Answered step by step

Verified Expert Solution

Question

1 Approved Answer

having a bit of trouble with this. I am about 70% done but I'm struggling. help would be very appreciated. I need help preparing a

having a bit of trouble with this. I am about 70% done but I'm struggling. help would be very appreciated. I need help preparing a direct cash flow statement using the information given. i need 1 through 11 value figured for it.

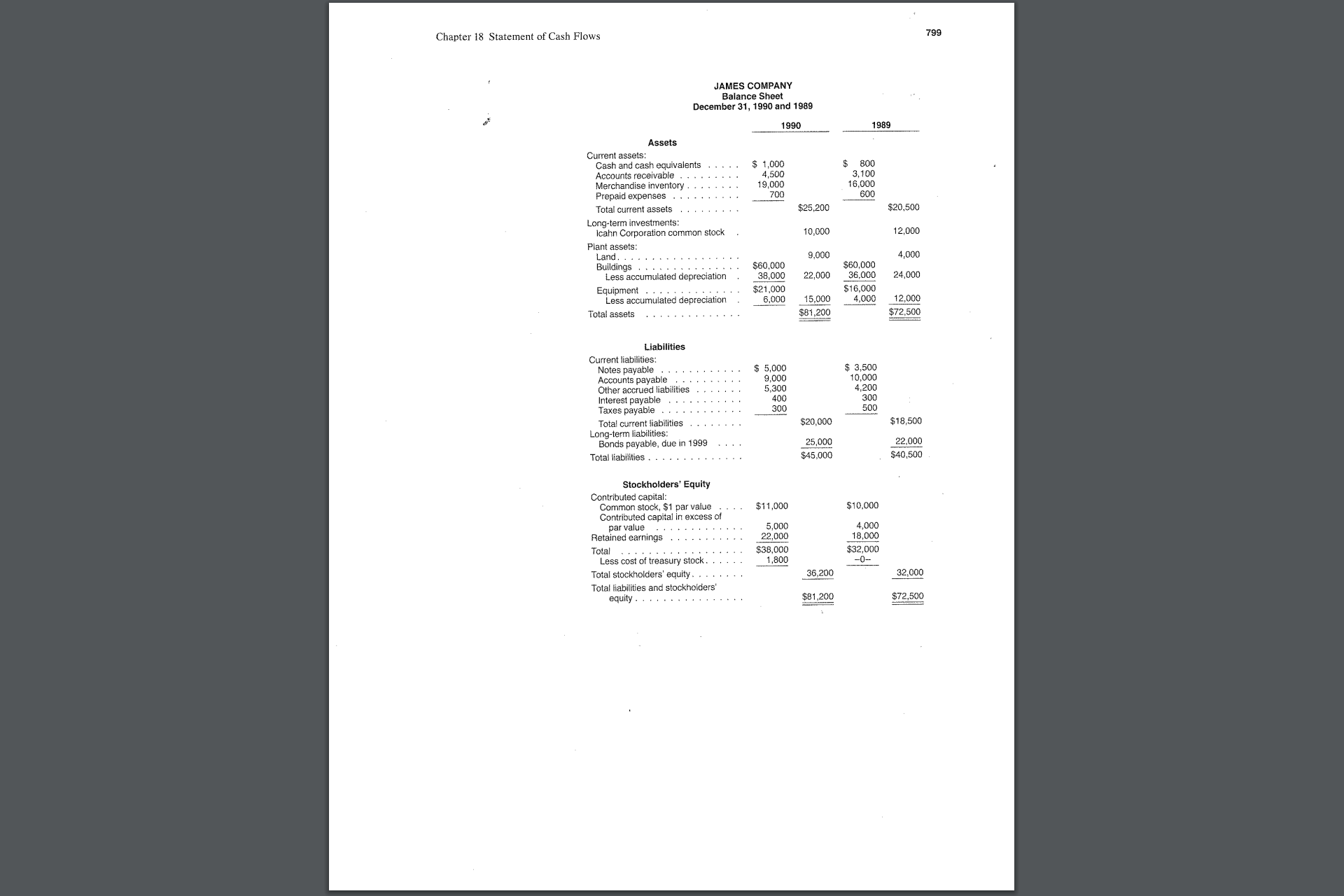

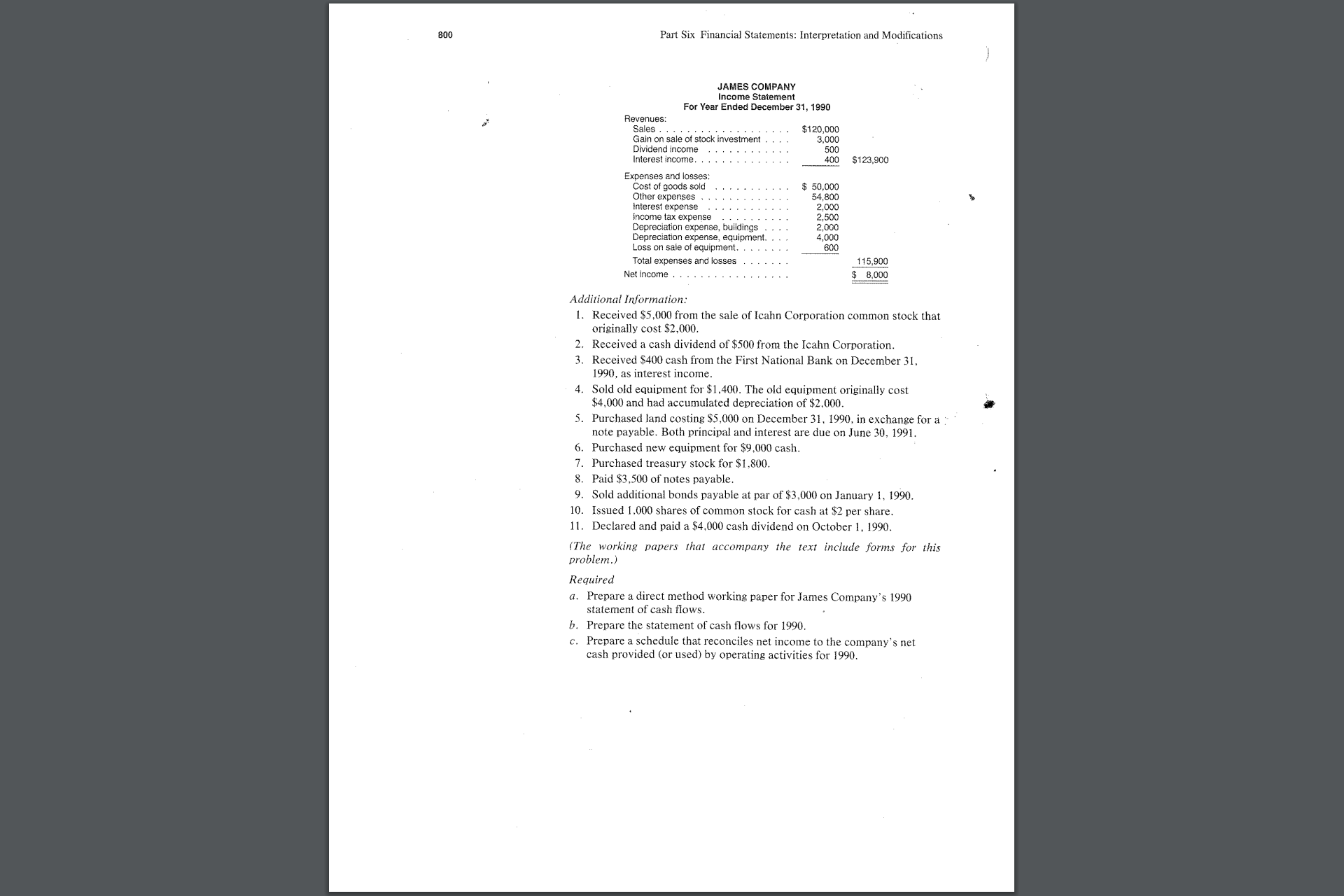

Chapter 18 Statement of Cash Flows Part Six Financial Statements: Interpretation and Modifications Additional Information: 1. Received $5,000 from the sale of Icahn Corporation common stock that originally cost $2,000. 2. Received a cash dividend of $500 from the Icahn Corporation. 3. Received $400 cash from the First National Bank on December 31 , 1990 , as interest income. 4. Sold old equipment for $1,400. The old equipment originally cost $4,000 and had accumulated depreciation of $2,000. 5. Purchased land costing $5,000 on December 31,1990 , in exchange for a note payable. Both principal and interest are due on June 30,1991. 6. Purchased new equipment for $9,000 cash. 7. Purchased treasury stock for $1,800. 8. Paid $3,500 of notes payable. 9. Sold additional bonds payable at par of $3,000 on January 1, 1990 . 10. Issued 1,000 shares of common stock for cash at $2 per share. 11. Declared and paid a $4,000 cash dividend on October 1,1990 . (The working papers that accompany the text include forms for this problem.) Required a. Prepare a direct method working paper for James Company's 1990 statement of cash flows. b. Prepare the statement of cash flows for 1990 . c. Prepare a schedule that reconciles net income to the company's net cash provided (or used) by operating activities for 1990 . Chapter 18 Statement of Cash Flows Part Six Financial Statements: Interpretation and Modifications Additional Information: 1. Received $5,000 from the sale of Icahn Corporation common stock that originally cost $2,000. 