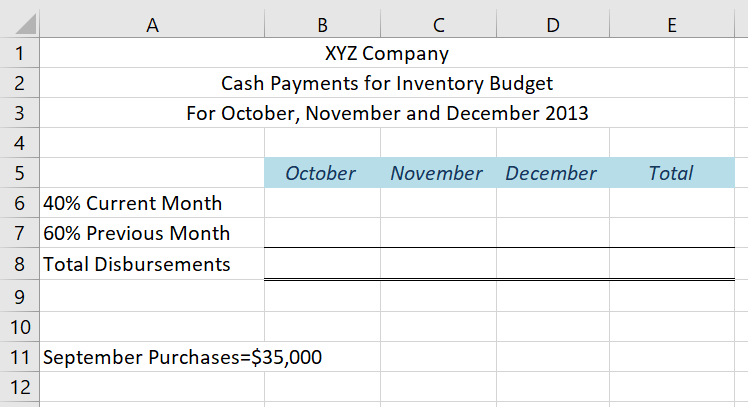

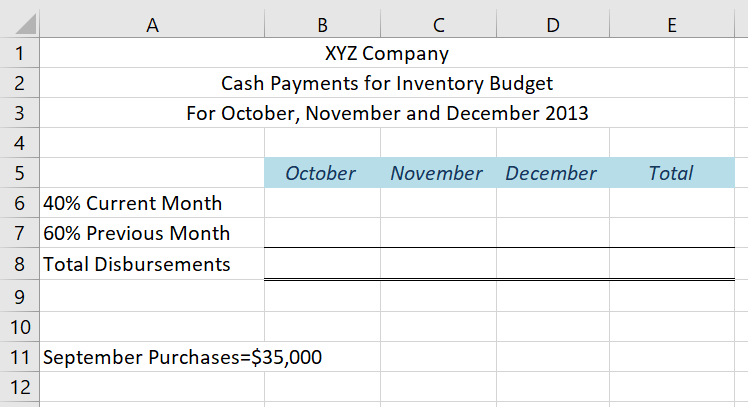

Having trouble with deferrals on the collection budget sheet, and well the rest of it. It kinda had a snowball effect.

