Answered step by step

Verified Expert Solution

Question

1 Approved Answer

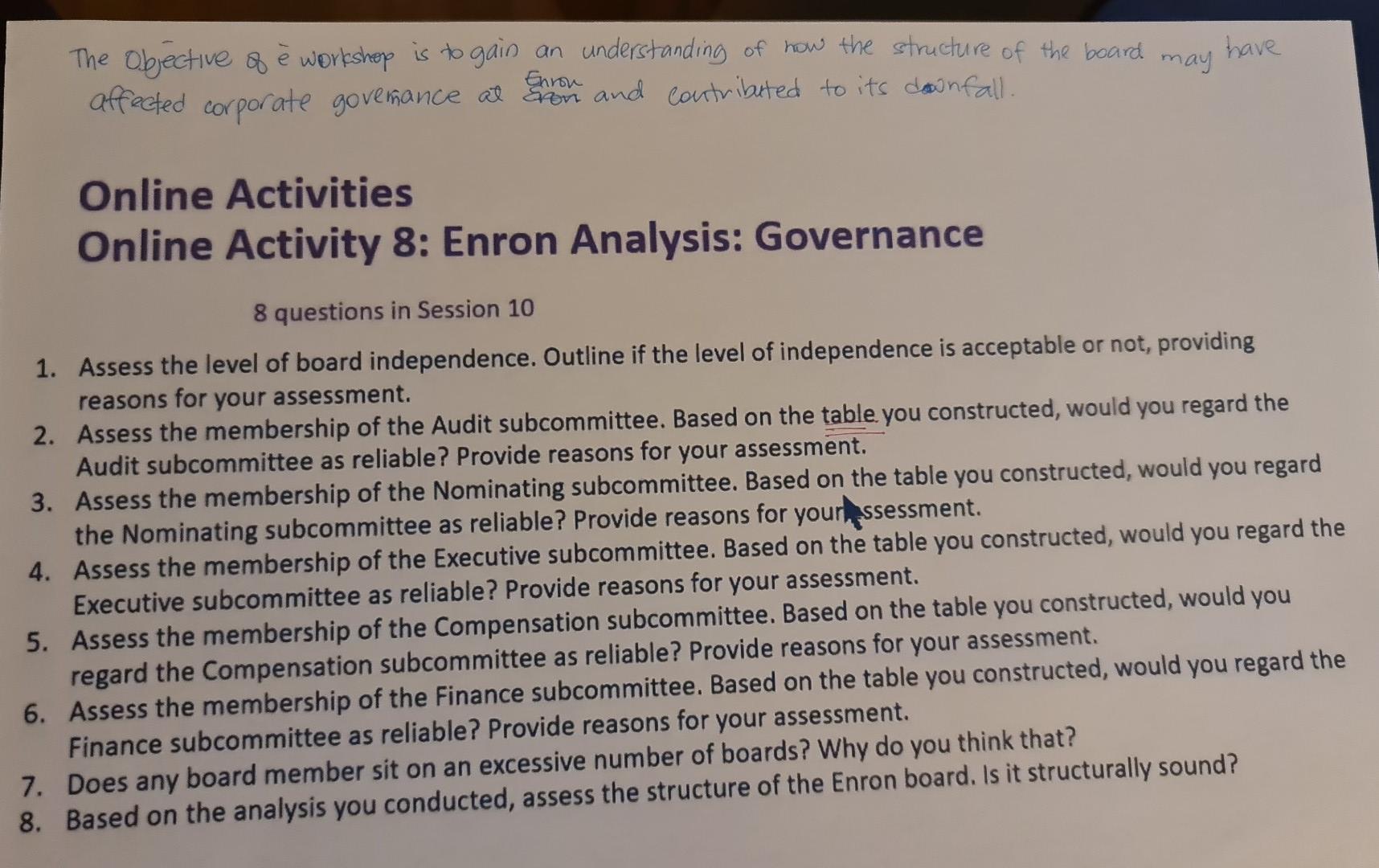

have may The objective of e workshop is to gain an understanding of how the structure of the board affected corporate governance at no one

