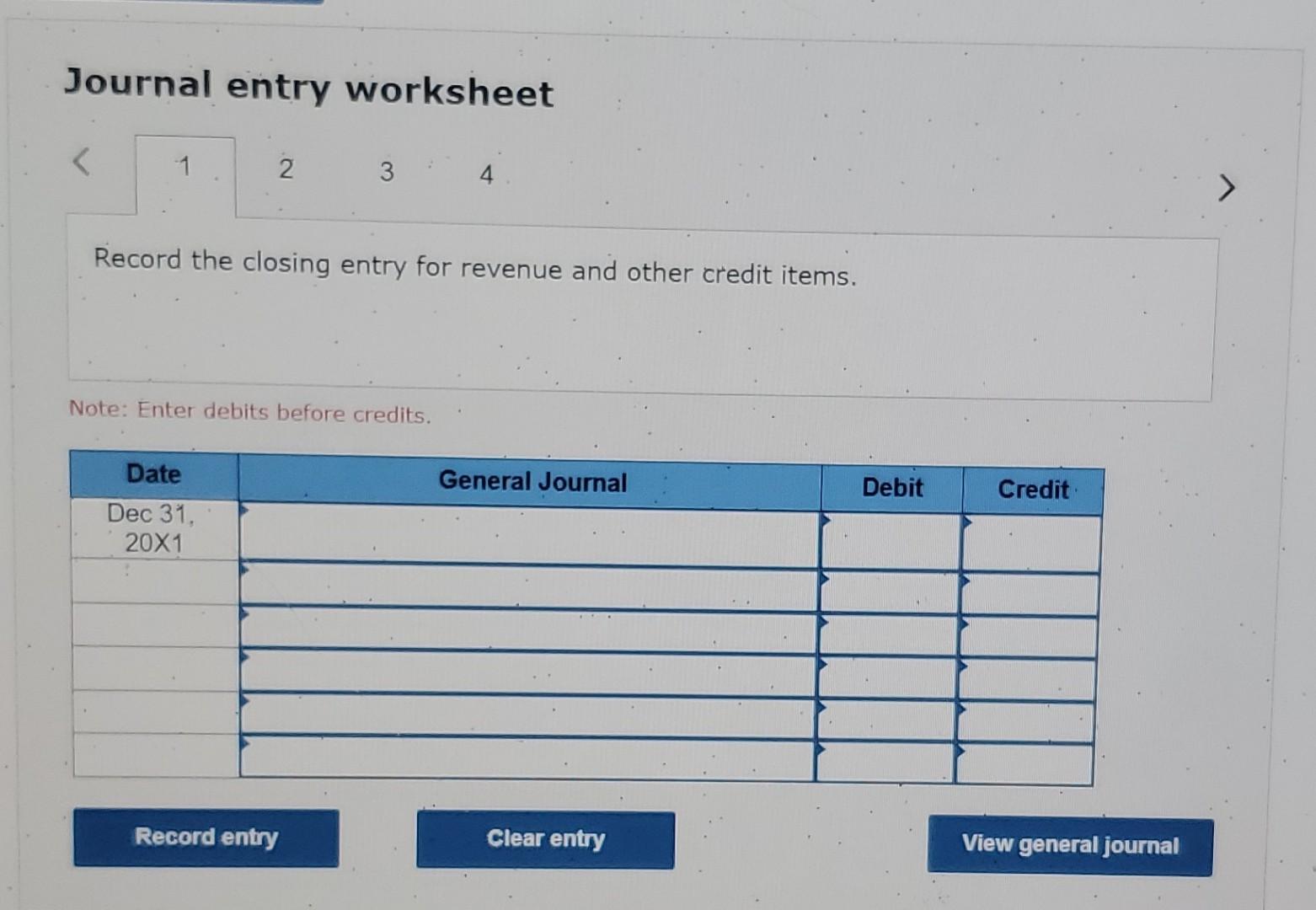

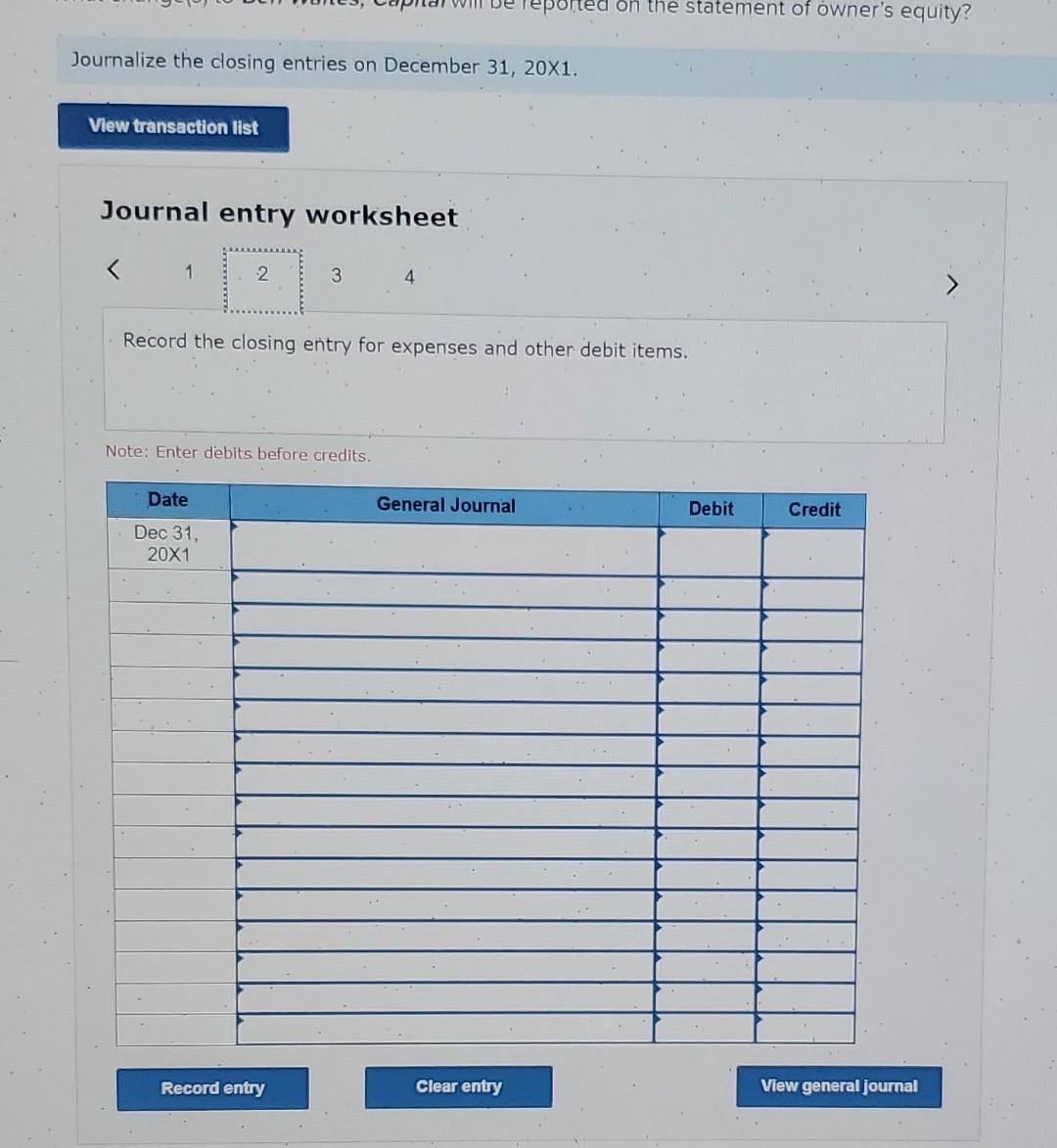

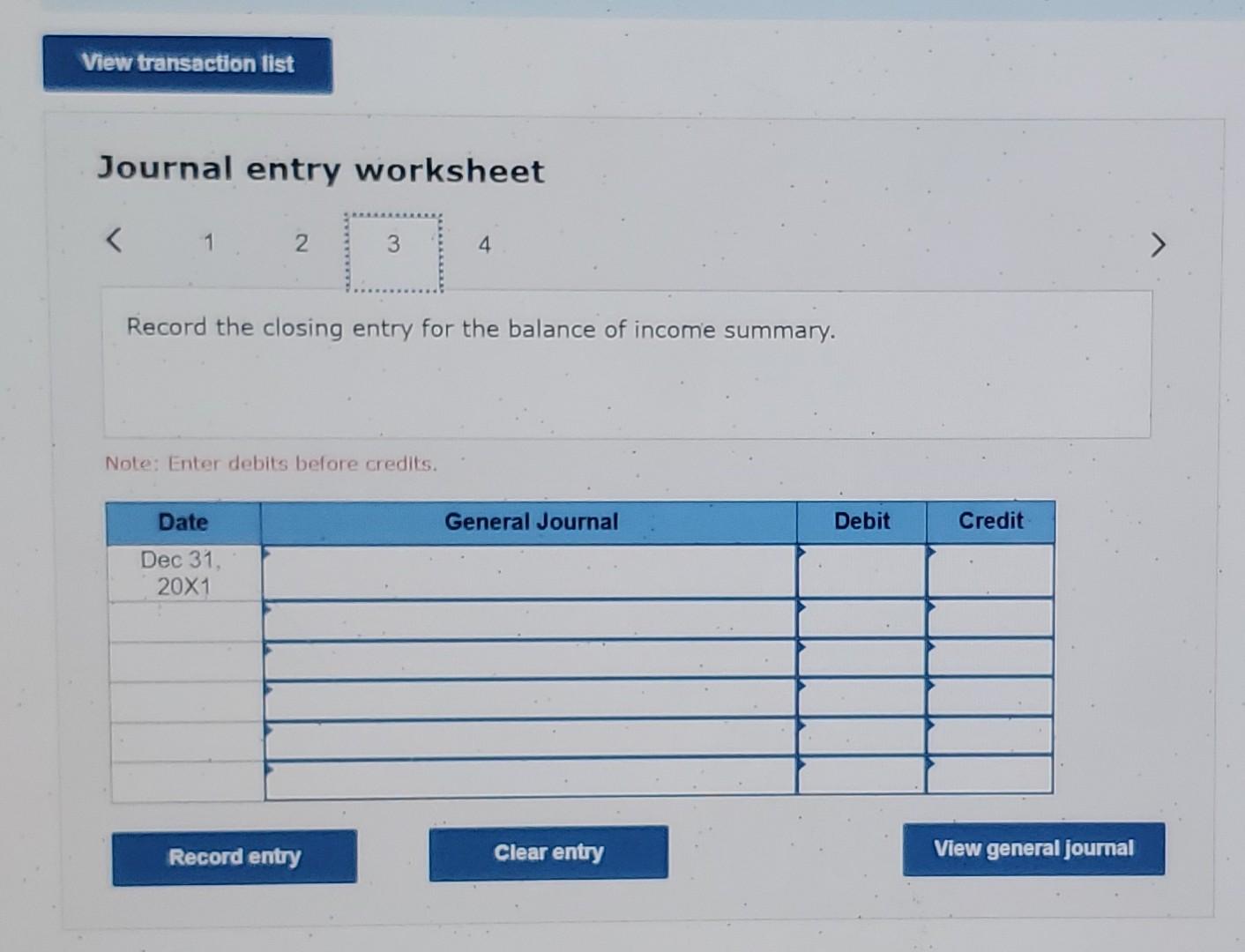

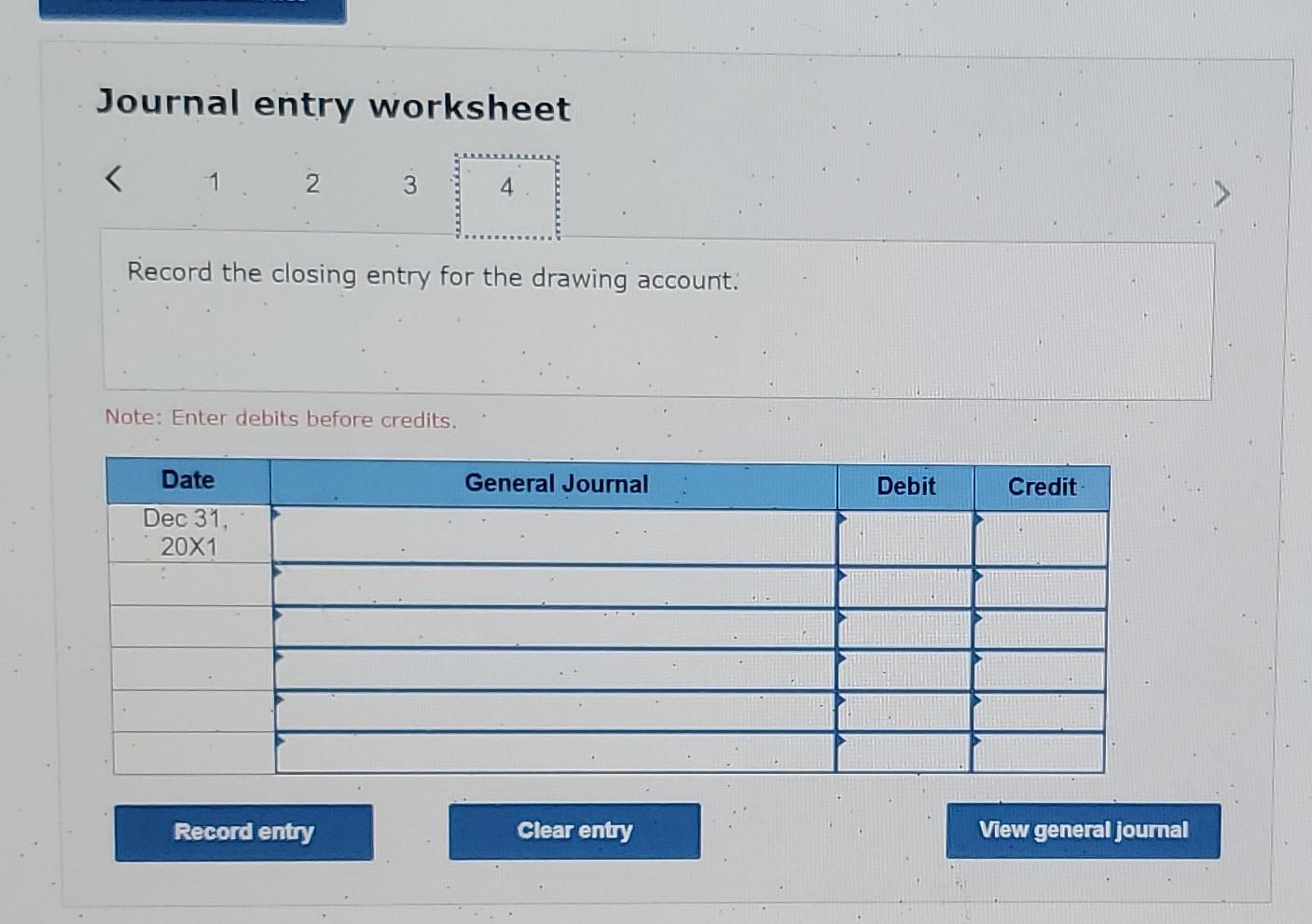

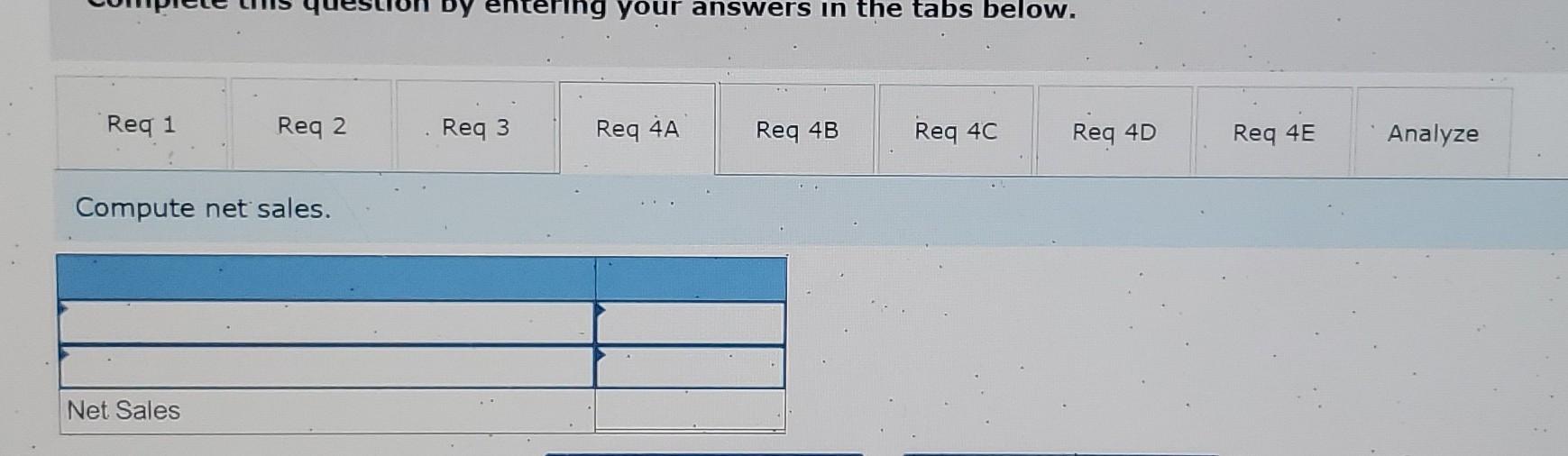

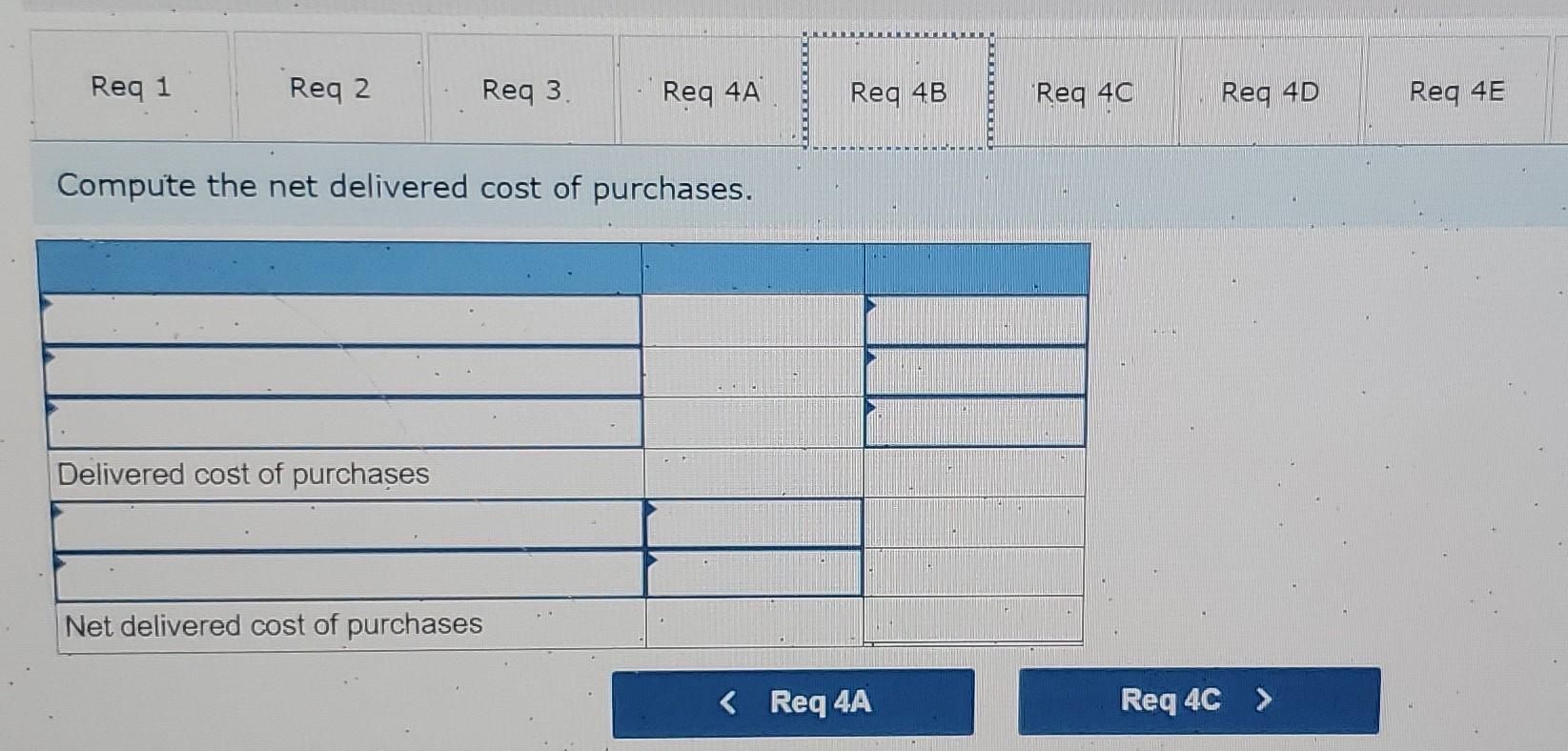

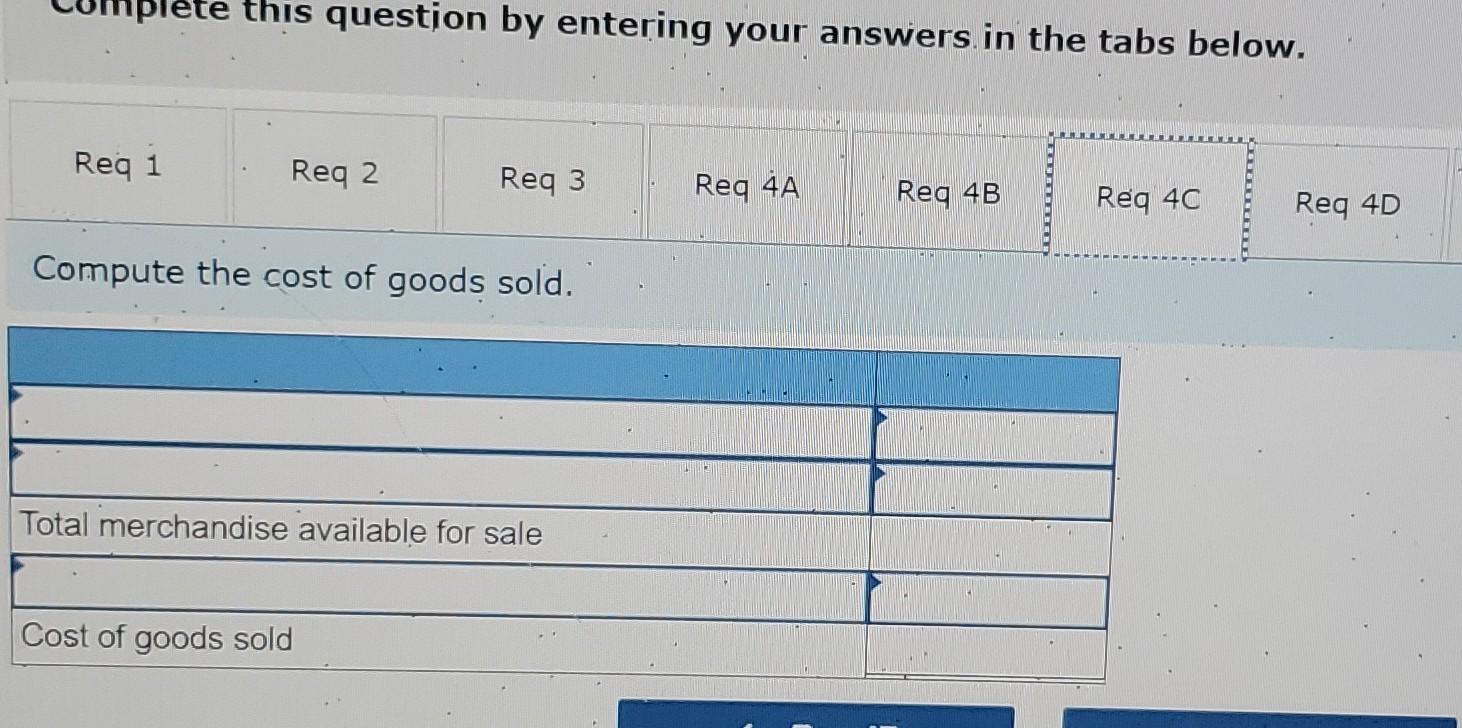

hat change(s). to Ben Waites, Capital will be reported on the statement of owner's equity? Complete this question by entering your answers in the tabs below. Compute the balance of Ben Waites, Capital on December 31, 201. Journal entry worksheet 12345 