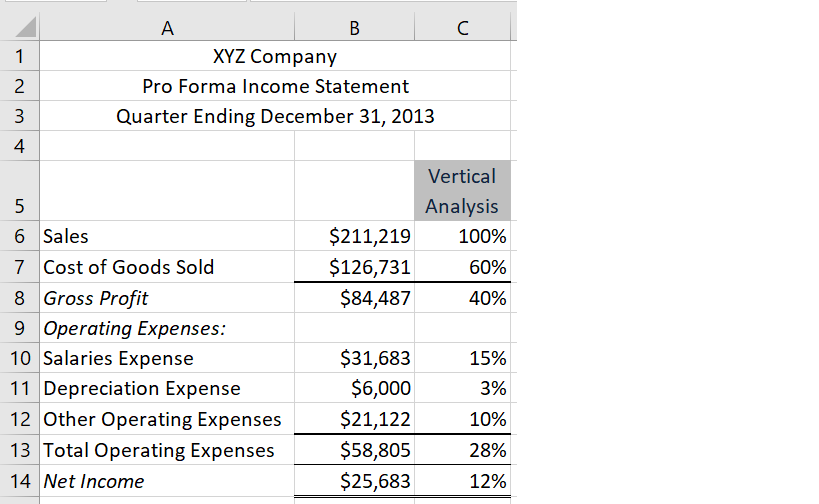

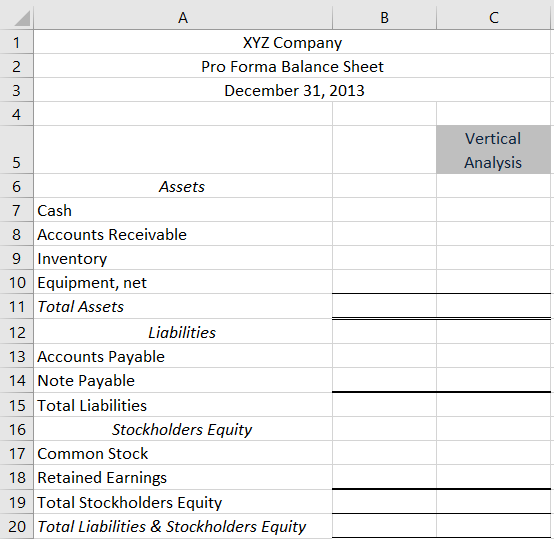

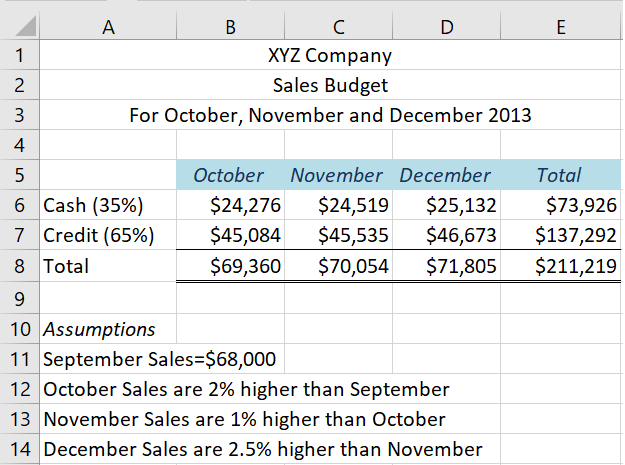

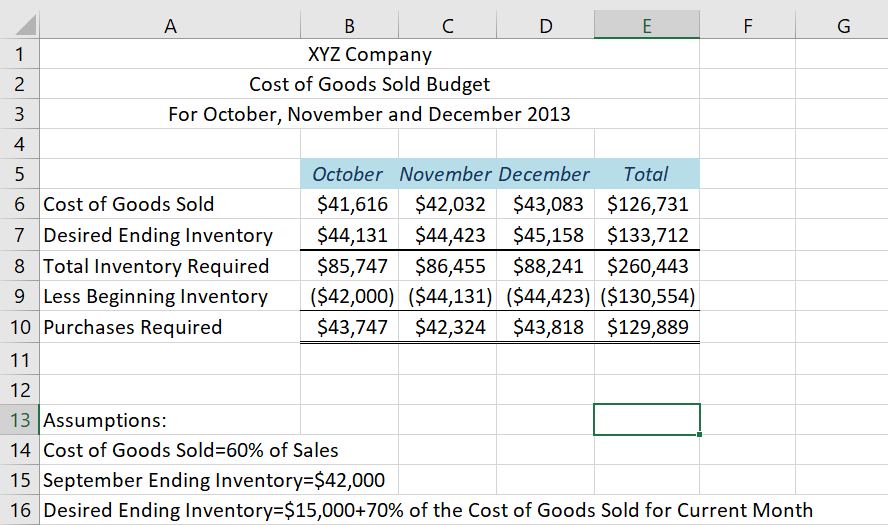

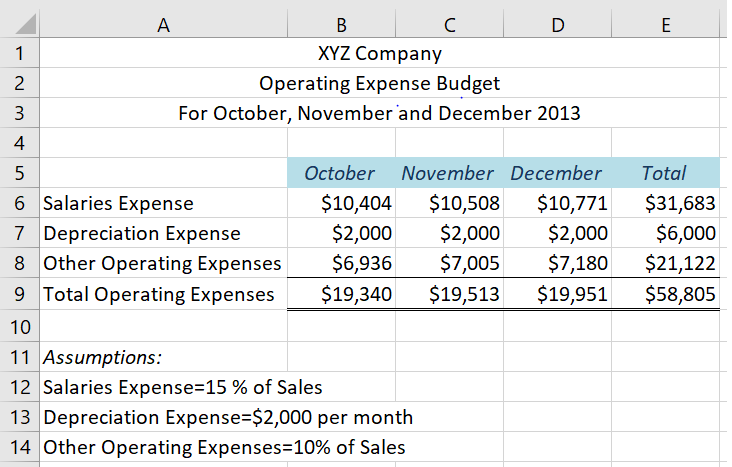

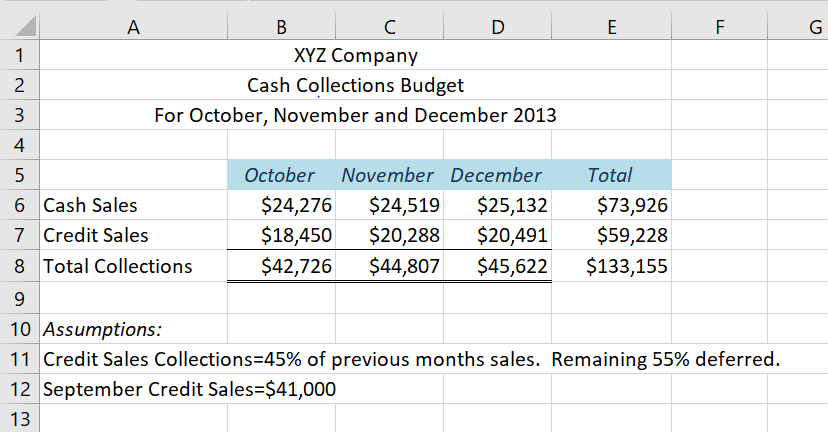

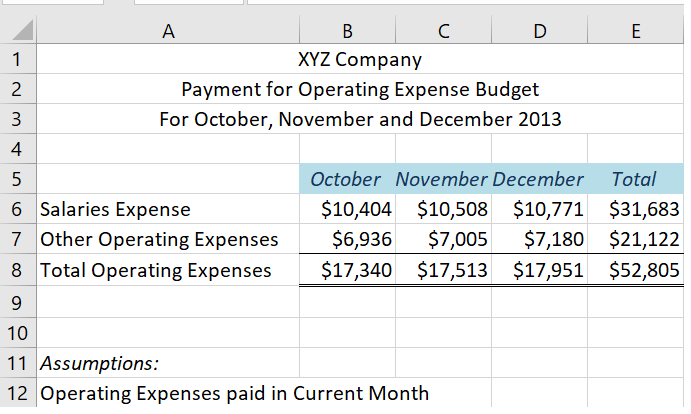

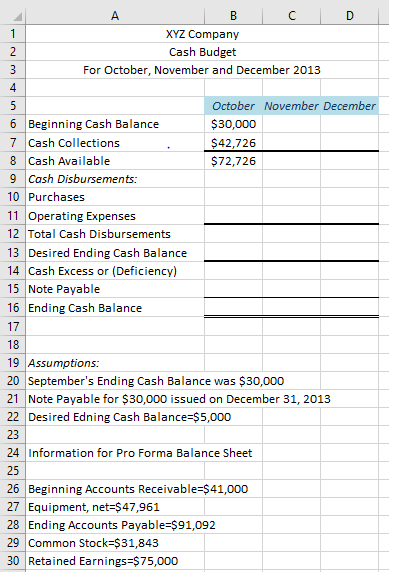

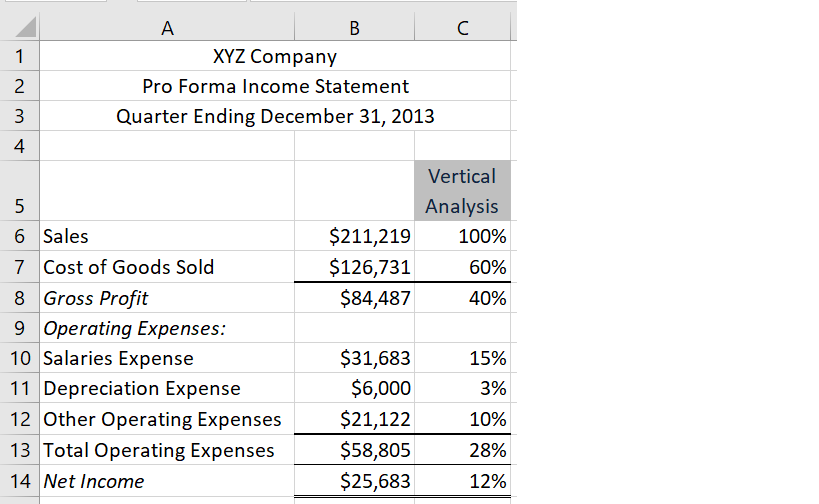

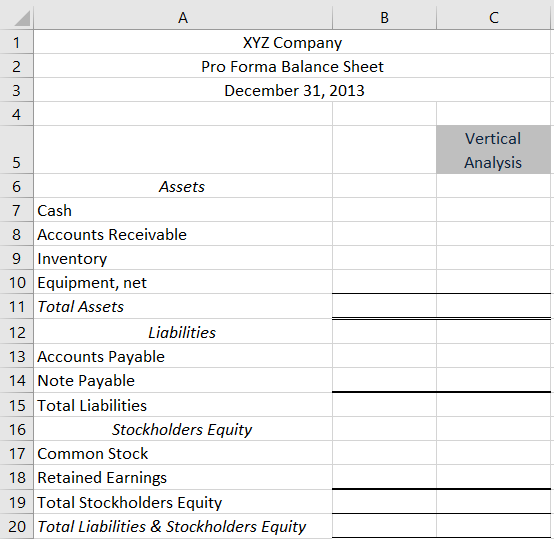

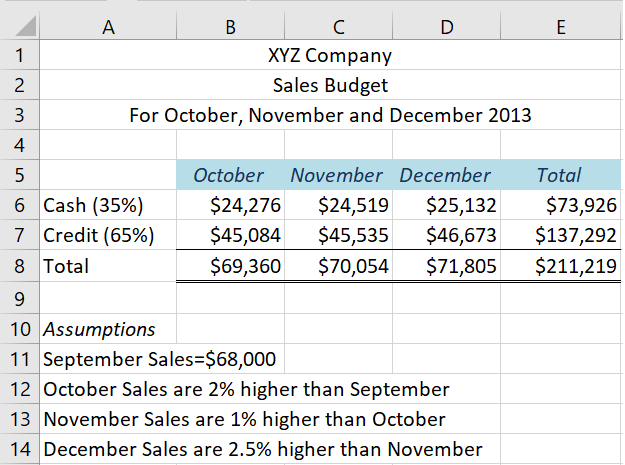

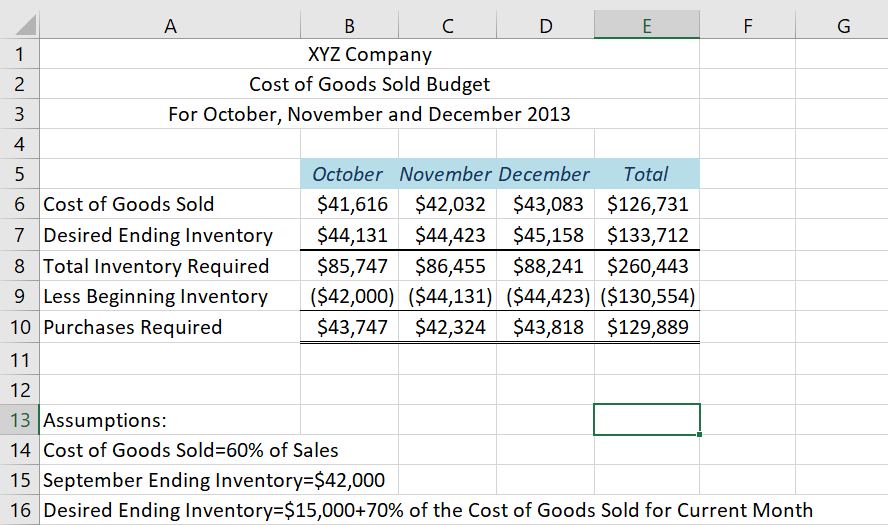

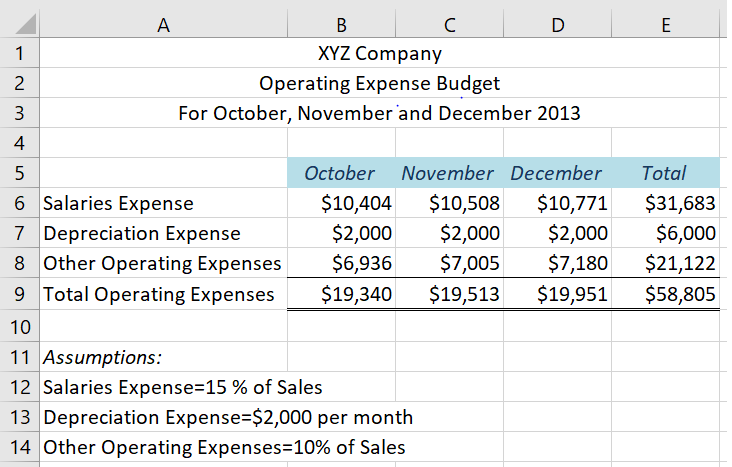

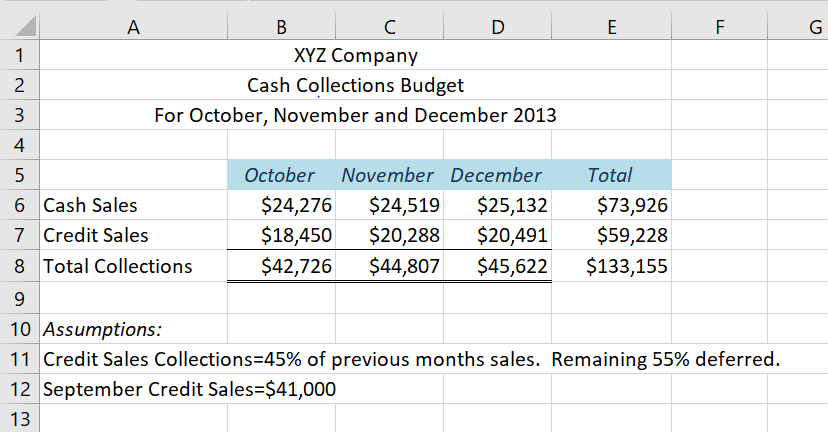

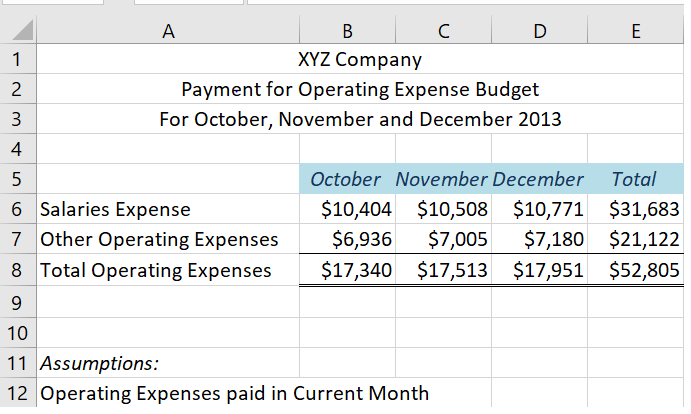

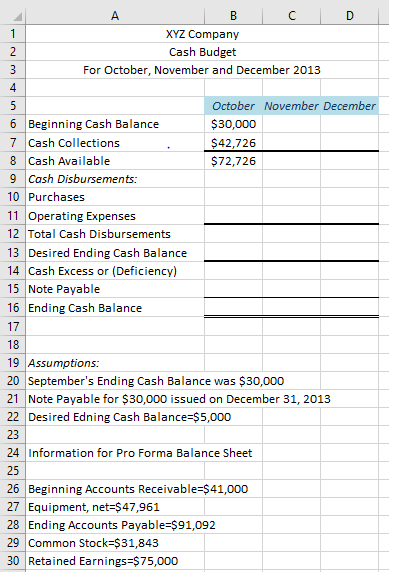

C 1 A B XYZ Company Pro Forma Income Statement Quarter Ending December 31, 2013 2 3 4 $211,219 $126,731 $84,487 Vertical Analysis 100% 60% 40% 5 6 Sales 7 Cost of Goods Sold 8 Gross Profit 9 Operating Expenses: 10 Salaries Expense 11 Depreciation Expense 12 Other Operating Expenses 13 Total Operating Expenses 14 Net Income 15% 3% $31,683 $6,000 $21,122 $58,805 $25,683 10% 28% 12% A 1 B XYZ Company Pro Forma Balance Sheet December 31, 2013 2 3 st Vertical Analysis 5 6 Assets 7 Cash 8 Accounts Receivable 9 Inventory 10 Equipment, net 11 Total Assets 12 Liabilities 13 Accounts Payable 14 Note Payable 15 Total Liabilities 16 Stockholders Equity 17 Common Stock 18 Retained Earnings 19 Total Stockholders Equity 20 Total Liabilities & Stockholders Equity A E 1 B C XYZ Company Sales