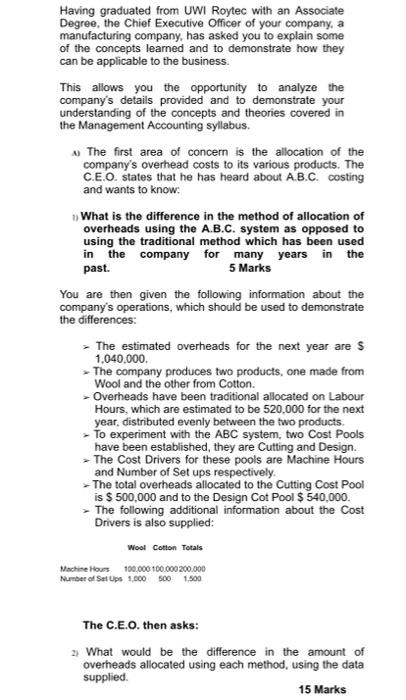

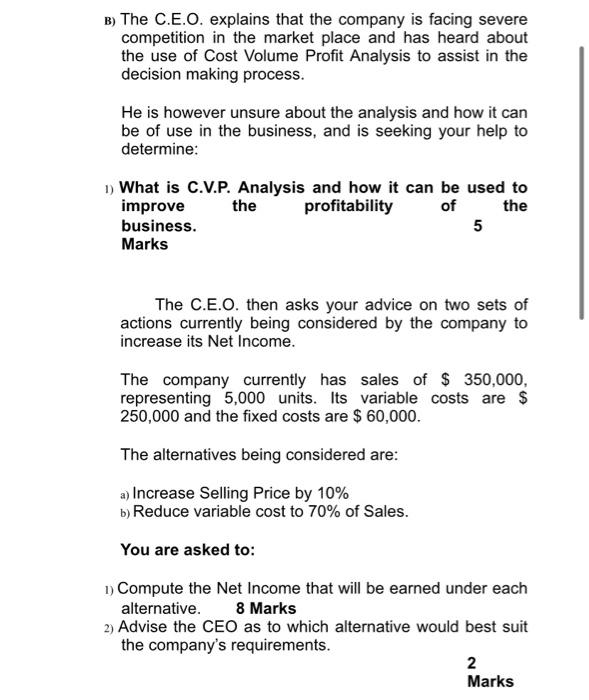

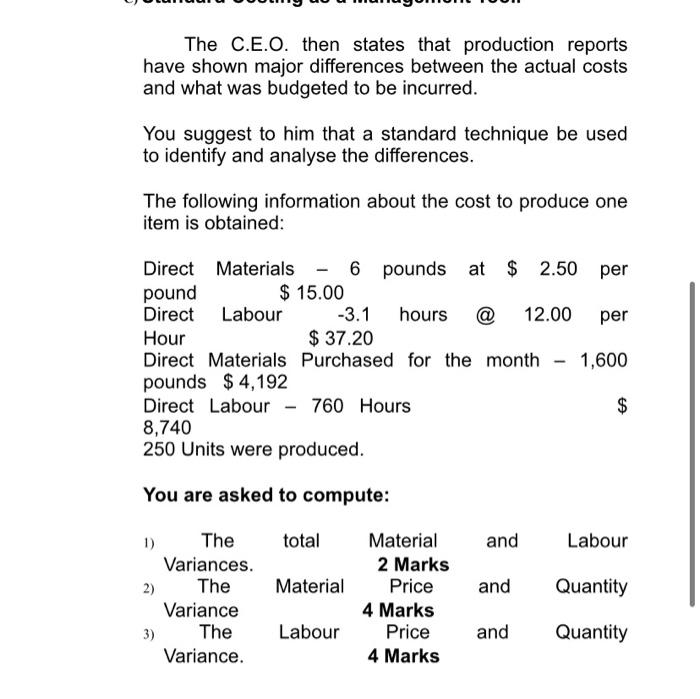

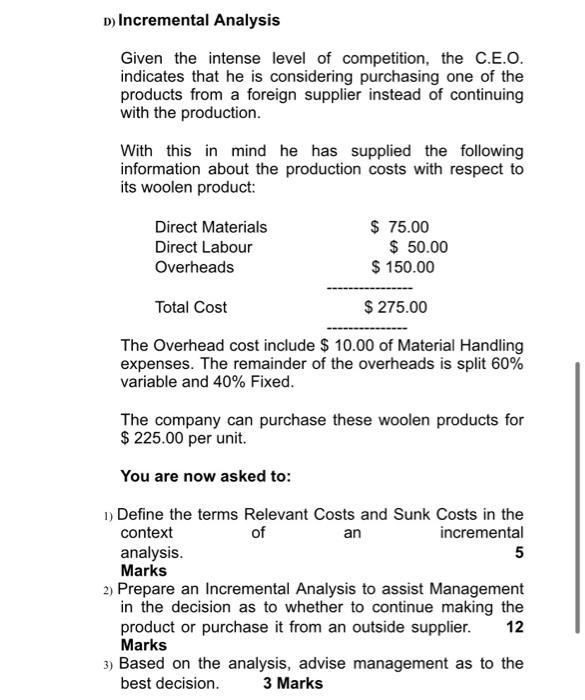

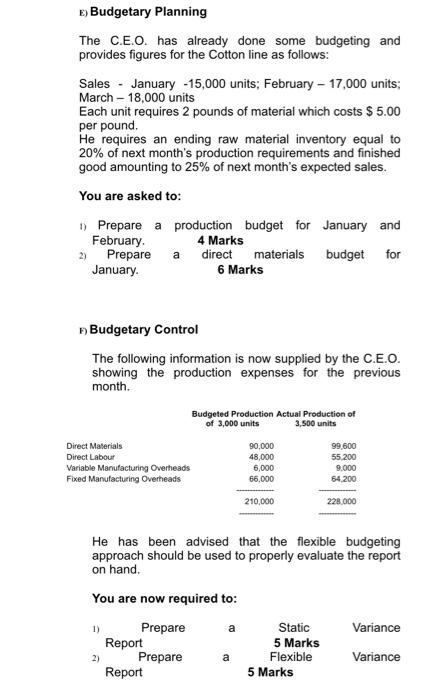

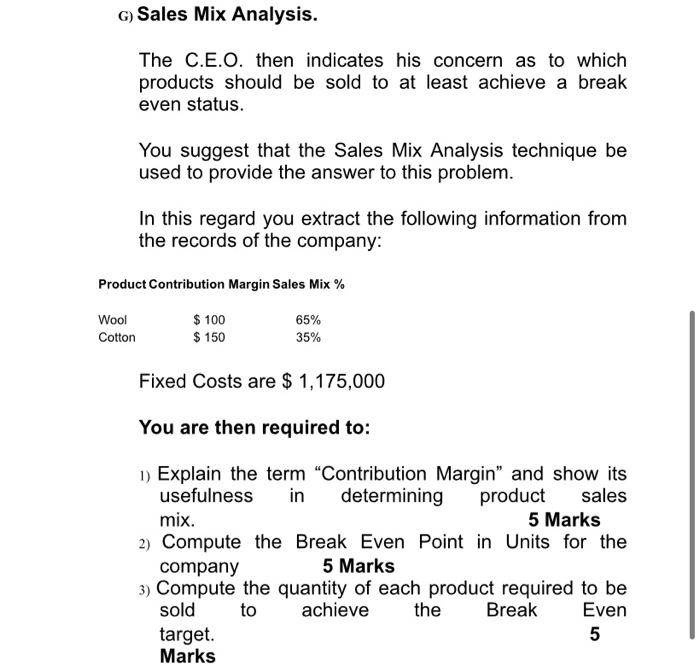

Having graduated from UWI Roytec with an Associate Degree, the Chief Executive Officer of your company, a manufacturing company, has asked you to explain some of the concepts learned and to demonstrate how they can be applicable to the business. This allows you the opportunity to analyze the company's details provided and to demonstrate your understanding of the concepts and theories covered in the Management Accounting syllabus, The first area of concern is the allocation of the company's overhead costs to its various products. The C.E.O. states that he has heard about A.B.C. costing and wants to know What is the difference in the method of allocation of overheads using the A.B.C. system as opposed to using the traditional method which has been used in the company for many years in the past. 5 Marks You are then given the following information about the company's operations, which should be used to demonstrate the differences: The estimated overheads for the next year are s 1.040.000 The company produces two products, one made from Wool and the other from Cotton. > Overheads have been traditional allocated on Labour Hours, which are estimated to be 520,000 for the next year, distributed evenly between the two products. To experiment with the ABC system, two Cost Pools have been established, they are Cutting and Design. > The Cost Drivers for these pools are Machine Hours and Number of Set ups respectively The total overheads allocated to the Cutting Cost Pool is $ 500,000 and to the Design Cot Pool $ 540,000 The following additional information about the cost Drivers is also supplied: Wool Cotton Totals Machine Hours 100.000 100.000 200.000 Number of Set Ups 1.000 500 1.500 The C.E.O. then asks: 2) What would be the difference in the amount of overheads allocated using each method, using the data supplied 15 Marks B) The C.E.O. explains that the company is facing severe competition in the market place and has heard about the use of Cost Volume Profit Analysis to assist in the decision making process. He is however unsure about the analysis and how it can be of use in the business, and is seeking your help to determine: 1) What is C.V.P. Analysis and how it can be used to improve the profitability of the business. 