Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Having taken the investment course, though, you know that historically you would have been able to beat the market by investing in passive funds that

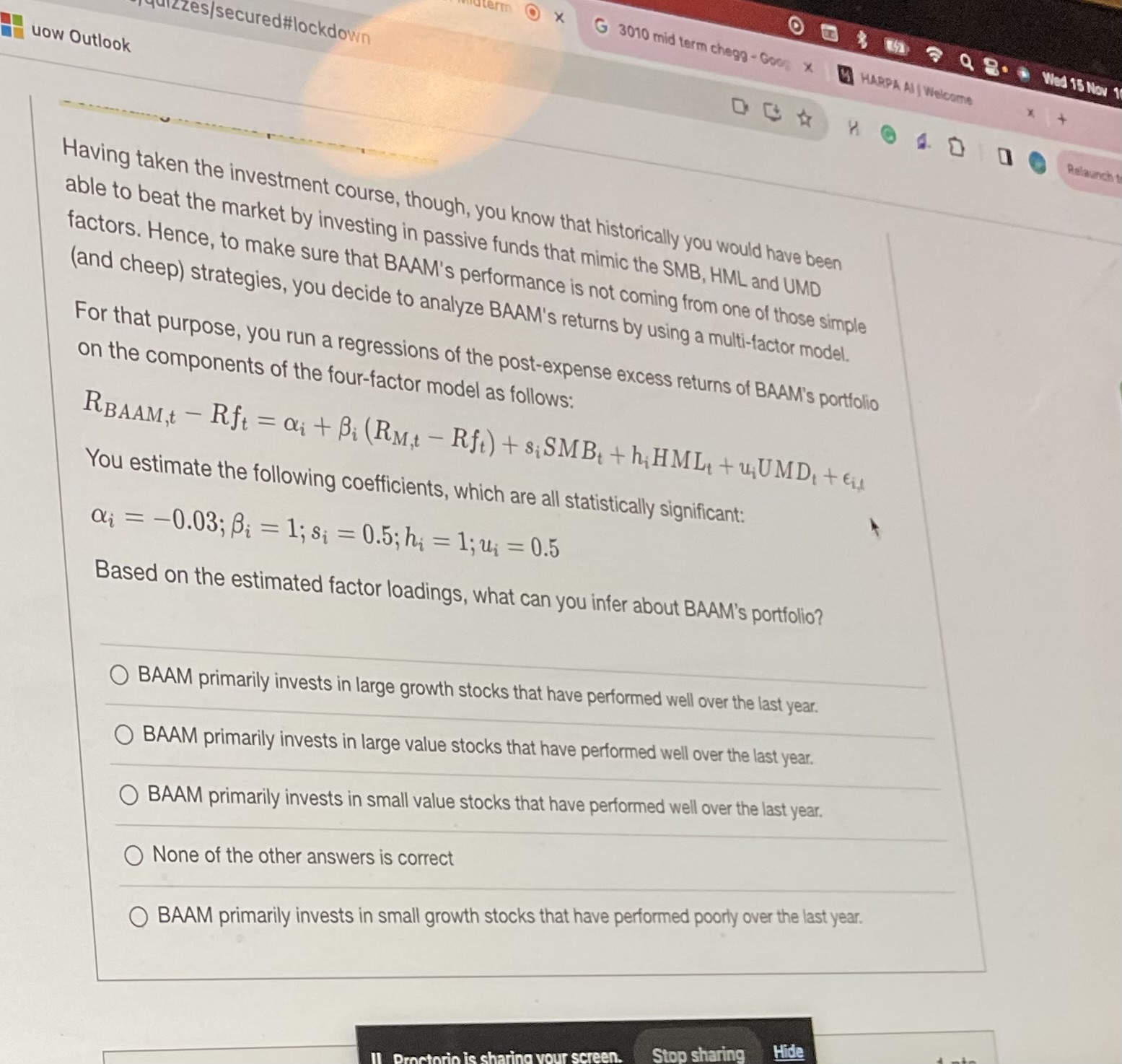

Having taken the investment course, though, you know that historically you would have been able to beat the market by investing in passive funds that mimic the SMB, HML and UMD factors. Hence, to make sure that BAAM's performance is not coming from one of those simple (and cheep) strategies, you decide to analyze BAAM's returns by using a multi-factor model. For that purpose, you run a regressions of the post-expense excess returns of BAAM's portfolio on the components of the four-factor model as follows: RBAAM,tRft=i+i(RM,tRft)+siSMBt+hiHMLt+uiUMDt+i,t You estimate the following coefficients, which are all statistically significant: i=0.03;i=1;si=0.5;hi=1;ui=0.5 Based on the estimated factor loadings, what can you infer about BAAM's portfolio? BAAM primarily invests in large growth stocks that have performed well over the last year. BAAM primarily invests in large value stocks that have performed well over the last year. BAAM primarily invests in small value stocks that have performed well over the last year. None of the other answers is correct BAAM primarily invests in small growth stocks that have performed poorly over the last year

Having taken the investment course, though, you know that historically you would have been able to beat the market by investing in passive funds that mimic the SMB, HML and UMD factors. Hence, to make sure that BAAM's performance is not coming from one of those simple (and cheep) strategies, you decide to analyze BAAM's returns by using a multi-factor model. For that purpose, you run a regressions of the post-expense excess returns of BAAM's portfolio on the components of the four-factor model as follows: RBAAM,tRft=i+i(RM,tRft)+siSMBt+hiHMLt+uiUMDt+i,t You estimate the following coefficients, which are all statistically significant: i=0.03;i=1;si=0.5;hi=1;ui=0.5 Based on the estimated factor loadings, what can you infer about BAAM's portfolio? BAAM primarily invests in large growth stocks that have performed well over the last year. BAAM primarily invests in large value stocks that have performed well over the last year. BAAM primarily invests in small value stocks that have performed well over the last year. None of the other answers is correct BAAM primarily invests in small growth stocks that have performed poorly over the last year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started