Answered step by step

Verified Expert Solution

Question

1 Approved Answer

having trouble with accounting ANSWER THE FOLLOWING QUESTION #56 BASED ON THE FOLLOWING GIVEN INFORMATION: Given: Below is information on an investment considered by the

having trouble with accounting

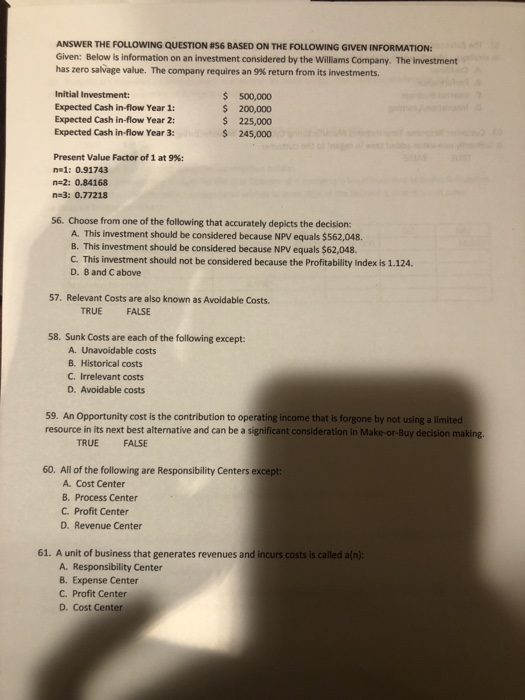

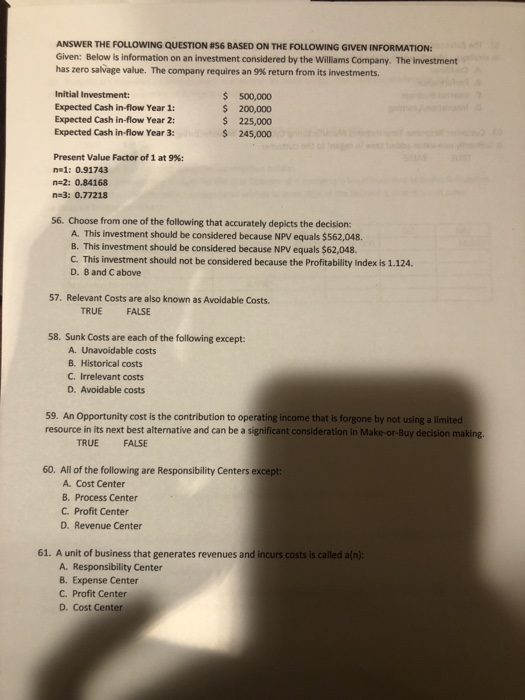

ANSWER THE FOLLOWING QUESTION #56 BASED ON THE FOLLOWING GIVEN INFORMATION: Given: Below is information on an investment considered by the Williams Company. The investment has zero salvage value. The company requires an 9% return from its investments. Initial Investment: Expected Cash in-flow Year 1: Expected Cash in-flow Year 2: Expected Cash in-flow Year 3: $ $ $ $ 500,000 200,000 225,000 245,000 Present Value Factor of 1 at 9%: na1: 0.91743 n=2: 0.84168 n=3: 0.77218 56. Choose from one of the following that accurately depicts the decision: A. This investment should be considered because NPV equals $562,048. B. This investment should be considered because NPV equals $62,048 C. This investment should not be considered because the Profitability Index is 1.124. D. B and C above 57. Relevant Costs are also known as Avoidable Costs. TRUE FALSE 58. Sunk Costs are each of the following except: A. Unavoidable costs B. Historical costs C. Irrelevant costs D. Avoidable costs 59. An Opportunity cost is the contribution to operating income that is forgone by not using a limited resource in its next best alternative and can be a significant consideration in Make-or-Buy decision making. TRUE FALSE 60. All of the following are Responsibility Centers except: A. Cost Center B. Process Center C. Profit Center D. Revenue Center 61. A unit of business that generates revenues and incurs costs is called an A. Responsibility Center B. Expense Center C. Profit Center D. Cost Center

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started