having trouble with finding some answer.

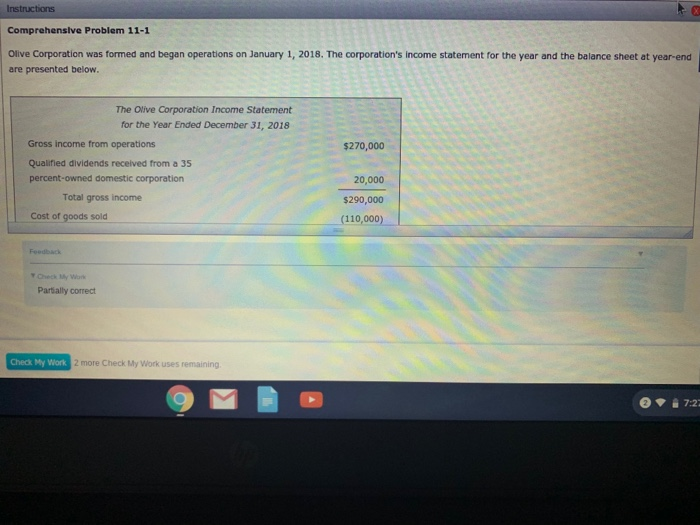

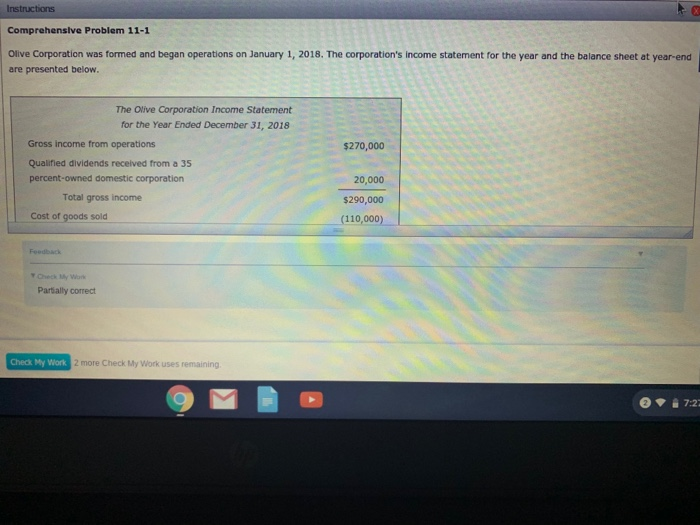

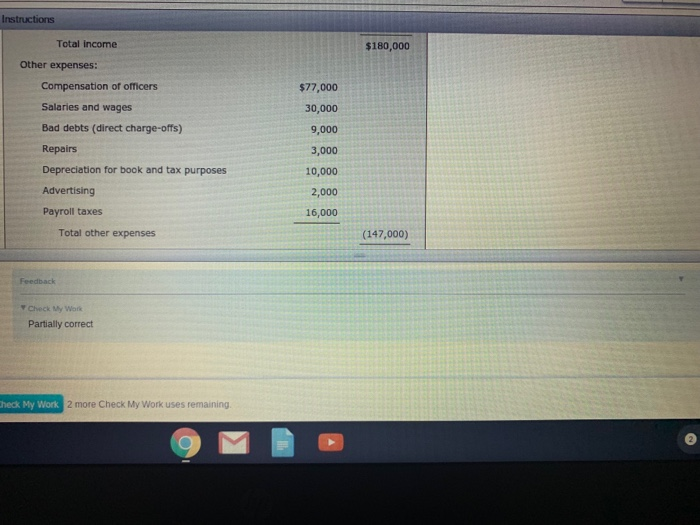

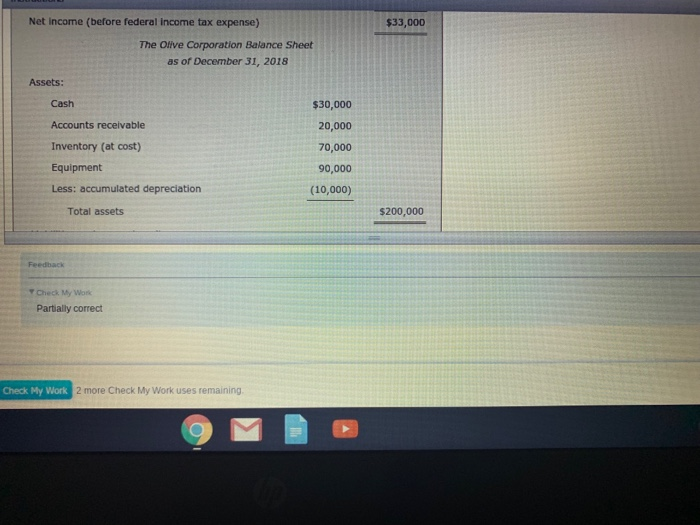

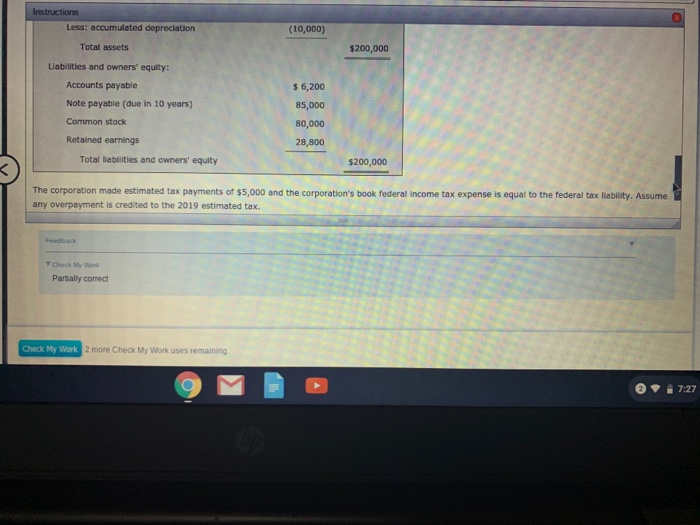

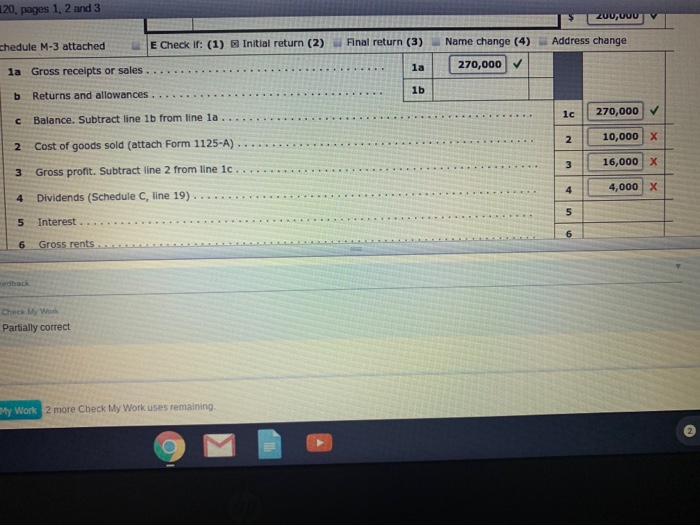

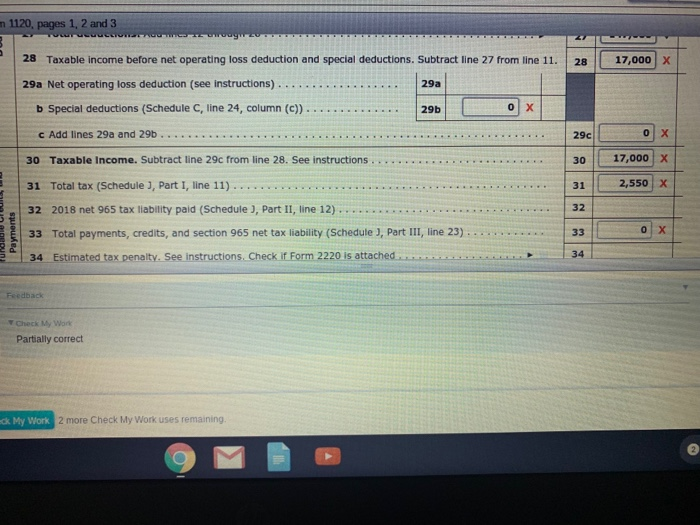

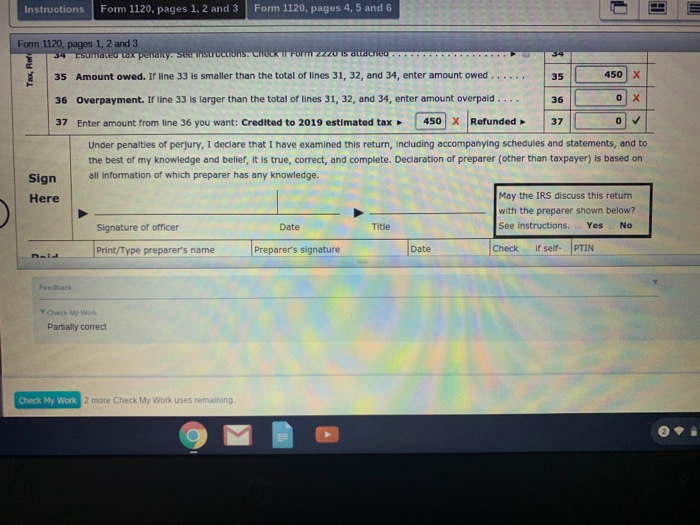

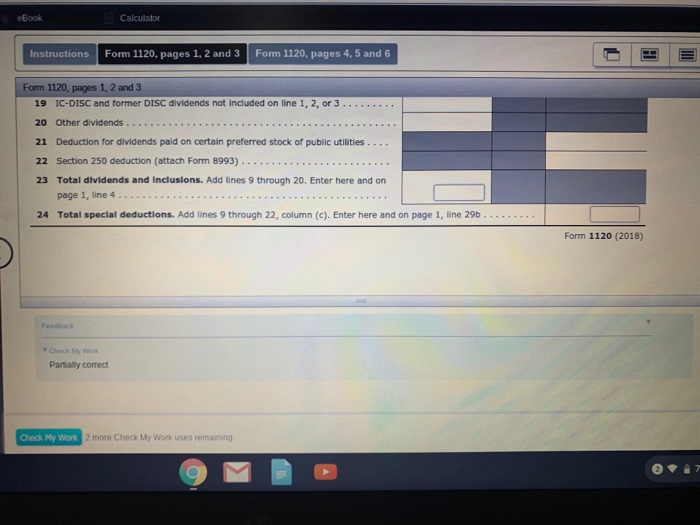

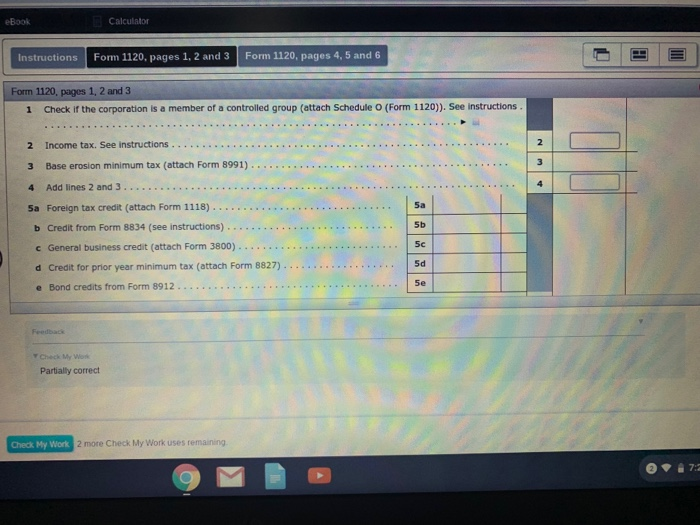

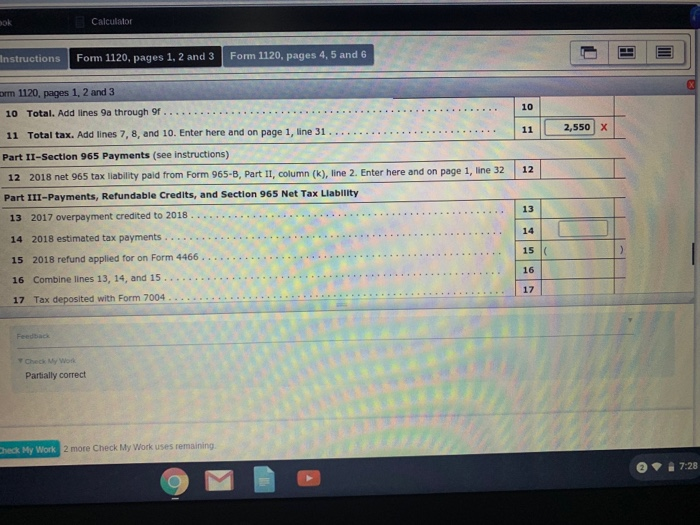

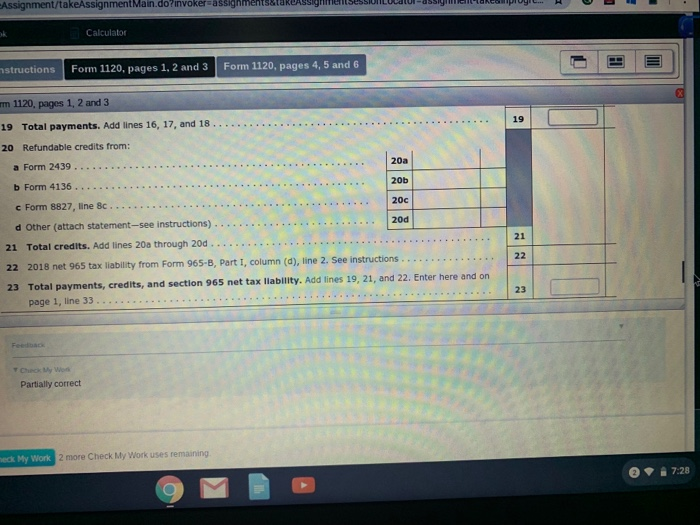

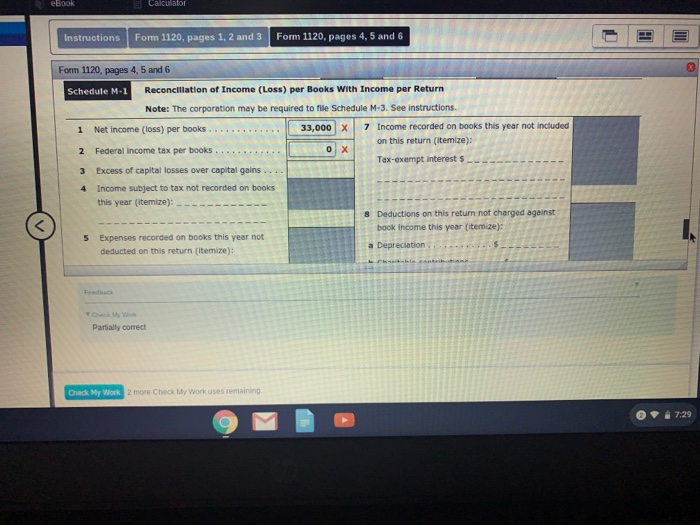

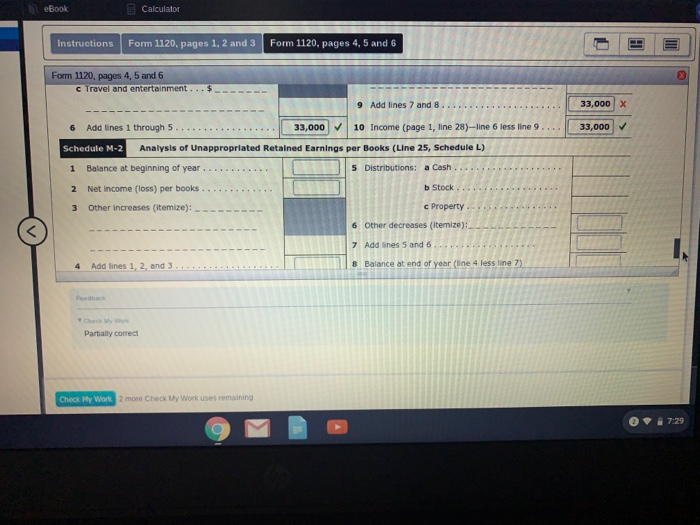

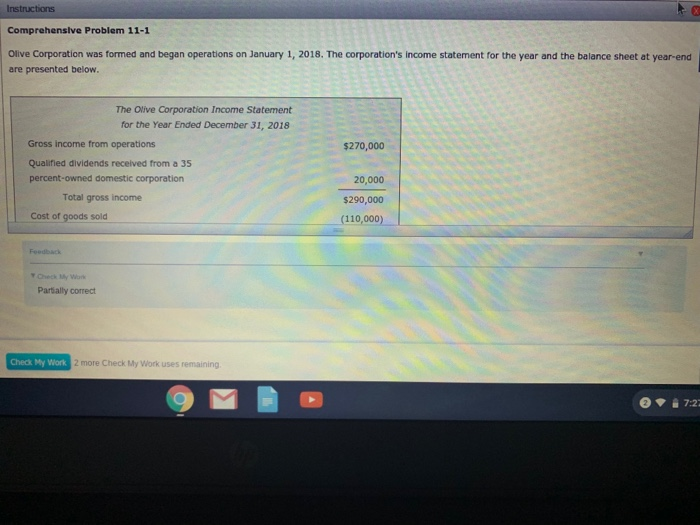

Instructions Comprehensive Problem 11-1 Olive Corporation was formed and began operations on January 1, 2018. The corporation's income statement for the year and the balance sheet at year-end are presented below. The Olive Corporation Income Statement for the Year Ended December 31, 2018 Gross income from operations Qualified dividends received from a 35 percent-owned