Budget For October, November and December 2013 N 3 4 5 6 Cash (35%) 7 Credit (65%) 8 Total October November December $24,276 $24,519 $25,132 $45,084 $45,535 $46,673 $69,360 $70,054 $71,805 Total $73,926 $137,292 $211,219 9 10 Assumptions 11 September Sales=$68,000 12 October Sales are 2% higher than September 13 November Sales are 1% higher than October 14 December Sales are 2.5% higher than November G 1 N A B E F XYZ Company Cost of Goods Sold Budget 3 For October, November and December 2013 4 5 October November December Total 6 Cost of Goods Sold $41,616 $42,032 $43,083 $126,731 7 Desired Ending Inventory $44,131 $44,423 $45,158 $133,712 8 Total Inventory Required $85,747 $86,455 $88,241 $260,443 9 Less Beginning Inventory ($42,000) ($44,131) ($44,423) ($130,554) 10 Purchases Required $43,747 $42,324 $43,818 $129,889 11 12 13 Assumptions: 14 Cost of Goods Sold=60% of Sales 15 September Ending Inventory=$42,000 16 Desired Ending Inventory=$15,000+70% of the Cost of Goods Sold for Current Month E 1 N 3 A B D XYZ Company Operating Expense Budget For October, November and December 2013 4 5 October November December 6 Salaries Expense $10,404 $10,508 $10,771 7 Depreciation Expense $2,000 $2,000 $2,000 8 Other Operating Expenses $6,936 $7,005 $7,180 9 Total Operating Expenses $19,340 $19,513 $19,951 10 11 Assumptions: 12 Salaries Expense=15% of Sales 13 Depreciation Expense=$2,000 per month 14 Other Operating Expenses=10% of Sales Total $31,683 $6,000 $21,122 $58,805 A E E F G 1 B D XYZ Company Cash Collections Budget For October, November and December 2013 2 3 4 5 6 Cash Sales 7 Credit Sales 8 Total Collections October November December $24,276 $24,519 $25,132 $18,450 $20,288 $20,491 $42,726 $44,807 $45,622 Total $73,926 $59,228 $133,155 9 10 Assumptions: 11 Credit Sales Collections=45% of previous months sales. Remaining 55% deferred. 12 September Credit Sales=$41,000 13 E 1 B D XYZ Company Cash Payments for Inventory Budget For October, November and December 2013 N 3 4 5 October November December Total 6 40% Current Month 7 60% Previous Month 8 Total Disbursements 9 10 11 September Purchases $35,000 12 1 A B D E XYZ Company 2 Payment for Operating Expense Budget 3 For October, November and December 2013 4 5 October November December Total 6 Salaries Expense $10,404 $10,508 $10,771 $31,683 7 Other Operating Expenses $6,936 $7,005 $7,180 $21,122 8 Total Operating Expenses $17,340 $17,513 $17,951 $52,805 9 10 11 Assumptions: 12 Operating Expenses paid in Current Month 1 A B D XYZ Company 2 Cash Budget 3 For October, November and December 2013 4 5 October November December 6 Beginning Cash Balance $30,000 7 Cash Collections $42,726 8 Cash Available $72,726 9 Cash Disbursements: 10 Purchases 11 Operating Expenses 12 Total Cash Disbursements 13 Desired Ending Cash Balance 14 Cash Excess or (Deficiency) 15 Note Payable 16 Ending Cash Balance 17 18 19 Assumptions: 20 