5 Marks The C.E.O. then asks your advice on two sets of actions currently being considered by the company to increase its Net Income. The company currently has sales of $ 350,000, representing 5,000 units. Its variable costs are $ 250,000 and the fixed costs are $ 60,000. The alternatives being considered are: a) Increase Selling Price by 10% b) Reduce variable cost to 70% of Sales. You are asked to: 1) Compute the Net Income that will be earned under each alternative. 8 Marks 2) Advise the CEO as to which alternative would best suit the company's requirements. 2 Marks The C.E.O. then states that production reports have shown major differences between the actual costs and what was budgeted to be incurred. You suggest to him that a standard technique be used to identify and analyse the differences. The following information about the cost to produce one item is obtained: per Direct Materials - 6 pounds at $ 2.50 per pound $ 15.00 Direct Labour -3.1 hours 12.00 Hour $ 37.20 Direct Materials Purchased for the month - 1,600 pounds $ 4,192 Direct Labour - 760 Hours $ 8,740 250 Units were produced. You are asked to compute: 1) total and Labour 2) Material and Quantity The Variances. The Variance The Variance. Material 2 Marks Price 4 Marks Price 4 Marks 3) Labour and Quantity D) Incremental Analysis Given the intense level of competition, the C.E.O. indicates that he is considering purchasing one of the products from a foreign supplier instead of continuing with the production. With this in mind he has supplied the following information about the production costs with respect to its woolen product: Direct Materials Direct Labour Overheads $ 75.00 $ 50.00 $ 150.00 Total Cost $ 275.00 The Overhead cost include $ 10.00 of Material Handling expenses. The remainder of the overheads is split 60% variable and 40% Fixed. The company can purchase these woolen products for $ 225.00 per unit You are now asked to: of 1) Define the terms Relevant Costs and Sunk Costs in the context an incremental analysis. 