Record entry for accrued sales and office salaries: Note: Enter debits before credits. Journalize the adjusting entries on December 31,201. Journal entry worksheet Note: Enter debits before credits. Analyze: What change(s) to Ben Waites, Capita/ will be reported on the statement of owner's equity? Complete this question by entering your answers in the tabs below. What change(s) to Ben Waites, Capital will be reported on the statement of owner's equity? Complete this question by entering your answers in the tabs below. Journalize the adjusting entries on December 31,201. Journal entry worksheet Compute net sales. Journalize the closing entries on December 31,201. Journal entry worksheet Record the closing entry for expenses and other debit items. Note: Enter debits before credits. Following is the unadjusted trial balance of Ben's Jewelers on December 31, 201. Complete this question by entering your answers in the tabs below. Complete the worksheet. (Enter both the debit and credit effects wherever required.) Journal entry worksheet 4 Record the closing entry for revenue and other credit items. Note: Enter debits before credits. Journalize the adjusting entries on December 31,201. Journal entry worksheet 4. 56 Note: Enter debits before credits. Journalize the adjusting entries on December 31,201. Journal entry worksheet 13456 Record entry for depreciation - office equipment. Note: Enter debits before credits. Journal entry worksheet Record the closing entry for the drawing account: Note: Enter debits before credits. Journal entry worksheet Record the closing entry for the balance of income summary. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Indicate the amount of net income or loss. Compute the cost of goods sold. Compute the net delivered cost of purchases. Journalize the adjusting entries on December 31,201. Journal entry worksheet Record entry for depreciation - store equipment. Note: Enter debits before credits. Required: 1. Complete the worksheet. a. - b. Ending merchandise inventory, $98,750. c. Uncollectible accounts expense, $1,050. d. Store supplies on hand December 31,201,$630. e. Office supplies on hand December 31,201,$310. f. Depreciation on store equipment, $11,360. g. Depreciation on office equipment, $3,320. h. Accrued sales salaries, $4,050, and accrued office salaries, $1,050. i. Social security tax on accrued salaries, $328; Medicare tax on accrued salaries, $77. (Assumes that tax rates have increased.) j. Federal unemployment tax on accrued salaries, \$57; state unemployment tax on accrued salaries, \$272. 2. Journalize the adjusting entries on December 31,201. 3. Journalize the closing entries on December 31,201. 4. Compute the following: a. net sales b. net delivered cost of purchases c. cost of goods sold d. net income or net loss e. balance of Ben Waites, Capital on December 31, 20X1. Analyze: What change(s) to Ben Waites, Capital will be reported on the statement of owner's equity? Journal entry worksheet 12345678 Record the Social Security and Medicare taxes on accrued salaries. Note: Enter debits before credits. Journal entry worksheet Journal entry worksheet Journalize the adjusting entries on December 31,201. Journal entry worksheet 12 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started