Question

have $210,000 of taxable income. View the standard deduction amounts. View the 2023 tax rate schedule for the Married filing_jointly filing status. View the 2023

have

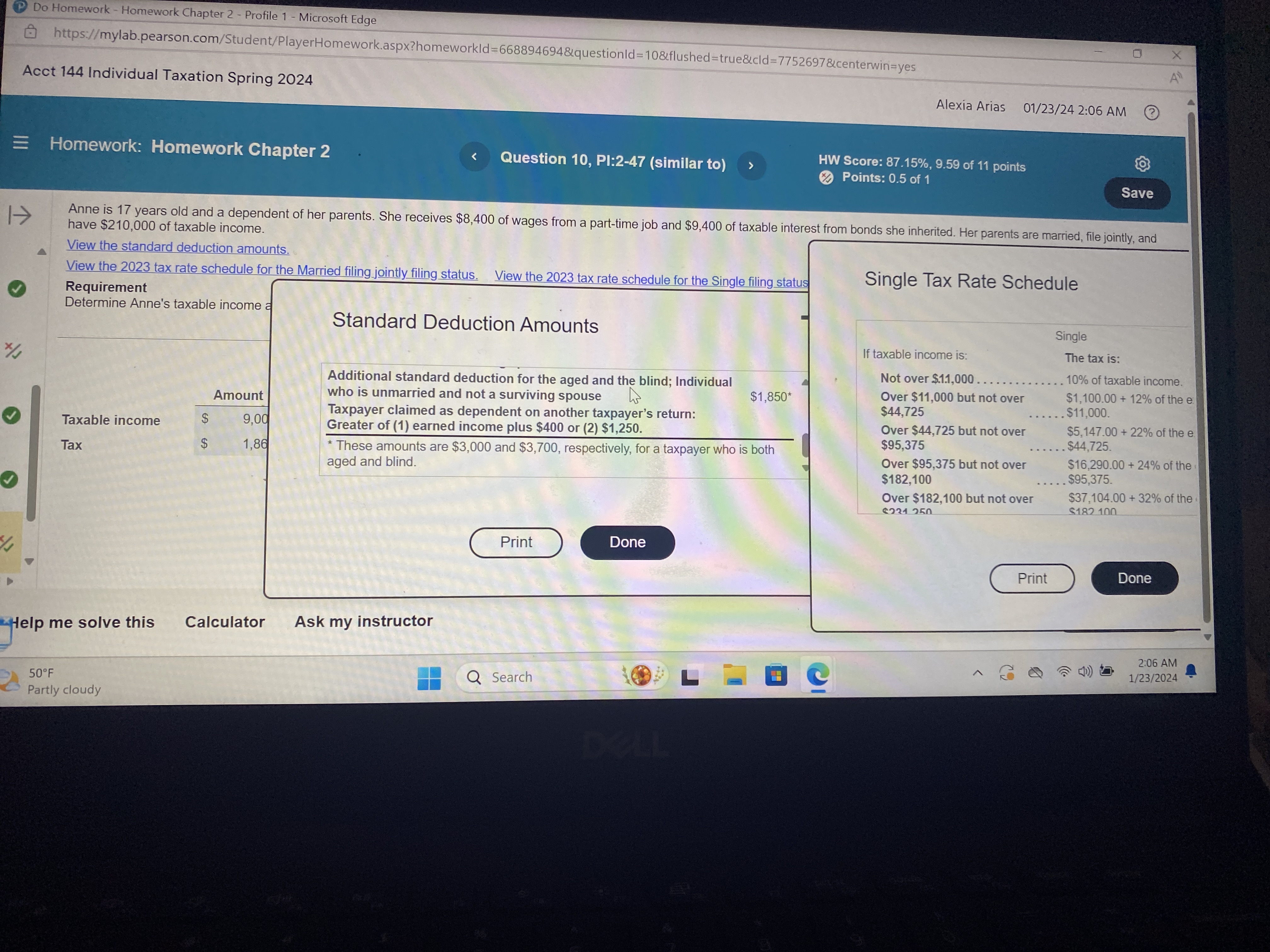

$210,000of taxable income.\ View the standard deduction amounts.\ View the 2023 tax rate schedule for the Married filing_jointly filing status. View the 2023 tax rate schedule for the Single filing status\ Requirement\ Standard Deduction Amounts\ Additional standard deduction for the aged and the blind; Individual\ who is unmarried and not a surviving spouse

$1,850^(**)\ Taxpayer claimed as dependent on another taxpayer's return:\ Greater of (1) earned income plus

$400or (2)

$1,250.\ These amounts are

$3,000and

$3,700, respectively, for a taxpayer who is both\ aged and blind.\ Single Tax Rate Schedule\ Help me solve this\

50\\\\deg F\ Partly cloudy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started