September's Ending Cash Balance was $30,000 21 Note Payable for $30,000 issued on December 31, 2013 22 Desired Edning Cash Balance-$5,000 23 24 Information for Pro Forma Balance Sheet 25 26 Beginning Accounts Receivable-$41,000 27 Equipment, net=$47,961 28 Ending Accounts Payable=$91,092 29 Common Stock=$31,843 30 Retained Earnings=$75,000 C 1 A B XYZ Company Pro Forma Income Statement Quarter Ending December 31, 2013 2 3 4 $211,219 $126,731 $84,487 Vertical Analysis 100% 60% 40% 5 6 Sales 7 Cost of Goods Sold 8 Gross Profit 9 Operating Expenses: 10 Salaries Expense 11 Depreciation Expense 12 Other Operating Expenses 13 Total Operating Expenses 14 Net Income 15% 3% $31,683 $6,000 $21,122 $58,805 $25,683 10% 28% 12% A 1 B XYZ Company Pro Forma Balance Sheet December 31, 2013 2 3 st Vertical Analysis 5 6 Assets 7 Cash 8 Accounts Receivable 9 Inventory 10 Equipment, net 11 Total Assets 12 Liabilities 13 Accounts Payable 14 Note Payable 15 Total Liabilities 16 Stockholders Equity 17 Common Stock 18 Retained Earnings 19 Total Stockholders Equity 20 Total Liabilities & Stockholders Equity A E 1 B C XYZ Company Sales Budget For October, November and December 2013 N 3 4 5 6 Cash (35%) 7 Credit (65%) 8 Total October November December $24,276 $24,519 $25,132 $45,084 $45,535 $46,673 $69,360 $70,054 $71,805 Total $73,926 $137,292 $211,219 9 10 Assumptions 11 September Sales=$68,000 12 October Sales are 2% higher than September 13 November Sales are 