Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Having Spam and Donuts information (page 11/33 to page 17 / 33): a. What impact does the covariance has on decision making? (Please not a

Having Spam and Donuts information (page 11/33 to page 17 / 33):

a. What impact does the covariance has on decision making? (Please not a one two sentence answer elaborate - discuss)

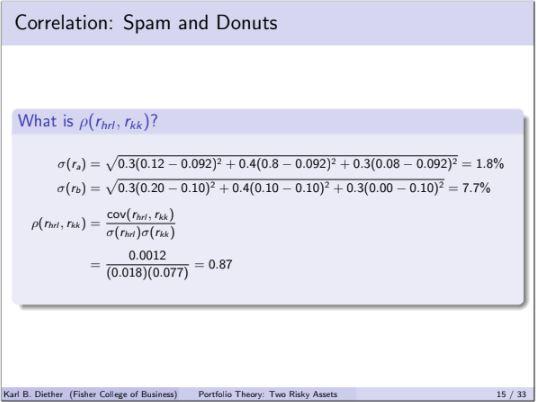

b. How does the correlation between the two assets help you make an informed decision? (Hint: What is P(rhrl , rkk)?

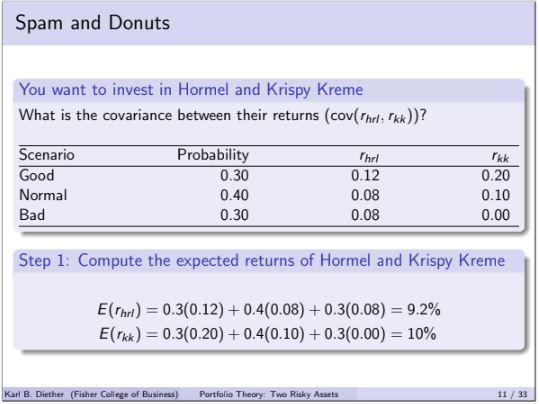

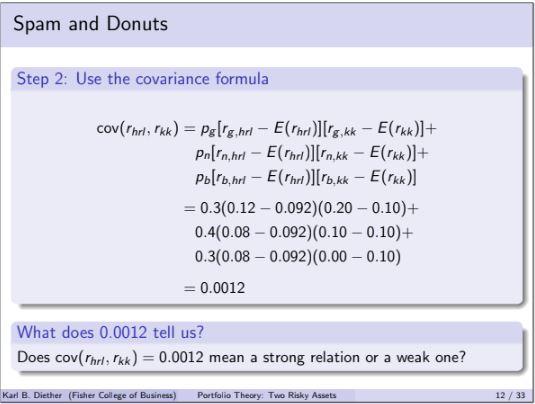

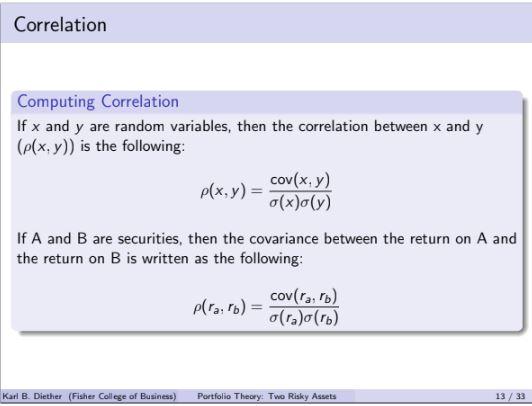

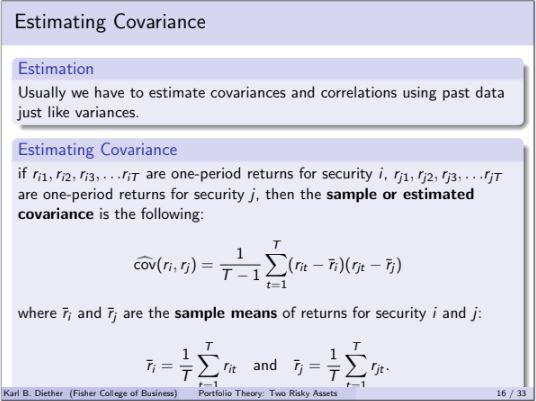

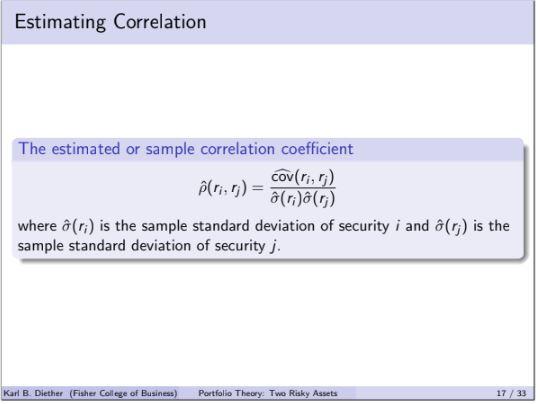

Spam and Donuts You want to invest in Hormel and Krispy Kreme What is the covariance between their returns (cov(rhrl,rkk)) ? Step 1: Compute the expected returns of Hormel and Krispy Kreme E(rhrl)=0.3(0.12)+0.4(0.08)+0.3(0.08)=9.2%E(rkk)=0.3(0.20)+0.4(0.10)+0.3(0.00)=10% Step 2: Use the covariance formula cov(rhrl,rkk)==pg[rg,hrlE(rhrl)][rg,kkE(rkk)]+pn[rn,hrlE(rhrl)][rn,kkE(rkk)]+pb[rb,hrlE(rhrl)][rb,kkE(rkk)]0.3(0.120.092)(0.200.10)+0.4(0.080.092)(0.100.10)+0.3(0.080.092)(0.000.10) If x and y are random variables, then the correlation between x and y ((x,y)) is the following: (x,y)=(x)(y)cov(x,y) If A and B are securities, then the covariance between the return on A and the return on B is written as the following: (ra,rb)=(ra)(rb)cov(ra,rb) Correlation ranges from 1 to 1 1, indicates perfect negative correlation. 0 , indicates that the two variables are unrelated. +1, indicates perfect positive correlation. Correlation: Spam and Donuts What is (rhrl,rkk) ? (ra)(rb)(rrk,rkk)=0.3(0.120.092)2+0.4(0.80.092)2+0.3(0.080.092)2=1.8%=0.3(0.200.10)2+0.4(0.100.10)2+0.3(0.000.10)2=7.7%=(rkr)(rkk)cov(rhrl,rkk)=(0.018)(0.077)0.0012=0.87 if ri1,ri2,ri3,riT are one-period returns for security i,rj1,rj2,rj3,rjT are one-period returns for security j, then the sample or estimated covariance is the following: cov(ri,rj)=T11t=1T(ritri)(rjtrj) where ri and rj are the sample