2. Received a cash dividend of $500 from the Icahn Corporation. 3. Received $400 cash from the First National Bank on December 31 , 1990 , as interest income. 4. Sold old equipment for $1,400. The old equipment originally cost $4,000 and had accumulated depreciation of $2,000. 5. Purchased land costing $5,000 on December 31,1990 , in exchange for a note payable. Both principal and interest are due on June 30,1991. 6. Purchased new equipment for $9,000 cash. 7. Purchased treasury stock for $1,800. 8. Paid $3,500 of notes payable. 9. Sold additional bonds payable at par of $3,000 on January 1, 1990 . 10. Issued 1,000 shares of common stock for cash at $2 per share. 11. Declared and paid a $4,000 cash dividend on October 1,1990 . (The working papers that accompany the text include forms for this problem.) Required a. Prepare a direct method working paper for James Company's 1990 statement of cash flows. b. Prepare the statement of cash flows for 1990 . c. Prepare a schedule that reconciles net income to the company's net cash provided (or used) by operating activities for 1990

Chapter 18 Statement of Cash Flows Part Six Financial Statements: Interpretation and Modifications Additional Information: 1. Received $5,000 from the sale of Icahn Corporation common stock that originally cost $2,000. 2. Received a cash dividend of $500 from the Icahn Corporation. 3. Received $400 cash from the First National Bank on December 31 , 1990 , as interest income. 4. Sold old equipment for $1,400. The old equipment originally cost $4,000 and had accumulated depreciation of $2,000. 5. Purchased land costing $5,000 on December 31,1990 , in exchange for a note payable. Both principal and interest are due on June 30,1991. 6. Purchased new equipment for $9,000 cash. 7. Purchased treasury stock for $1,800. 8. Paid $3,500 of notes payable. 