1% higher than October 14 December Sales are 2.5% higher than November G 1 N A B E F XYZ Company Cost of Goods Sold Budget 3 For October, November and December 2013 4 5 October November December Total 6 Cost of Goods Sold $41,616 $42,032 $43,083 $126,731 7 Desired Ending Inventory $44,131 $44,423 $45,158 $133,712 8 Total Inventory Required $85,747 $86,455 $88,241 $260,443 9 Less Beginning Inventory ($42,000) ($44,131) ($44,423) ($130,554) 10 Purchases Required $43,747 $42,324 $43,818 $129,889 11 12 13 Assumptions: 14 Cost of Goods Sold=60% of Sales 15 September Ending Inventory=$42,000 16 Desired Ending Inventory=$15,000+70% of the Cost of Goods Sold for Current Month E 1 N 3 A B D XYZ Company Operating Expense Budget For October, November and December 2013 4 5 October November December 6 Salaries Expense $10,404 $10,508 $10,771 7 Depreciation Expense $2,000 $2,000 $2,000 8 Other Operating Expenses $6,936 $7,005 $7,180 9 Total Operating Expenses $19,340 $19,513 $19,951 10 11 Assumptions: 12 Salaries Expense=15% of Sales 13 Depreciation Expense=$2,000 per month 14 Other Operating Expenses=10% of Sales Total $31,683 $6,000 $21,122 $58,805 A E E F G 1 B D XYZ Company Cash Collections Budget For October, November and December 2013 2 3 4 5 6 Cash Sales 7 Credit Sales 8 Total Collections October November December $24,276 $24,519 $25,132 $18,450 $20,288 $20,491 $42,726 $44,807 $45,622 Total $73,926 $59,228 $133,155 9 10 Assumptions: 11 Credit Sales Collections=45% of previous months sales. Remaining 55% deferred. 