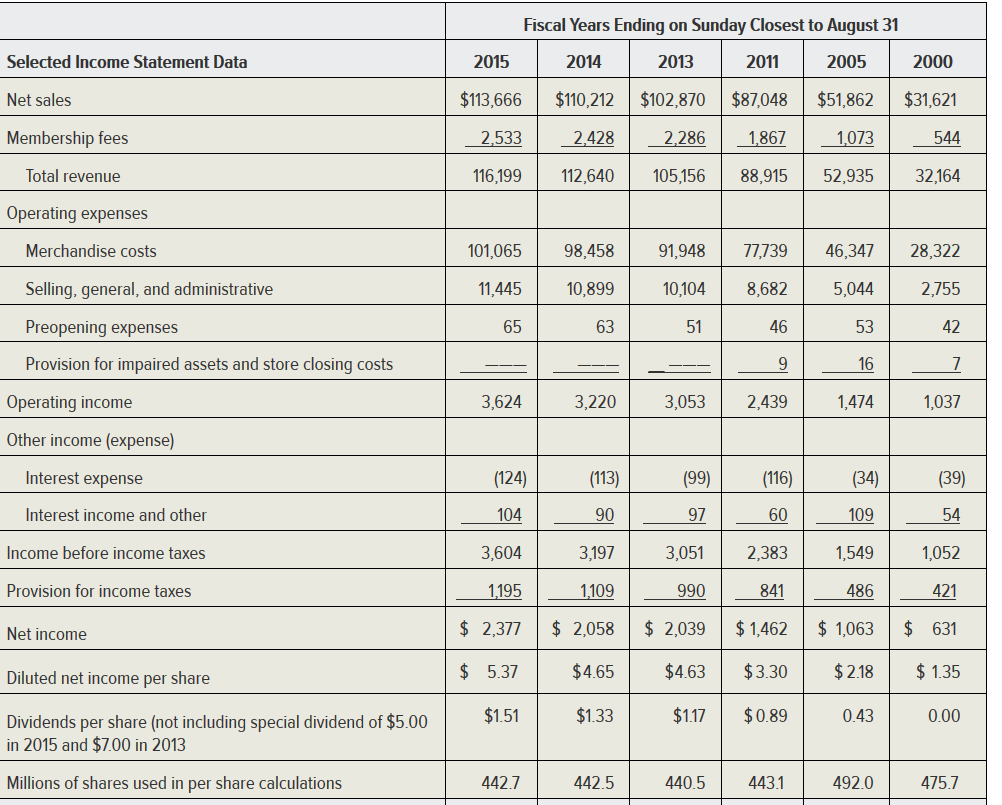

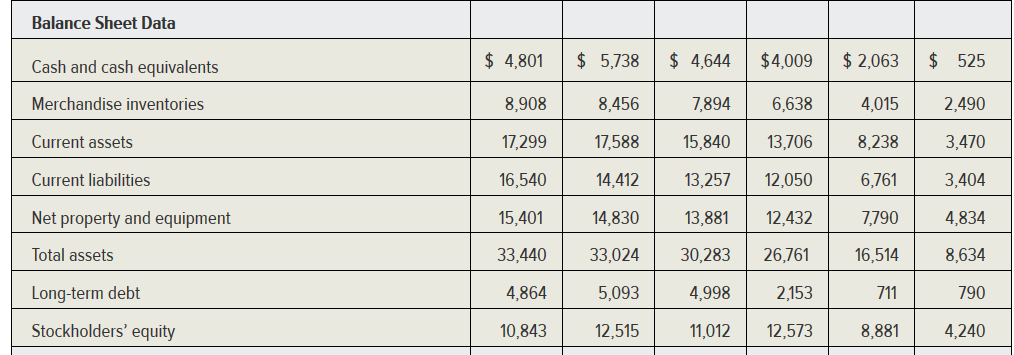

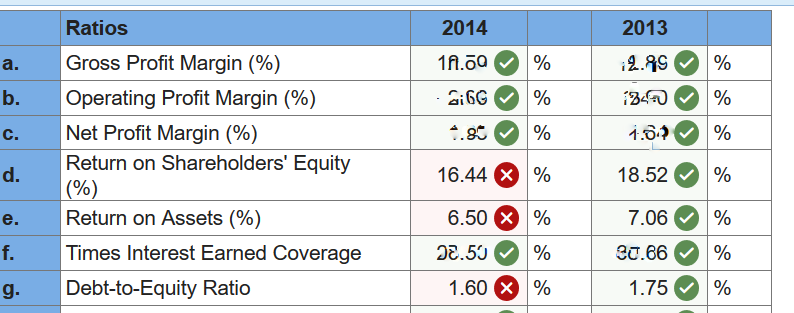

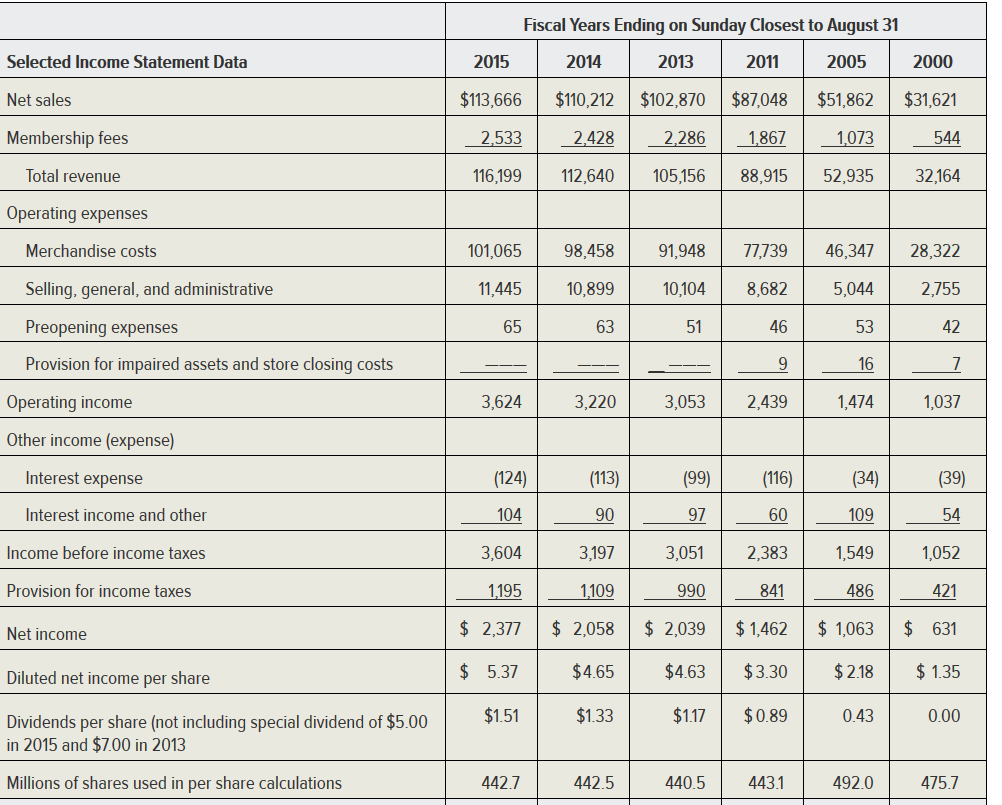

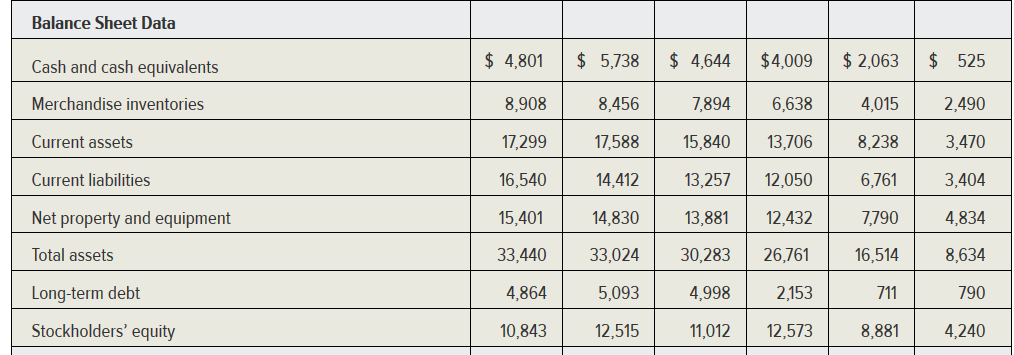

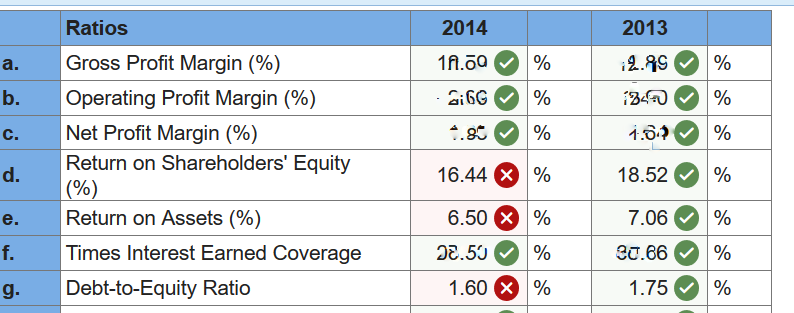

Having a lot of trouble calculating these values. Please round to 4 decimal places. Total Debt for 2013 = $19,271.00 and I cannot figure out how total debt for 2014 is calculated...

