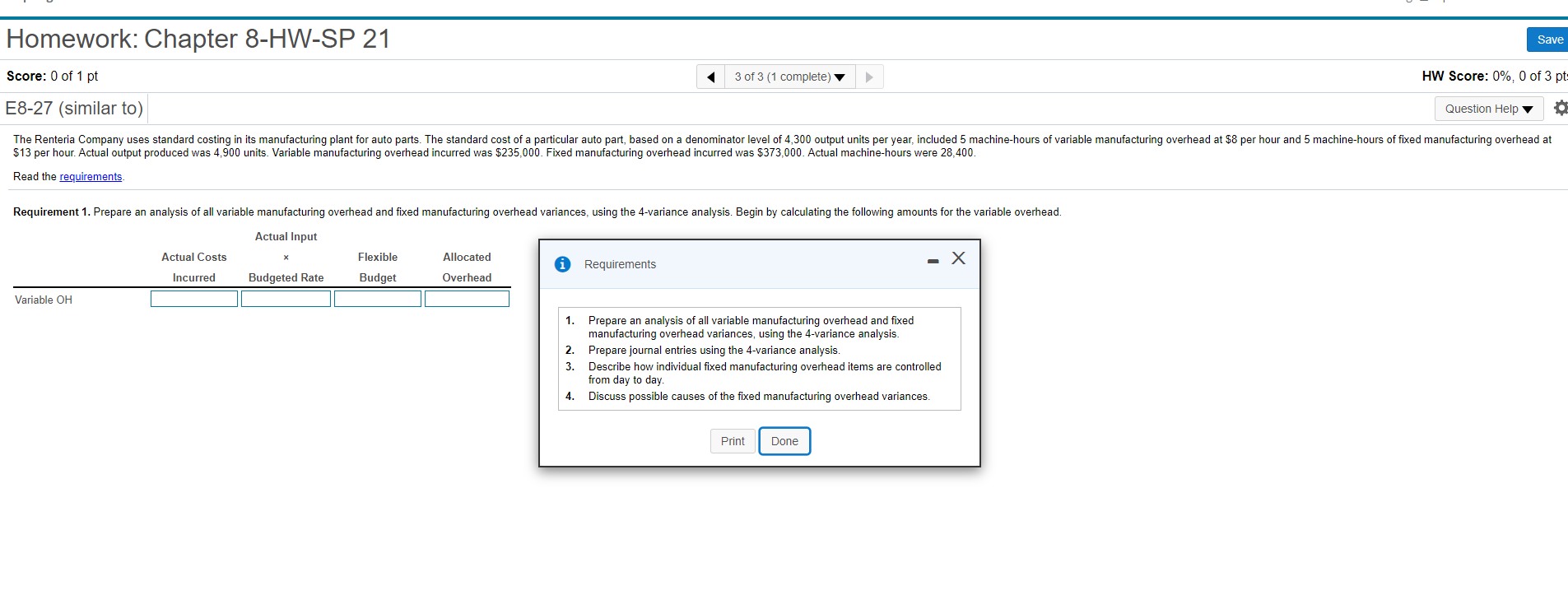

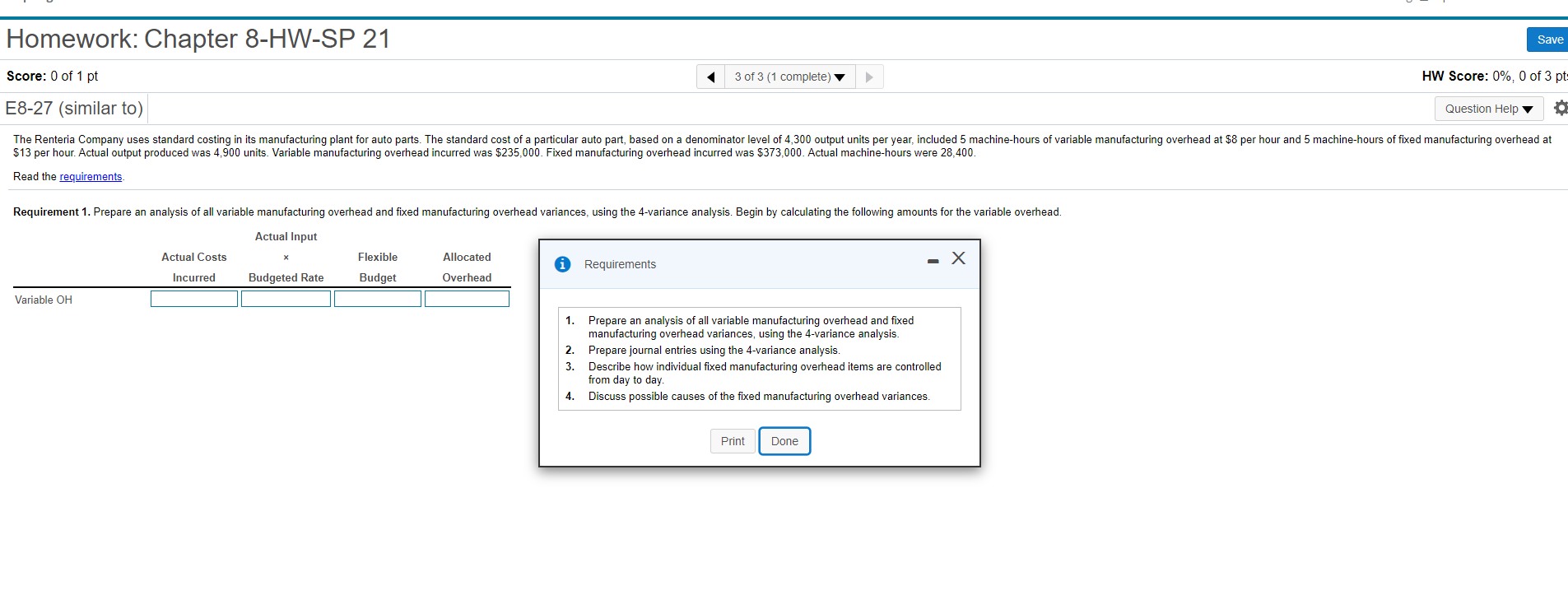

Homework: Chapter 8-HW-SP 21 Save Score: 0 of 1 pt 3 of 3 (1 complete) HW Score: 0%, 0 of 3 pts E8-27 (similar to) Question Help The Renteria Company uses standard costing in its manufacturing plant for auto parts. The standard cost of a particular auto part, based on a denominator level of 4,300 output units per year, included 5 machine-hours of variable manufacturing overhead at $8 per hour and 5 machine-hours of fixed manufacturing overhead at $13 per hour. Actual output produced was 4,900 units. Variable manufacturing overhead incurred was $235,000. Fixed manufacturing overhead incurred was $373,000. Actual machine-hours were 28,400. Read the requirements Requirement 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis. Begin by calculating the following amounts for the variable overhead. Actual Input Actual Costs Flexible Allocated Overhead Requirements Incurred Budgeted Rate Budget Variable OH 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis. 2. Prepare journal entries using the 4-variance analysis. 3. Describe how individual fixed manufacturing overhead items are controlled from day to day 4. Discuss possible causes of the fixed manufacturing overhead variances. Print Done Homework: Chapter 8-HW-SP 21 Save Score: 0 of 1 pt 3 of 3 (1 complete) HW Score: 0%, 0 of 3 pts E8-27 (similar to) Question Help The Renteria Company uses standard costing in its manufacturing plant for auto parts. The standard cost of a particular auto part, based on a denominator level of 4,300 output units per year, included 5 machine-hours of variable manufacturing overhead at $8 per hour and 5 machine-hours of fixed manufacturing overhead at $13 per hour. Actual output produced was 4,900 units. Variable manufacturing overhead incurred was $235,000. Fixed manufacturing overhead incurred was $373,000. Actual machine-hours were 28,400. Read the requirements Requirement 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis. Begin by calculating the following amounts for the variable overhead. Actual Input Actual Costs Flexible Allocated Overhead Requirements Incurred Budgeted Rate Budget Variable OH 1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis. 2. Prepare journal entries using the 4-variance analysis. 3. Describe how individual fixed manufacturing overhead items are controlled from day to day 4. Discuss possible causes of the fixed manufacturing overhead variances. Print Done