12 September Credit Sales=$41,000 13 E 1 B D XYZ Company Cash Payments for Inventory Budget For October, November and December 2013 N 3 4 5 October November December Total 6 40% Current Month 7 60% Previous Month 8 Total Disbursements 9 10 11 September Purchases $35,000 12 1 A B D E XYZ Company 2 Payment for Operating Expense Budget 3 For October, November and December 2013 4 5 October November December Total 6 Salaries Expense $10,404 $10,508 $10,771 $31,683 7 Other Operating Expenses $6,936 $7,005 $7,180 $21,122 8 Total Operating Expenses $17,340 $17,513 $17,951 $52,805 9 10 11 Assumptions: 12 Operating Expenses paid in Current Month 1 A B D XYZ Company 2 Cash Budget 3 For October, November and December 2013 4 5 October November December 6 Beginning Cash Balance $30,000 7 Cash Collections $42,726 8 Cash Available $72,726 9 Cash Disbursements: 10 Purchases 11 Operating Expenses 12 Total Cash Disbursements 13 Desired Ending Cash Balance 14 Cash Excess or (Deficiency) 15 Note Payable 16 Ending Cash Balance 17 18 19 Assumptions: 20 September's Ending Cash Balance was $30,000 21 Note Payable for $30,000 issued on December 31, 2013 22 Desired Edning Cash Balance-$5,000 23 24 Information for Pro Forma Balance Sheet 25 26 Beginning Accounts Receivable-$41,000 27 Equipment, net=$47,961 28 Ending Accounts Payable=$91,092 29 Common Stock=$31,843 30 Retained Earnings=$75,000