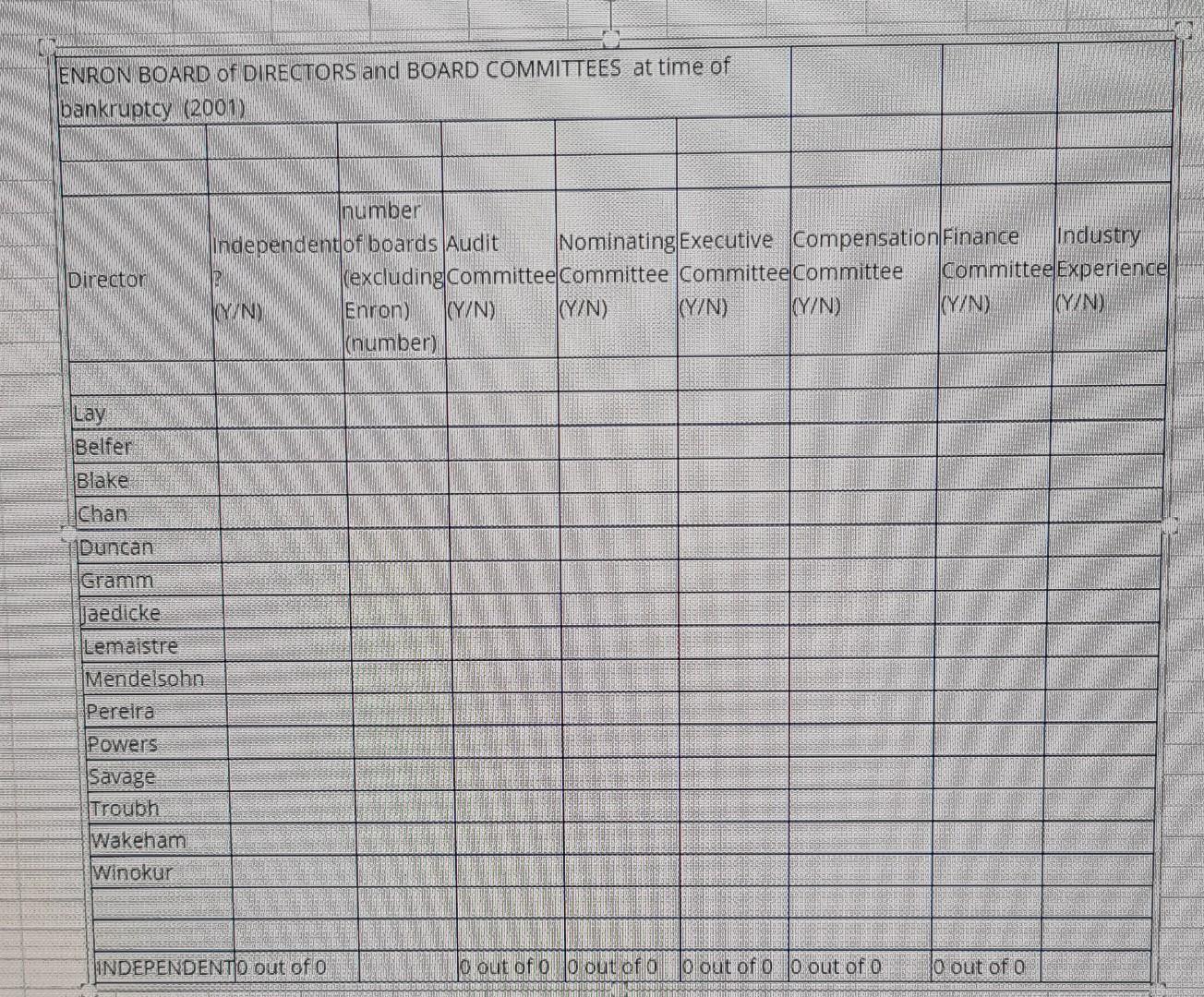

have may The objective of e workshop is to gain an understanding of how the structure of the board affected corporate governance at no one and contributed to its downfall. Enron Online Activities Online Activity 8: Enron Analysis: Governance 8 questions in Session 10 1. Assess the level of board independence. Outline if the level of independence is acceptable or not, providing reasons for your assessment. 2. Assess the membership of the Audit subcommittee. Based on the table you constructed, would you regard the Audit subcommittee as reliable? Provide reasons for your assessment. 3. Assess the membership of the Nominating subcommittee. Based on the table you constructed, would you regard the Nominating subcommittee as reliable? Provide reasons for your ssessment. 4. Assess the membership of the Executive subcommittee. Based on the table you constructed, would you regard the Executive subcommittee as reliable? Provide reasons for your assessment. 5. Assess the membership of the Compensation subcommittee. Based on the table you constructed, would you regard the Compensation subcommittee as reliable? Provide reasons for your assessment. 6. Assess the membership of the Finance subcommittee. Based on the table you constructed, would you regard the Finance subcommittee as reliable? Provide reasons for your assessment. 7. Does any board member sit on an excessive number of boards? Why do you think that? 8. Based on the analysis you conducted, assess the structure of the Enron board. Is it structurally sound? ENRON BOARD of DIRECTORS and BOARD COMMITTEES at time of bankruptcy (2001) Director number Independent of boards Audit Nominating Executive Compensation Finance Industry (excluding Committee Committee Committee Committee Committee Experience NY/N) Enron) (Y/N) (Y/N) (Y/N) (Y/N) (Y/N) CYN) (number) Lay Belfer Blake Chan Duncan Gramm laedicke Lemaistre Mendelsohn Pereira Powers Savage Troubh Wakeham Winokur INDEPENDENTO out of o o out of o o out of o 10 out of o o out of o 0 out of o have may