Answered step by step

Verified Expert Solution

Question

1 Approved Answer

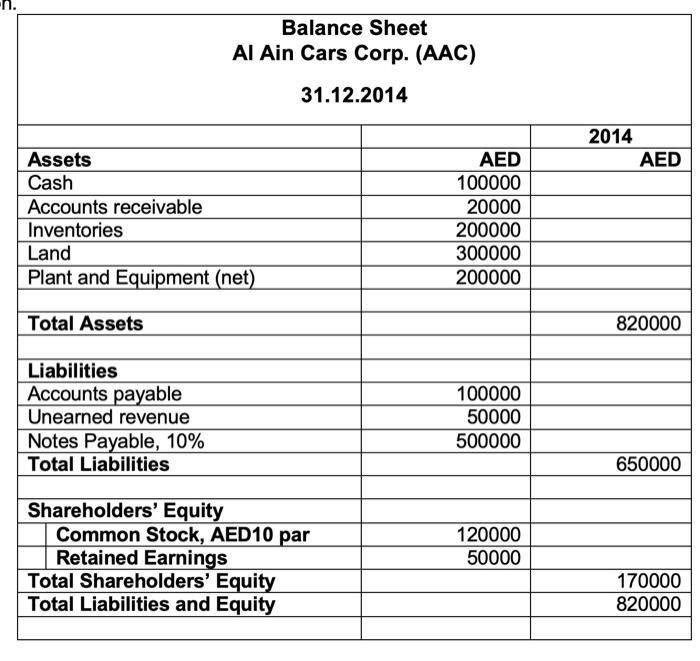

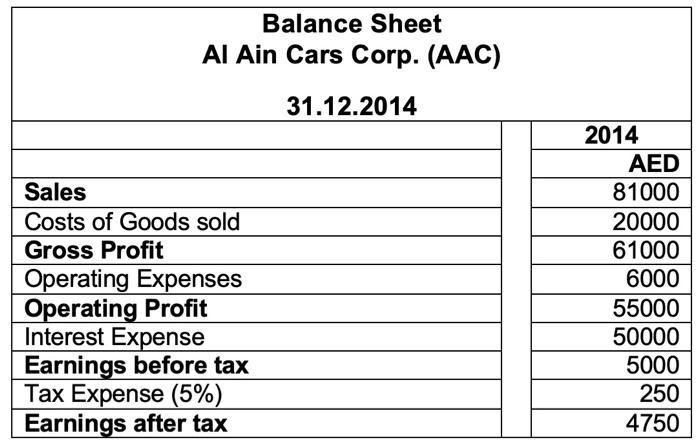

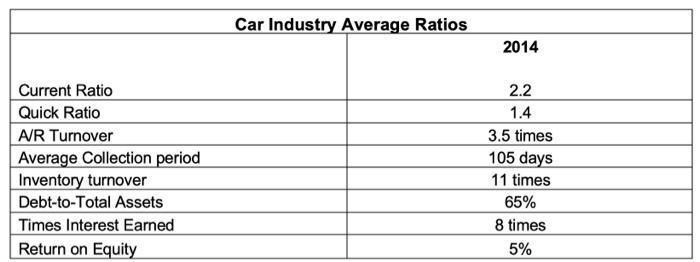

Evaluate with the financial statements below the company's performance. Describe all four classification and give one final statement how the company is performing in comparison

Evaluate with the financial statements below the company's performance. Describe all four classification and give one final statement how the company is performing in comparison to the industry averages. Please note that you do not need to show your calculations from the ratios in this question.

Assets Cash Accounts receivable Inventories Balance Sheet Al Ain Cars Corp. (AAC) Land Plant and Equipment (net) Total Assets Liabilities Accounts payable Unearned revenue Notes Payable, 10% Total Liabilities 31.12.2014 Shareholders Equity Common Stock, AED10 par Retained Earnings Total Shareholders Equity Total Liabilities and Equity AED 100000 20000 200000 300000 200000 100000 50000 500000 120000 50000 2014 AED 820000 650000 170000 820000 Balance Sheet Al Ain Cars Corp. (AAC) Sales Costs of Goods sold Gross Profit Operating Expenses Operating Profit Interest Expense Earnings before tax Tax Expense (5%) Earnings after tax 31.12.2014 2014 AED 81000 20000 61000 6000 55000 50000 5000 250 4750 Current Ratio Quick Ratio A/R Turnover Average Collection period Inventory turnover Debt-to-Total Assets Times Interest Earned Return on Equity Car Industry Average Ratios 2014 2.2 1.4 3.5 times 105 days 11 times 65% 8 times 5%

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The average revenue growth allows a company to track its growth Comparing this against the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started