Question

Hatfield Medical Supplys stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had

Hatfield Medical Supplys stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been working for a consulting company, to replace the old CFO, and Lee asked Novak to develop the financial planning section of the strategic plan. In her previous job, Novaks primary task had been to help clients develop financial forecasts, and that was one reason Lee hired her.

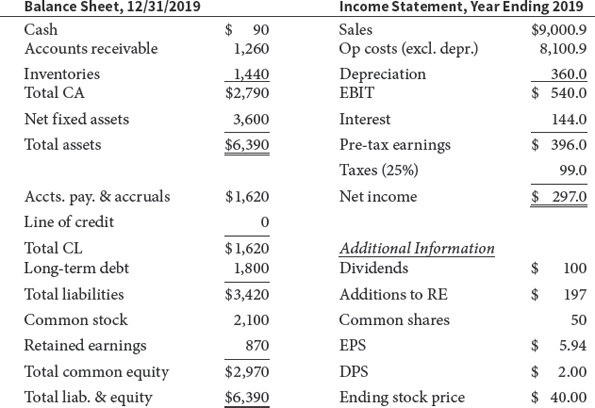

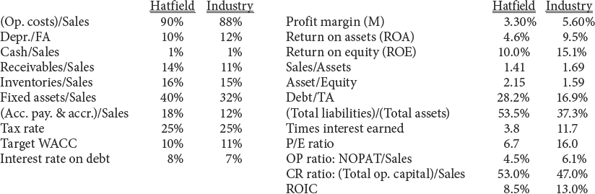

Novak began by comparing Hatfields financial ratios to the industry averages. If any ratio was substandard, she discussed it with the responsible manager to see what could be done to improve the situation. The following data show Hatfields latest financial statements plus some ratios and other data that Novak plans to use in her analysis.

Hatfield Medical Supply (Millions of Dollars, Except per Share Data)

Selected Additional Data for 2019

Continue with the same assumptions for the No Change scenario from the previous question, but now forecast the balance sheet and income statements for 2020 (but not for the following 3 years) using the following preliminary financial policy. (1) Regular dividends will grow by 10%. (2) No additional long-term debt or common stock will be issued. (3) The interest rate on all debt is 8%. (4) Interest expense for long-term debt is based on the average balance during the year. (5) If the operating results and the preliminary financing plan cause a financing deficit, eliminate the deficit by drawing on a line of credit. The line of credit would be tapped on the last day of the year, so it would create no additional interest expenses for that year. (6) If there is a financing surplus, eliminate it by paying a special dividend. After forecasting the 2020 financial statements, answer the following questions.

- (1)

How much will Hatfield need to draw on the line of credit?

- (2)

What are some alternative ways than those in the preliminary financial policy that Hatfield might choose to eliminate the financing deficit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started