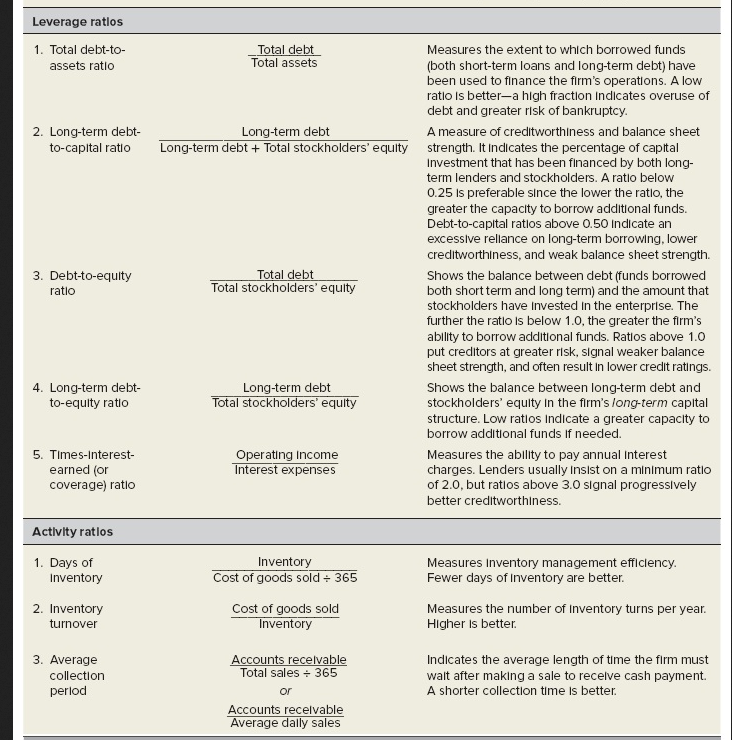

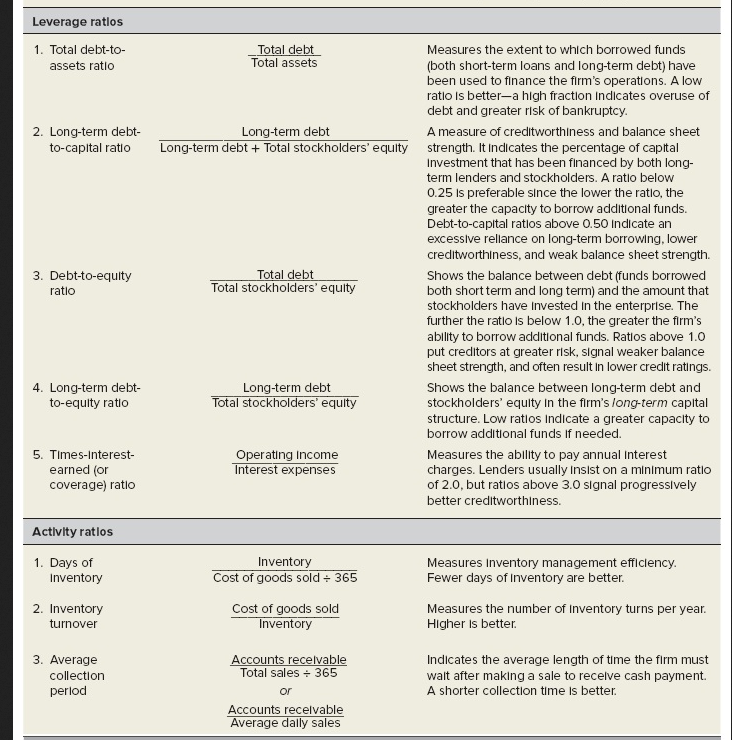

Leverage ratlos 1. Total debt-to- assets ratio Total debt Total assets Measures the extent to which borrowed funds (both short-term loans and long-term debt) have been used to finance the firm's operations. A low ratlo Is better-a high fraction Indicates overuse of debt and greater risk of bankruptcy A measure of creditworthiness and balance sheet 2. Long-term debt Long-term debt to-capital ratio Long-term debtTotal stockholders' equity strength. It Indicates the percentage of capital Investment that has been financed by both long- term lenders and stockholders. A ratio below 0.25 Is preferable since the lower the ratio, the greater the capacity to borrow additional funds. Debt-to-capltal ratlos above 0.50 Indicate an excesslve rellance on long-term borrowing, lower creditworthiness, and weak balance sheet strength. Total debt Total stockholders' equity 3. Debt-to-equity Shows the balance between debt funds borrowed both short term and long term) and the amount that stockholders have Invested In the enterprise. The further the ratio is below 1.0, the greater the firm's abllity to borrow additional funds. Ratios above 1.0 put creditors at greater risk, slgnal weaker balance sheet strength, and often result in lower credit ratings. ratio 4. Long-term debt to-equity ratio Long-term debt Total stockholders' equity Shows the balance between long-term debt and stockholders' equity in the firm's long-term capital structure. Low ratios Indicate a greater capacity to borrow additional funds If needed. 5. Times-Interest Operating Income Interest expenses Measures the abllity to pay annual Interest charges. Lenders usually Insist on a minlmum ratlo of 2.0, but ratlos above 3.0 slgnal progresslvely better creditworthiness. earned (or coverage) ratio Actlvity ratios 1. Days of Inventoryy Measures Inventory management efficlency Fewer days of Inventory are better. inventory Cost of goods sold 365 2. Inventory Cost of goods sold Inventory Measures the number of Inventory turns per year Higher is better. turnover 3. Average collection perlod ccounts recelvable Total sales365 Indicates the average length of time the firm must walt after maklng a sale to recelve cash payment. A shorter collection time is better. or Accounts recelvable Average dally sales