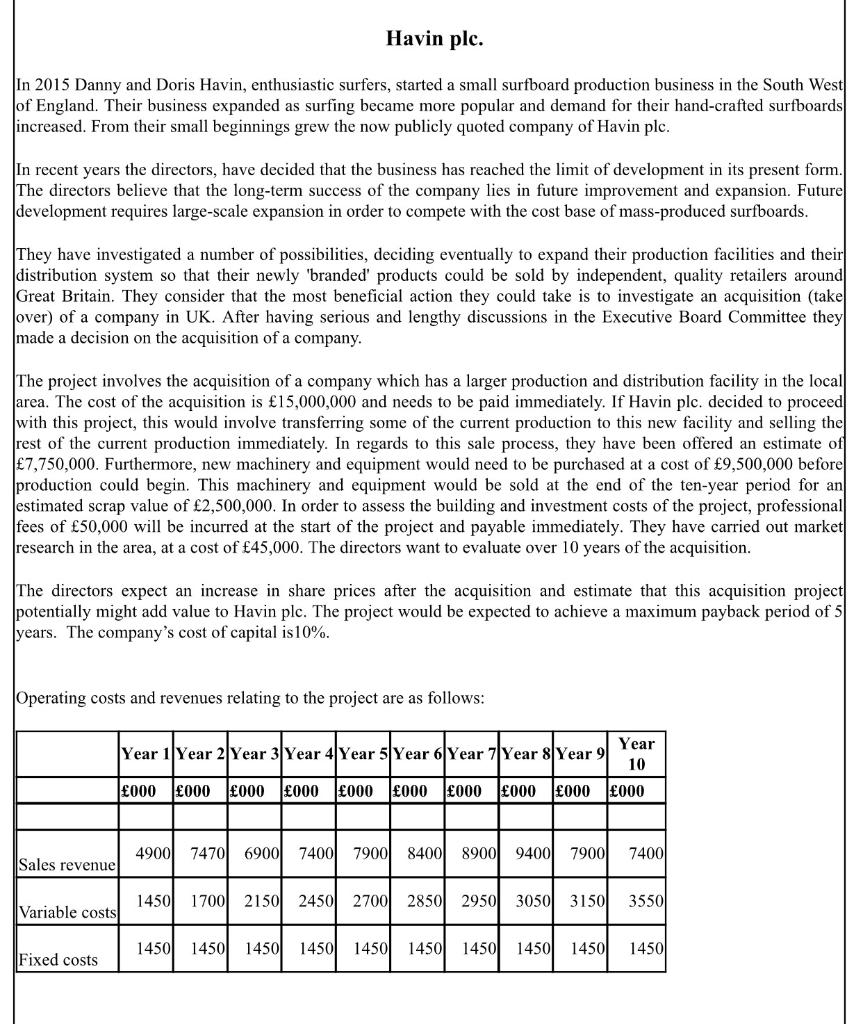

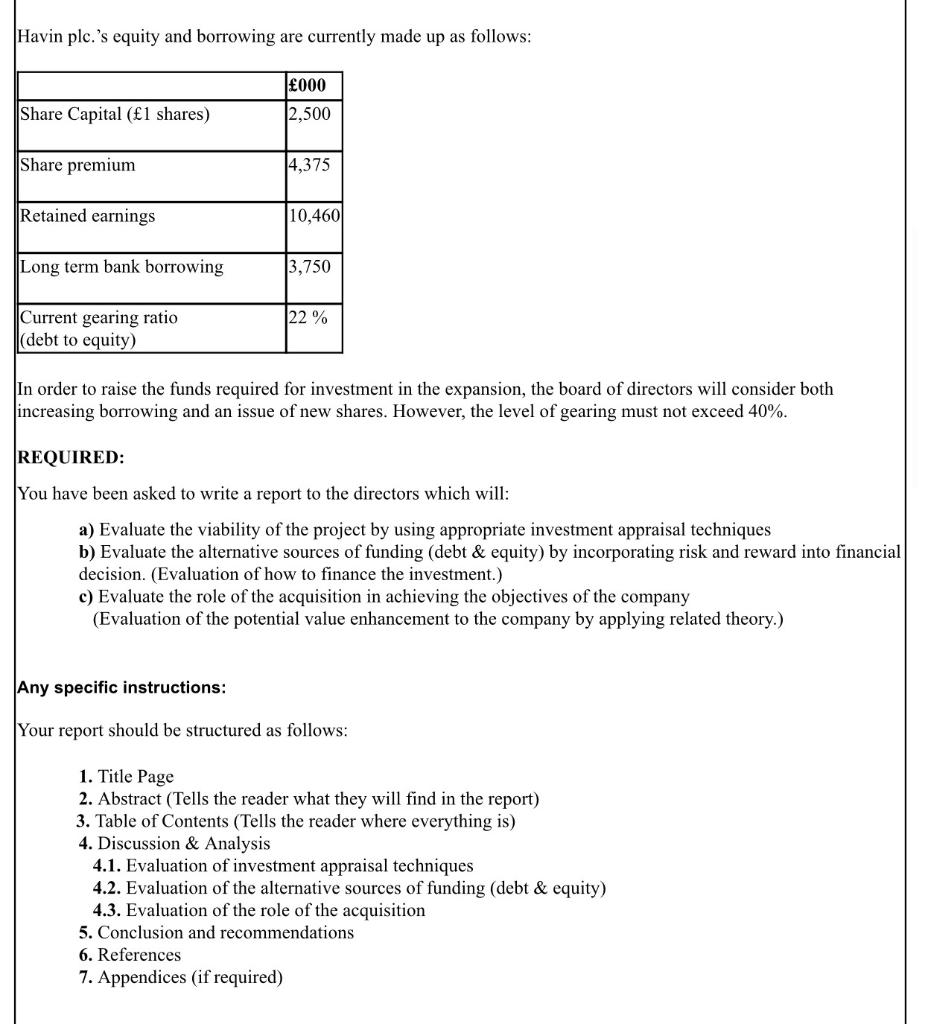

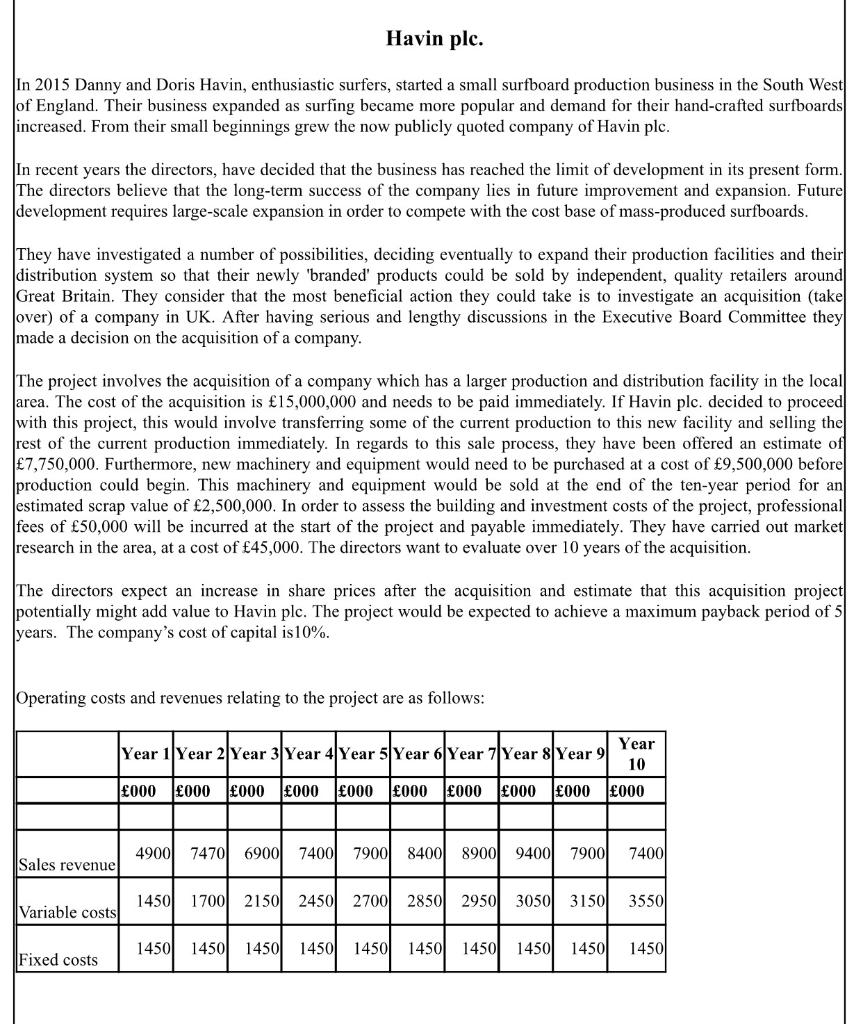

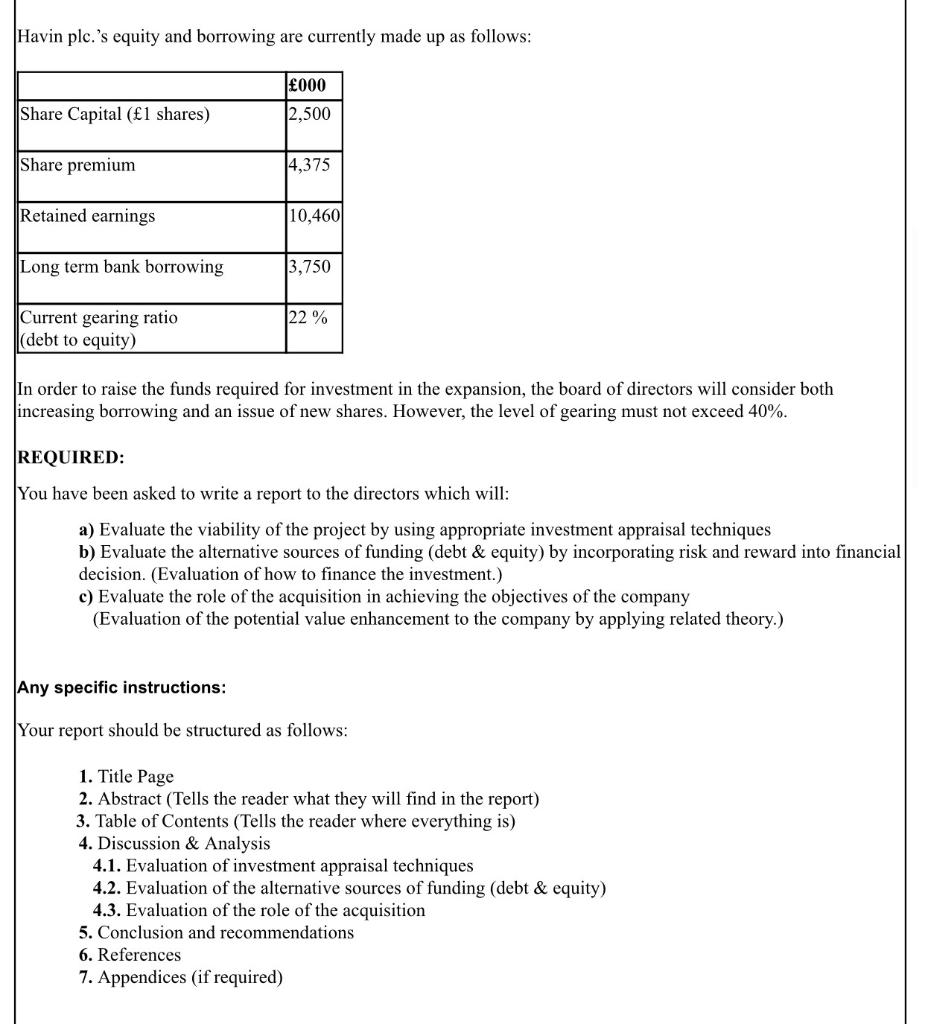

Havin plc. In 2015 Danny and Doris Havin, enthusiastic surfers, started a small surfboard production business in the South West of England. Their business expanded as surfing became more popular and demand for their hand-crafted surfboards increased. From their small beginnings grew the now publicly quoted company of Havin plc. In recent years the directors, have decided that the business has reached the limit of development in its present form. The directors believe that the long-term success of the company lies in future improvement and expansion. Future development requires large-scale expansion in order to compete with the cost base of mass-produced surfboards. They have investigated a number of possibilities, deciding eventually to expand their production facilities and their distribution system so that their newly 'branded products could be sold by independent, quality retailers around Great Britain. They consider that the most beneficial action they could take is to investigate an acquisition (take over) of a company in UK. After having serious and lengthy discussions in the Executive Board Committee they made a decision on the acquisition of a company. The project involves the acquisition of a company which has a larger production and distribution facility in the local area. The cost of the acquisition is 15,000,000 and needs to be paid immediately. If Havin plc. decided to proceed with this project, this would involve transferring some of the current production to this new facility and selling the rest of the current production immediately. In regards to this sale process, they have been offered an estimate of 7,750,000. Furthermore, new machinery and equipment would need to be purchased at a cost of 9,500,000 before production could begin. This machinery and equipment would be sold at the end of the ten-year period for an estimated scrap value of 2,500,000. In order to assess the building and investment costs of the project, professional fees of 50,000 will