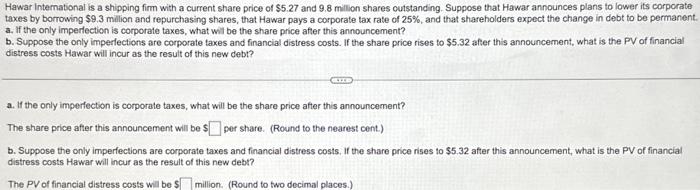

Hawar International is a shipping firm with a current share price of $5.27 and 9.8 million shares cutstanding. Suppose that Hawar announces plans to lower its corporate taxes by borrowing $9.3 million and repurchasing shares, that Hawar pays a corporate tax rate of 25%, and that shareholders expect the change in debt to be permanent. a. if the only imperlection is corporate taxes, what will be the share price after this announcement? b. Suppose the only imperlections are corporate taxes and financial distress costs. If the share price rises to $5.32 after this announcement, what is the PV of financial distress costs Hawar will incur as the result of this new debt? a. If the only imperfection is corporate taxes, what will be the share price after this announcement? The share price after this announcement will be 5 per share. (Round to the nearest cent.) b. Suppose the only imperfections are corporate taxes and financial distress costs, If the share price rises to $5.32 after this announcement, what is the PV of financia distress costs Hawar will incur as the result of this new debs? The PV of financial distress costs wili be $ million. (Round to two decimal places.) Hawar International is a shipping firm with a current share price of $5.27 and 9.8 million shares cutstanding. Suppose that Hawar announces plans to lower its corporate taxes by borrowing $9.3 million and repurchasing shares, that Hawar pays a corporate tax rate of 25%, and that shareholders expect the change in debt to be permanent. a. if the only imperlection is corporate taxes, what will be the share price after this announcement? b. Suppose the only imperlections are corporate taxes and financial distress costs. If the share price rises to $5.32 after this announcement, what is the PV of financial distress costs Hawar will incur as the result of this new debt? a. If the only imperfection is corporate taxes, what will be the share price after this announcement? The share price after this announcement will be 5 per share. (Round to the nearest cent.) b. Suppose the only imperfections are corporate taxes and financial distress costs, If the share price rises to $5.32 after this announcement, what is the PV of financia distress costs Hawar will incur as the result of this new debs? The PV of financial distress costs wili be $ million. (Round to two decimal places.)