Answered step by step

Verified Expert Solution

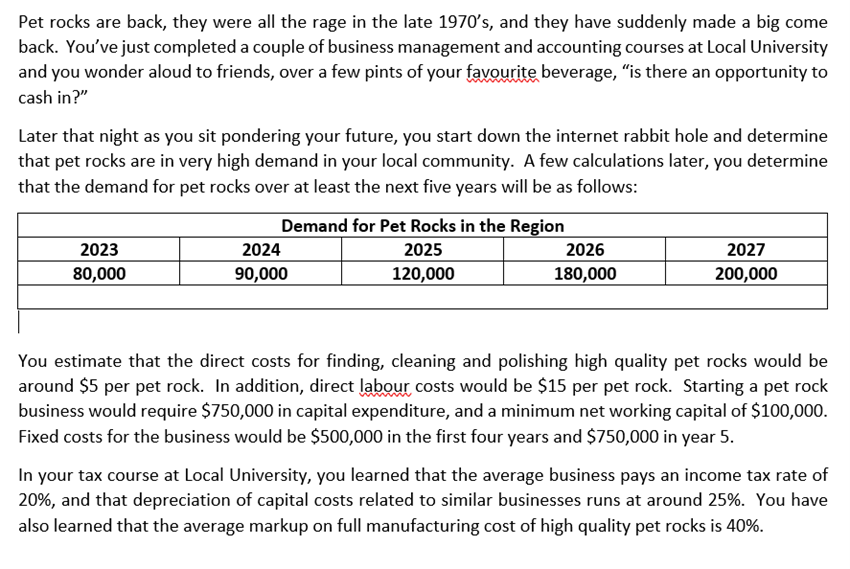

Question

1 Approved Answer

Having collected all of this information, you realize that there are two remaining questions to be answered before approaching your parents and asking them to

Having collected all of this information, you realize that there are two remaining questions to be answered before approaching your parents and asking them to lend you the money to start this new business venture:

- At what price should high-quality pet rocks be sold at to ensure a minimum 10% return on invested capital?

- Pet rocks are a fad that has come and gone in previous generations. So in making your assessment of this business opportunity should you assume a 3% terminal growth rate after year 5 or should you assume a declining 3% in demand for pet rocks after year 5?

- Your parents, having heard you talking about this business with your friends and siblings, have stated that any assessments must show the up-side of pet rock growth, and the down-side of pet rock growth, in year 5 and beyond.

- Based on your analysis, would your parents invest in your new pet rock business?

- Justify your answer by discussing the potential returns on investment assuming growing demand and declining demand after year 5.

- Which measure of return would you recommend be used to make the investment decision?

- Your parents also wonder aloud what is this perpetuity thing that you keep referring to? Why is it important to your assessment of the pet rock business?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started