5 Marks 2) Prepare an Incremental Analysis to assist Management in the decision as to whether to continue making the product or purchase it from an outside supplier. 12 Marks 3) Based on the analysis, advise management as to the best decision. 3 Marks E) Budgetary Planning The C.E.O. has already done some budgeting and provides figures for the Cotton line as follows: Sales - January -15,000 units; February - 17,000 units; March - 18,000 units Each unit requires 2 pounds of material which costs $ 5.00 per pound. He requires an ending raw material inventory equal to 20% of next month's production requirements and finished good amounting to 25% of next month's expected sales. You are asked to: 1) Prepare a production budget for January and February 4 Marks Prepare direct materials budget for January 6 Marks 2) ) Budgetary Control The following information is now supplied by the C.E.O. showing the production expenses for the previous month. Budgeted Production Actual Production of of 3,000 units 3,500 units Direct Materials Direct Labour Variable Manufacturing Overheads Fixed Manufacturing Overheads 90,000 48,000 6,000 66,000 99.600 55.200 9,000 64.200 210,000 228.000 He has been advised that the flexible budgeting approach should be used to properly evaluate the report on hand a You are now required to: 1) Prepare Report 2) Prepare Report Variance Static 5 Marks Flexible 5 Marks a Variance G) Sales Mix Analysis. The C.E.O. then indicates his concern as to which products should be sold to at least achieve a break even status. You suggest that the Sales Mix Analysis technique be used to provide the answer to this problem. In this regard you extract the following information from the records of the company: Product Contribution Margin Sales Mix % Wool Cotton $ 100 $ 150 65% 35% Fixed Costs are $ 1,175,000 You are then required to: 1) Explain the term "Contribution Margin" and show its usefulness in determining product sales mix. 5 Marks 2) Compute the Break Even Point in Units for the company 5 Marks 3) Compute the quantity of each product required to be sold to achieve Break Even target. 5 Marks the