be incurred at the start of the project and payable immediately. They have carried out market research in the area, at a cost of 45,000. The directors want to evaluate over 10 years of the acquisition. The directors expect an increase in share prices after the acquisition and estimate that this acquisition project potentially might add value to Havin plc. The project would be expected to achieve a maximum payback period of 5 years. The company's cost of capital is 10%. Operating costs and revenues relating to the project are as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 |000 000 000 000 000 000 000 000 000 000 4900 74701 6900 7400 7900 8400 8900 9400 79001 7400 Sales revenue 1450 1700 2150 2450 2700 2850 2950 3050 3150 3550 Variable costs 1450 1450 1450 1450 14501 1450 1450 1450 1450 1450 Fixed costs Havin plc.'s equity and borrowing are currently made up as follows: 000 Share Capital (1 shares) 12,500 Share premium 4,375 Retained earnings 10,460 Long term bank borrowing 3,750 22 % Current gearing ratio (debt to equity) In order to raise the funds required for investment in the expansion, the board of directors will consider both increasing borrowing and an issue of new shares. However, the level of gearing must not exceed 40%. REQUIRED: You have been asked to write a report to the directors which will: a) Evaluate the viability of the project by using appropriate investment appraisal techniques b) Evaluate the alternative sources of funding (debt & equity) by incorporating risk and reward into financial decision. (Evaluation of how to finance the investment.) c) Evaluate the role of the acquisition in achieving the objectives of the company (Evaluation of the potential value enhancement to the company by applying related theory.) Any specific instructions: Your report should be structured as follows: 1. Title Page 2. Abstract (Tells the reader what they will find in the report) 3. Table of Contents (Tells the reader where everything is) 4. Discussion & Analysis 4.1. Evaluation of investment appraisal techniques 4.2. Evaluation of the alternative sources of funding (debt & equity) 4.3. Evaluation of the role of the