domestic corporation $270,000 20,000 $290,000 (110,000) Total gross income Cost of goods sold Parially correct Check hy Wonk 2 more Check My Work uses remaining Total income $180,000 Other expenses: Compensation of officers Salaries and wages Bad debts (direct charge-offs) Repairs Depreciation for book and tax purposes Advertising Payroll taxes $77,000 30,000 9,000 3,000 10,000 2,000 16,000 Total other expenses (147,000) Check My Work Partially correct heck My Work 2 more Check My Work uses remaining Net income (before federal income tax expense) $33,000 The Olive Corporation Balance Sheet as of December 31, 2018 Assets: Cash Accounts receivable Inventory (at cost) Equipment Less: accumulated depreciation $30,000 20,000 70,000 90,000 (10,000) $200,000 Total assets Feedback Check My Work Partially correct 2 more Check My Work uses remaining Check My Work Less: accumulated depreciation (10,000) Total assets $200,000 Liabilities and owners' equity: Accounts payable Note payable (due in 10 years) Common stock Retained earnings s 6,200 85,000 80,000 28,800 Total iabilities and owners' equity $200,000 The corporation made estimated tax payments of $5,000 and the corporation's book federal Income tax expense is equal to the federal tax liability. Assume any overpayment is credited to the 2019 estimated tax. Partally correct Check My Work 2 more Check My Work uses remaining 7:27 20, pages 1, 2 and 3 Address change chedule M-3 attachedE Check if: (1) B Initial return (2) Final return (3) Name change (4) 270,000 V la 1b .1c 270,000 v c Balance. Subtract line 1b from line la 2 Cost of goods sold (attach Form 1125-A) .. 3 Gross profit. Subtract line 2 from line Ic... 4 Dividends (Schedule C, line 19)... 5 Interest . 6 Gross rents 10,000X 316,000 x 4,000 X Check My Work Partially correct ty Work 2 more Check My Work uses remaining eBook Form 1120, pages 1, 2 and 3 Form 1120, pages 4, 5 and 6 Instructions Form 1120, pages 1, 2 and 3 1 Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions 2 Income tax. See instructions 5a 5b 5c Sd 5e 5a Foreign tax credit (attach Form 1118)................. Credit from Form 8834 (see instructions) b c General business credit (attach Form 3800)........ d Credit for prior year minimum tax (attach Form 8827)- e Bond credits from Form 8912 My Won Partially correct Check My Work 2 more Checi My Work uses temaning 2 more Check My Work uses remaining Instructions Comprehensive Problem 11-1 Olive Corporation was formed and began operations on January 1, 2018. The corporation's income statement for the year and the balance sheet at year-end are presented below. The Olive Corporation Income Statement for the Year Ended December 31, 2018 Gross income from operations Qualified dividends received from a 35 percent-owned domestic corporation $270,000 20,000 $290,000 (110,000) Total gross income Cost of goods sold Parially correct Check hy Wonk 2 more Check My Work uses remaining Total income $180,000 Other expenses: Compensation of officers Salaries and wages Bad debts (direct charge-offs) Repairs Depreciation for book and tax purposes Advertising Payroll taxes $77,000 30,000 9,000 3,000 10,000 2,000 16,000 Total other expenses (147,000) Check My Work Partially correct heck My Work 2 more Check My Work uses remaining Net income (before federal income tax expense) $33,000 The Olive Corporation Balance Sheet as of December 31, 2018 Assets: Cash Accounts receivable Inventory (at cost) Equipment Less: accumulated depreciation $30,000 20,000 70,000 90,000 (10,000) $200,000 Total assets Feedback Check My Work Partially correct 2 more Check My Work uses remaining Check My Work Less: accumulated depreciation (10,000) Total assets $200,000 Liabilities and owners' equity: Accounts payable Note payable (due in 10 years) Common stock Retained earnings s 6,200 85,000 80,000 28,800 Total iabilities and owners' equity $200,000 The corporation made estimated tax payments of $5,000 and the corporation's book federal Income tax expense is equal to the federal tax liability. Assume any overpayment is credited to the 2019 estimated tax. Partally correct Check My Work 2 more Check My Work uses remaining 7:27 20, pages 1, 2 and 3 Address change chedule M-3 attachedE Check if: (1) B Initial return (2) Final return (3) Name change (4) 270,000 V la 1b .1c 270,000 v c Balance. Subtract line 1b from line la 2 Cost of goods sold (attach Form 1125-A) .. 3 Gross profit. Subtract line 2 from line Ic... 4 Dividends (Schedule C, line 19)... 5 Interest . 6 Gross rents 10,000X 316,000 x 4,000 X Check My Work Partially correct ty Work 2 more Check My Work uses remaining eBook Form 1120, pages 1, 2 and 3 Form 1120, pages 4, 5 and 6 Instructions Form 1120, pages 1, 2 and 3 1 Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions 2 Income tax. See instructions 5a 5b 5c Sd 5e 5a Foreign tax credit (attach Form 1118)................. Credit from Form 8834 (see instructions) b c General business credit (attach Form 3800)........ d Credit for prior year minimum tax (attach Form 8827)- e Bond credits from Form 8912 My Won Partially correct Check My Work 2 more Checi My Work uses temaning 2 more Check My Work uses remaining