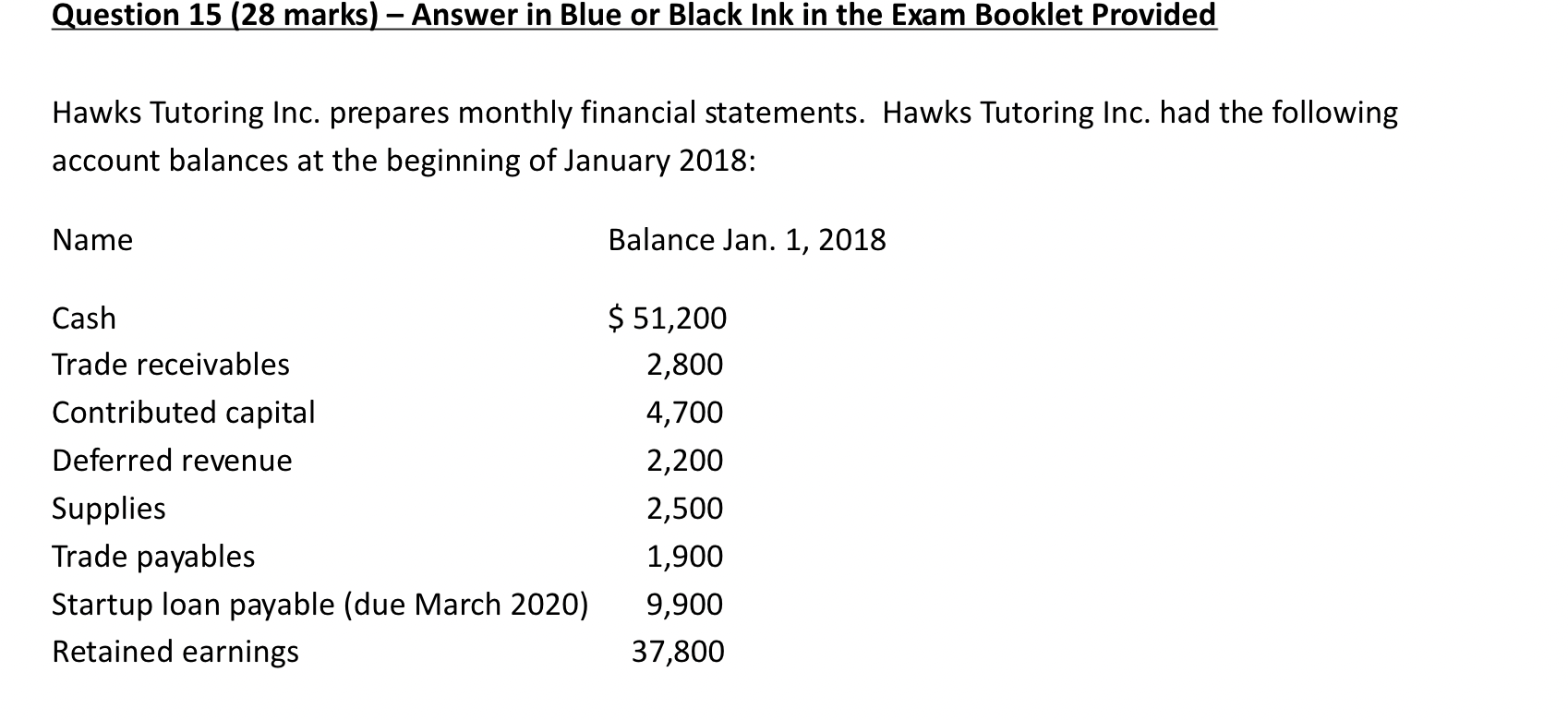

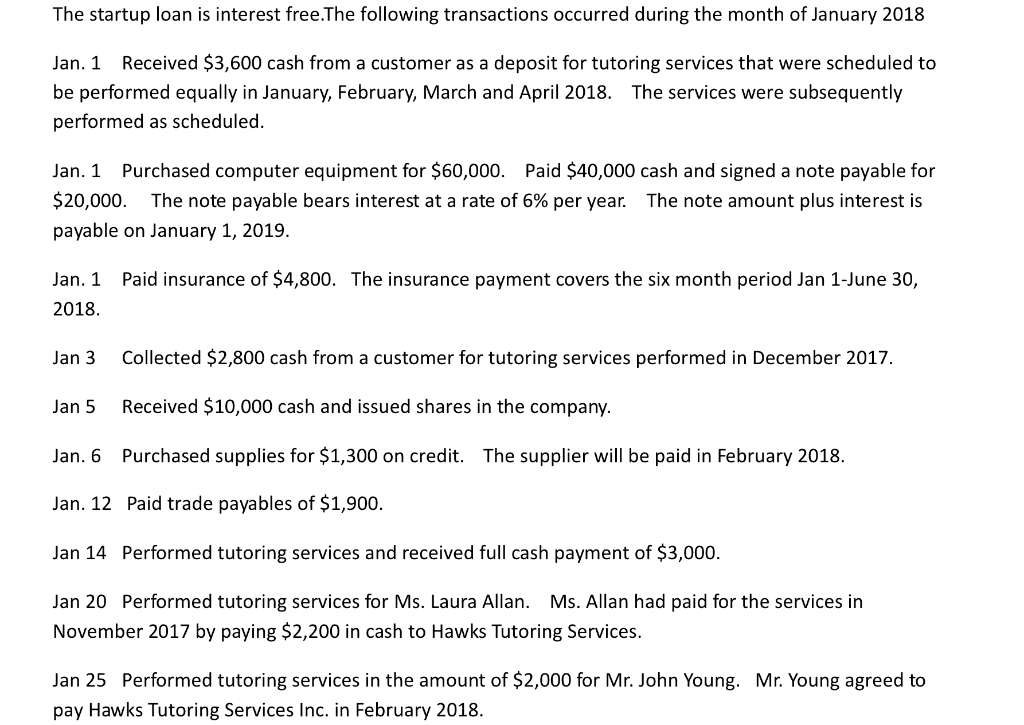

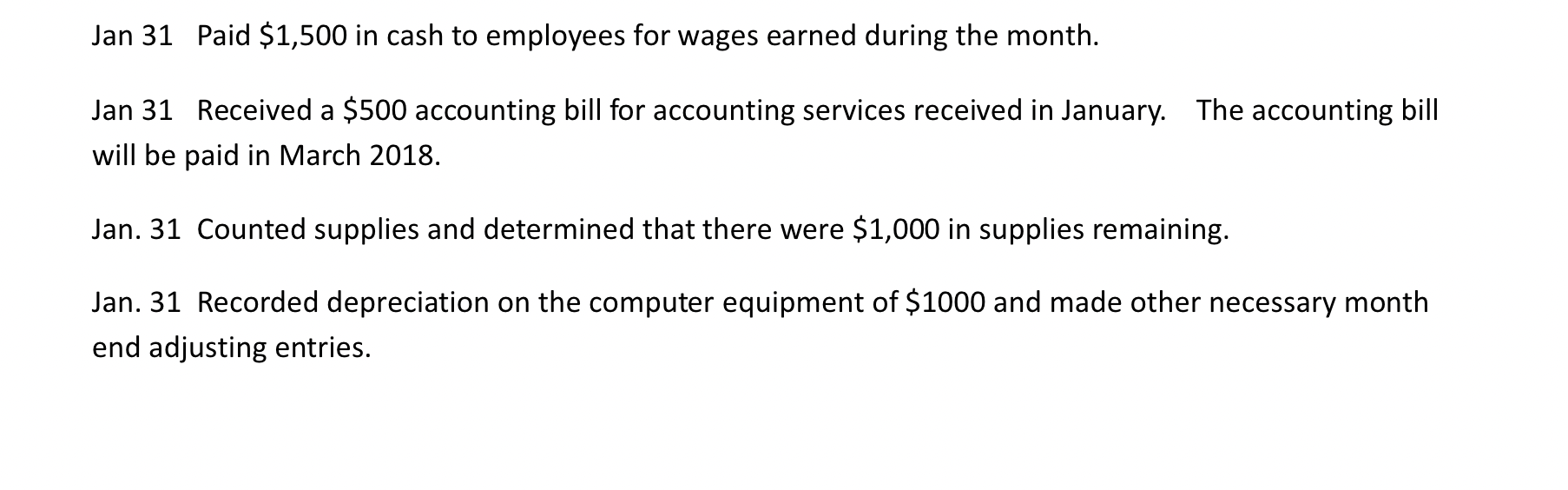

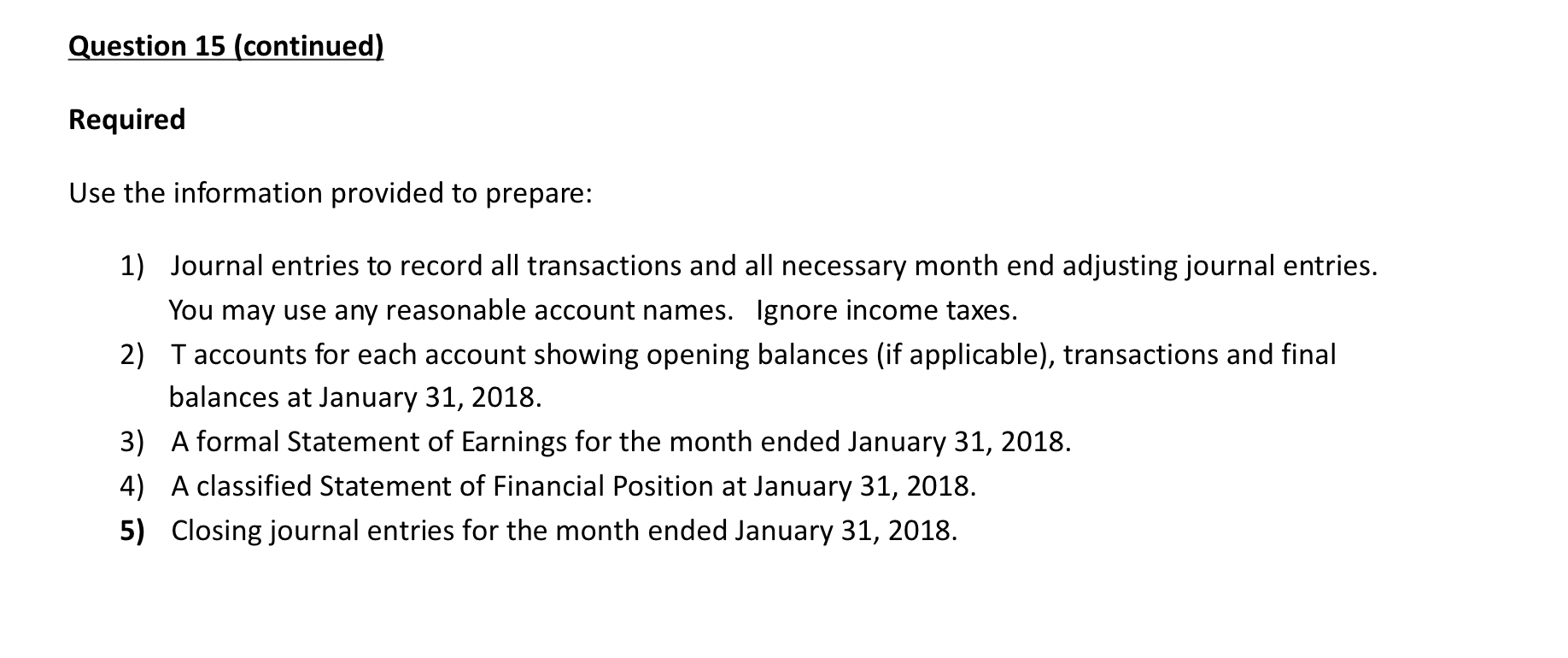

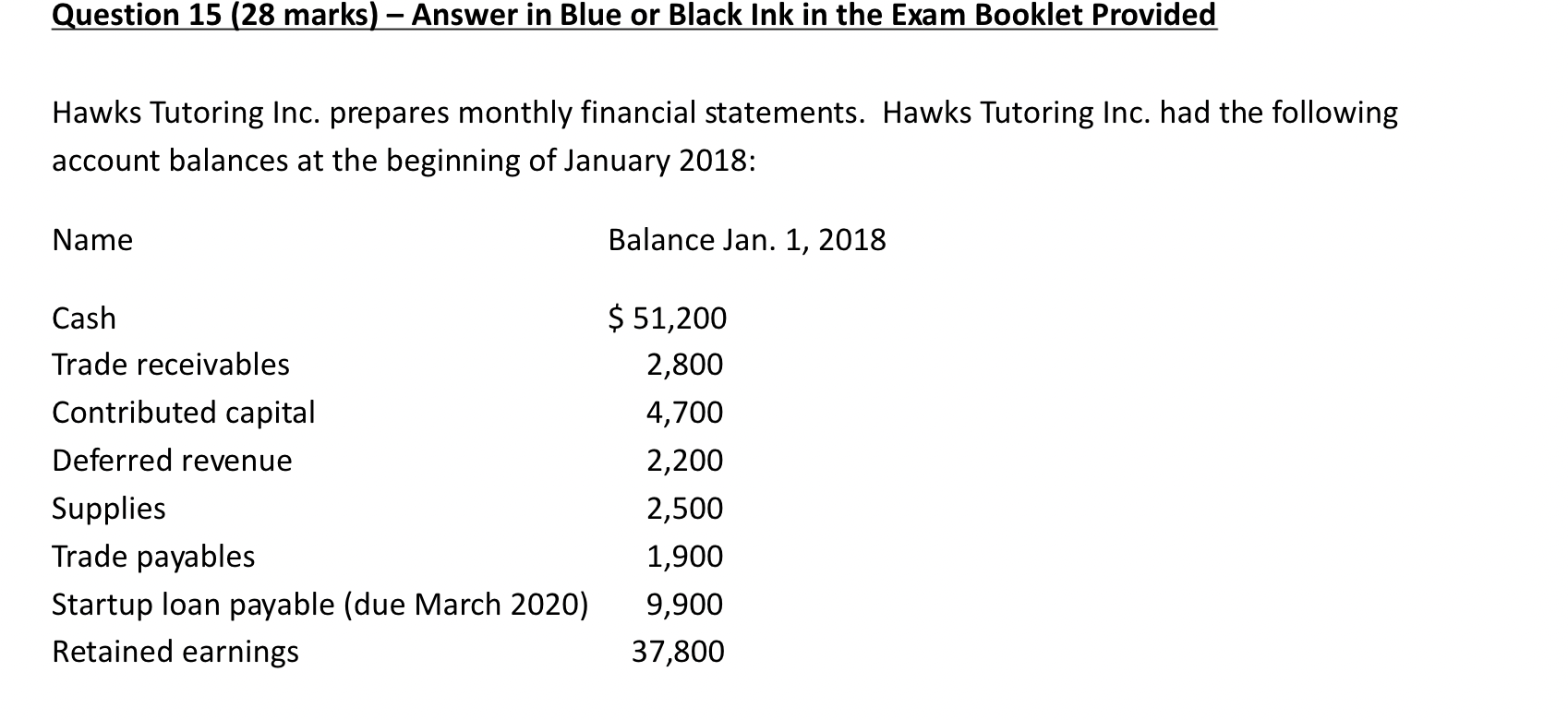

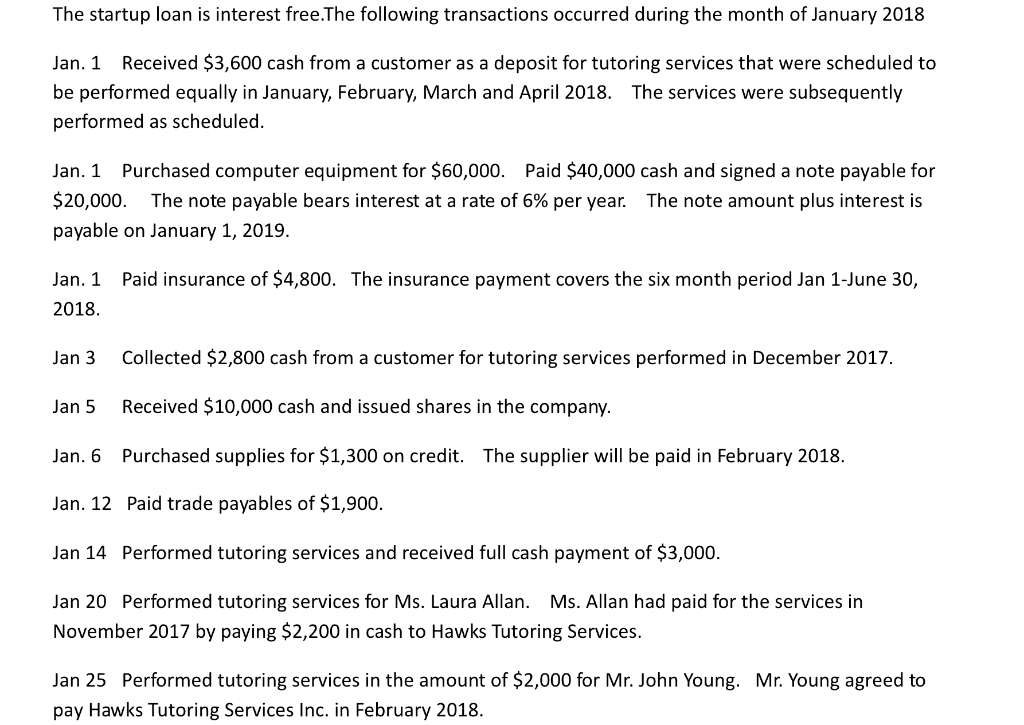

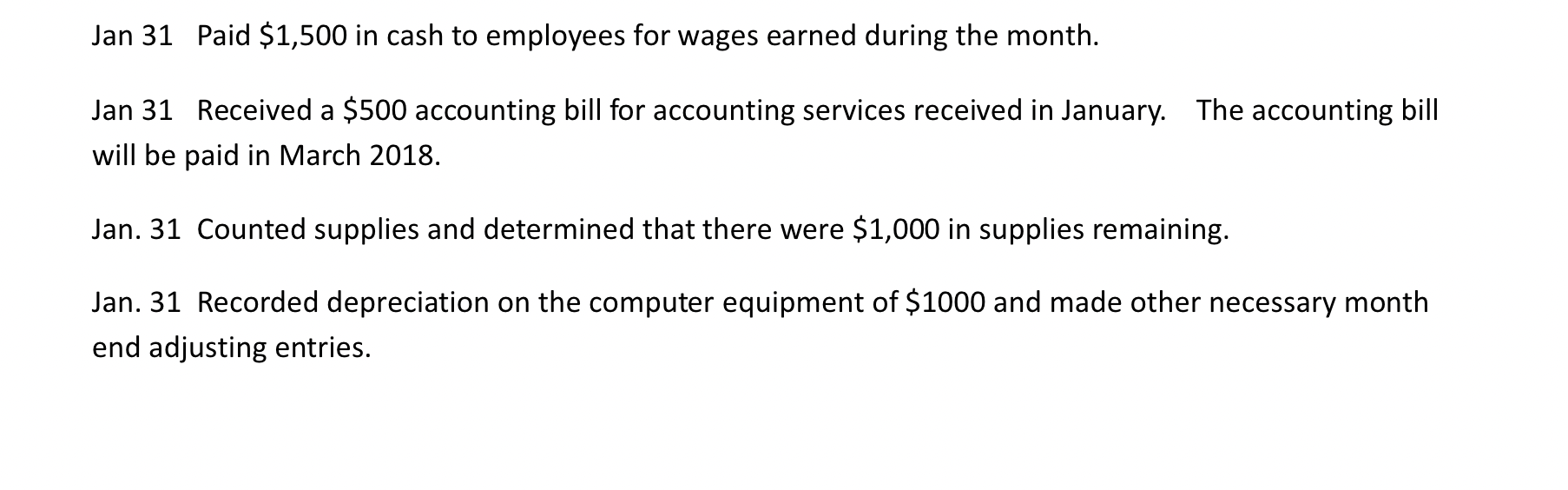

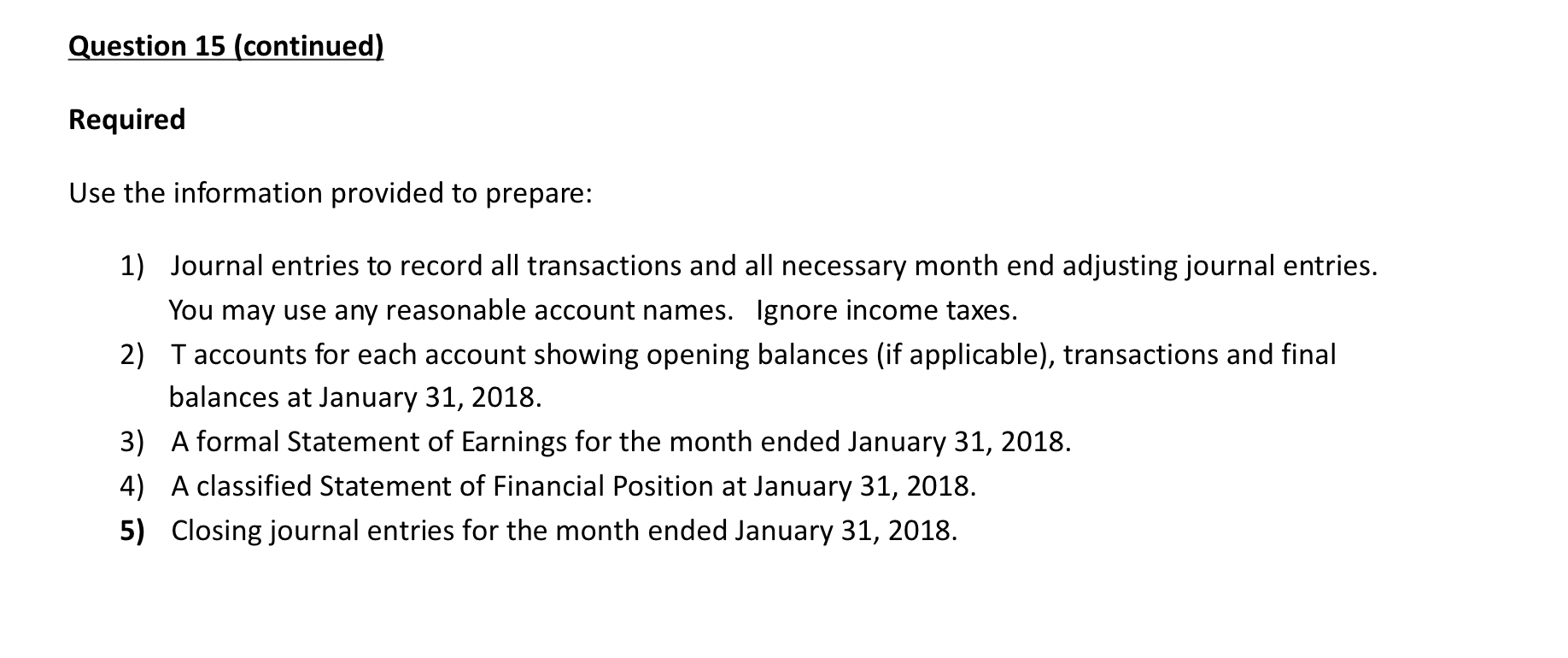

Hawks Tutoring Inc. prepares monthly financial statements. Hawks Tutoring Inc. had the following account balances at the