acquisition 5. Conclusion and recommendations 6. References 7. Appendices (if required) Havin plc. In 2015 Danny and Doris Havin, enthusiastic surfers, started a small surfboard production business in the South West of England. Their business expanded as surfing became more popular and demand for their hand-crafted surfboards increased. From their small beginnings grew the now publicly quoted company of Havin plc. In recent years the directors, have decided that the business has reached the limit of development in its present form. The directors believe that the long-term success of the company lies in future improvement and expansion. Future development requires large-scale expansion in order to compete with the cost base of mass-produced surfboards. They have investigated a number of possibilities, deciding eventually to expand their production facilities and their distribution system so that their newly 'branded products could be sold by independent, quality retailers around Great Britain. They consider that the most beneficial action they could take is to investigate an acquisition (take over) of a company in UK. After having serious and lengthy discussions in the Executive Board Committee they made a decision on the acquisition of a company. The project involves the acquisition of a company which has a larger production and distribution facility in the local area. The cost of the acquisition is 15,000,000 and needs to be paid immediately. If Havin plc. decided to proceed with this project, this would involve transferring some of the current production to this new facility and selling the rest of the current production immediately. In regards to this sale process, they have been offered an estimate of 7,750,000. Furthermore, new machinery and equipment would need to be purchased at a cost of 9,500,000 before production could begin. This machinery and equipment would be sold at the end of the ten-year period for an estimated scrap value of 2,500,000. In order to assess the building and investment costs of the project, professional fees of 50,000 will be incurred at the start of the project and payable immediately. They have carried