means of returns for security i and j : ri=T1t=1Tritandrj=T1t=1Trjt. Karl B. Diether (Fisher College of Business) Portfolio Theory: Two Risky Assets The estimated or sample correlation coefficient ^(ri,rj)=^(ri)^(rj)cov(ri,rj) where ^(ri) is the sample standard deviation of security i and ^(rj) is the sample standard deviation of security j. Spam and Donuts You want to invest in Hormel and Krispy Kreme What is the covariance between their returns (cov(rhrl,rkk)) ? Step 1: Compute the expected returns of Hormel and Krispy Kreme E(rhrl)=0.3(0.12)+0.4(0.08)+0.3(0.08)=9.2%E(rkk)=0.3(0.20)+0.4(0.10)+0.3(0.00)=10% Step 2: Use the covariance formula cov(rhrl,rkk)==pg[rg,hrlE(rhrl)][rg,kkE(rkk)]+pn[rn,hrlE(rhrl)][rn,kkE(rkk)]+pb[rb,hrlE(rhrl)][rb,kkE(rkk)]0.3(0.120.092)(0.200.10)+0.4(0.080.092)(0.100.10)+0.3(0.080.092)(0.000.10) If x and y are random variables, then the correlation between x and y ((x,y)) is the following: (x,y)=(x)(y)cov(x,y) If A and B are securities, then the covariance between the return on A and the return on B is written as the following: (ra,rb)=(ra)(rb)cov(ra,rb) Correlation ranges from 1 to 1 1, indicates perfect negative correlation. 0 , indicates that the two variables are unrelated. +1, indicates perfect positive correlation. Correlation: Spam and Donuts What is (rhrl,rkk) ? (ra)(rb)(rrk,rkk)=0.3(0.120.092)2+0.4(0.80.092)2+0.3(0.080.092)2=1.8%=0.3(0.200.10)2+0.4(0.100.10)2+0.3(0.000.10)2=7.7%=(rkr)(rkk)cov(rhrl,rkk)=(0.018)(0.077)0.0012=0.87 if ri1,ri2,ri3,riT are one-period returns for security i,rj1,rj2,rj3,rjT are one-period returns for security j, then the sample or estimated covariance is the following: cov(ri,rj)=T11t=1T(ritri)(rjtrj) where ri and rj are the sample means of returns for security i and j : ri=T1t=1Tritandrj=T1t=1Trjt. Karl B. Diether (Fisher College of Business) Portfolio Theory: Two Risky Assets The estimated or sample correlation coefficient ^(ri,rj)=^(ri)^(rj)cov(ri,rj) where ^(ri) is the sample standard deviation of security i and ^(rj) is the sample standard deviation of security jStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started