beginning of January 2018: The startup loan is interest free.The following transactions occurred during the month of January 2018 Jan. 1 Received $3,600 cash from a customer as a deposit for tutoring services that were scheduled to be performed equally in January, February, March and April 2018. The services were subsequently performed as scheduled. Jan. 1 Purchased computer equipment for $60,000. Paid $40,000 cash and signed a note payable for $20,000. The note payable bears interest at a rate of 6% per year. The note amount plus interest is payable on January 1, 2019. Jan. 1 Paid insurance of $4,800. The insurance payment covers the six month period Jan 1-June 30, 2018. Jan 3 Collected \$2,800 cash from a customer for tutoring services performed in December 2017. Jan 5 Received $10,000 cash and issued shares in the company. Jan. 6 Purchased supplies for $1,300 on credit. The supplier will be paid in February 2018. Jan. 12 Paid trade payables of $1,900. Jan 14 Performed tutoring services and received full cash payment of $3,000. Jan 20 Performed tutoring services for Ms. Laura Allan. Ms. Allan had paid for the services in November 2017 by paying \$2,200 in cash to Hawks Tutoring Services. Jan 25 Performed tutoring services in the amount of $2,000 for Mr. John Young. Mr. Young agreed to pay Hawks Tutoring Services Inc. in February 2018. Jan 31 Paid $1,500 in cash to employees for wages earned during the month. Jan 31 Received a $500 accounting bill for accounting services received in January. The accounting bill will be paid in March 2018. Jan. 31 Counted supplies and determined that there were $1,000 in supplies remaining. Jan. 31 Recorded depreciation on the computer equipment of $1000 and made other necessary month end adjusting entries. Required Use the information provided to prepare: 1) Journal entries to record all transactions and all necessary month end adjusting journal entries. You may use any reasonable account names. Ignore income taxes. 2) T accounts for each account showing opening balances (if applicable), transactions and final balances at January 31, 2018. 3) A formal Statement of Earnings for the month ended January 31, 2018. 4) A classified Statement of Financial Position at January 31, 2018. 5) Closing journal entries for the month ended January 31, 2018