out market research in the area, at a cost of 45,000. The directors want to evaluate over 10 years of the acquisition. The directors expect an increase in share prices after the acquisition and estimate that this acquisition project potentially might add value to Havin plc. The project would be expected to achieve a maximum payback period of 5 years. The company's cost of capital is 10%. Operating costs and revenues relating to the project are as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 |000 000 000 000 000 000 000 000 000 000 4900 74701 6900 7400 7900 8400 8900 9400 79001 7400 Sales revenue 1450 1700 2150 2450 2700 2850 2950 3050 3150 3550 Variable costs 1450 1450 1450 1450 14501 1450 1450 1450 1450 1450 Fixed costs Havin plc.'s equity and borrowing are currently made up as follows: 000 Share Capital (1 shares) 12,500 Share premium 4,375 Retained earnings 10,460 Long term bank borrowing 3,750 22 % Current gearing ratio (debt to equity) In order to raise the funds required for investment in the expansion, the board of directors will consider both increasing borrowing and an issue of new shares. However, the level of gearing must not exceed 40%. REQUIRED: You have been asked to write a report to the directors which will: a) Evaluate the viability of the project by using appropriate investment appraisal techniques b) Evaluate the alternative sources of funding (debt & equity) by incorporating risk and reward into financial decision. (Evaluation of how to finance the investment.) c) Evaluate the role of the acquisition in achieving the objectives of the company (Evaluation of the potential value enhancement to the company by applying related theory.) Any specific instructions: Your report should be structured as follows: 1. Title Page 2. Abstract (Tells the reader what they will find in the report) 3. Table of Contents (Tells the reader where everything is) 4. Discussion & Analysis 4.1. Evaluation of investment appraisal techniques 4.2. Evaluation of the alternative sources of funding (debt & equity) 4.3. Evaluation of the role of the acquisition 5. Conclusion and recommendations 6. References 7. Appendices (if required)