The objective of e workshop is to gain an understanding of how the structure of the board affected corporate governance at no one and contributed to its downfall. Enron Online Activities Online Activity 8: Enron Analysis: Governance 8 questions in Session 10 1. Assess the level of board independence. Outline if the level of independence is acceptable or not, providing reasons for your assessment. 2. Assess the membership of the Audit subcommittee. Based on the table you constructed, would you regard the Audit subcommittee as reliable? Provide reasons for your assessment. 3. Assess the membership of the Nominating subcommittee. Based on the table you constructed, would you regard the Nominating subcommittee as reliable? Provide reasons for your ssessment. 4. Assess the membership of the Executive subcommittee. Based on the table you constructed, would you regard the Executive subcommittee as reliable? Provide reasons for your assessment. 5. Assess the membership of the Compensation subcommittee. Based on the table you constructed, would you regard the Compensation subcommittee as reliable? Provide reasons for your assessment. 6. Assess the membership of the Finance subcommittee. Based on the table you constructed, would you regard the Finance subcommittee as reliable? Provide reasons for your assessment. 7. Does any board member sit on an excessive number of boards? Why do you think that? 8. Based on the analysis you conducted, assess the structure of the Enron board. Is it structurally sound? ENRON BOARD of DIRECTORS and BOARD COMMITTEES at time of bankruptcy (2001) Director number Independent of boards Audit Nominating Executive Compensation Finance Industry (excluding Committee Committee Committee Committee Committee Experience NY/N) Enron) (Y/N) (Y/N) (Y/N) (Y/N) (Y/N) CYN) (number) Lay Belfer Blake Chan Duncan Gramm laedicke Lemaistre Mendelsohn Pereira Powers Savage Troubh Wakeham Winokur INDEPENDENTO out of o o out of o o out of o 10 out of o o out of o 0 out of o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started