9. Sold additional bonds payable at par of $3,000 on January 1, 1990 . 10. Issued 1,000 shares of common stock for cash at $2 per share. 11. Declared and paid a $4,000 cash dividend on October 1,1990 . (The working papers that accompany the text include forms for this problem.) Required a. Prepare a direct method working paper for James Company's 1990 statement of cash flows. b. Prepare the statement of cash flows for 1990 . c. Prepare a schedule that reconciles net income to the company's net cash provided (or used) by operating activities for 1990 . Chapter 18 Statement of Cash Flows Part Six Financial Statements: Interpretation and Modifications Additional Information: 1. Received $5,000 from the sale of Icahn Corporation common stock that originally cost $2,000. 2. Received a cash dividend of $500 from the Icahn Corporation. 3. Received $400 cash from the First National Bank on December 31 , 1990 , as interest income. 4. Sold old equipment for $1,400. The old equipment originally cost $4,000 and had accumulated depreciation of $2,000. 5. Purchased land costing $5,000 on December 31,1990 , in exchange for a note payable. Both principal and interest are due on June 30,1991. 6. Purchased new equipment for $9,000 cash. 7. Purchased treasury stock for $1,800. 8. Paid $3,500 of notes payable. 9. Sold additional bonds payable at par of $3,000 on January 1, 1990 . 10. Issued 1,000 shares of common stock for cash at $2 per share. 11. Declared and paid a $4,000 cash dividend on October 1,1990 . (The working papers that accompany the text include forms for this problem.) Required a. Prepare a direct method working paper for James Company's 1990 statement of cash flows. b. Prepare the statement of cash flows for 1990 . c. Prepare a schedule that reconciles net income to the company's net cash provided (or used) by operating activities for 1990 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started