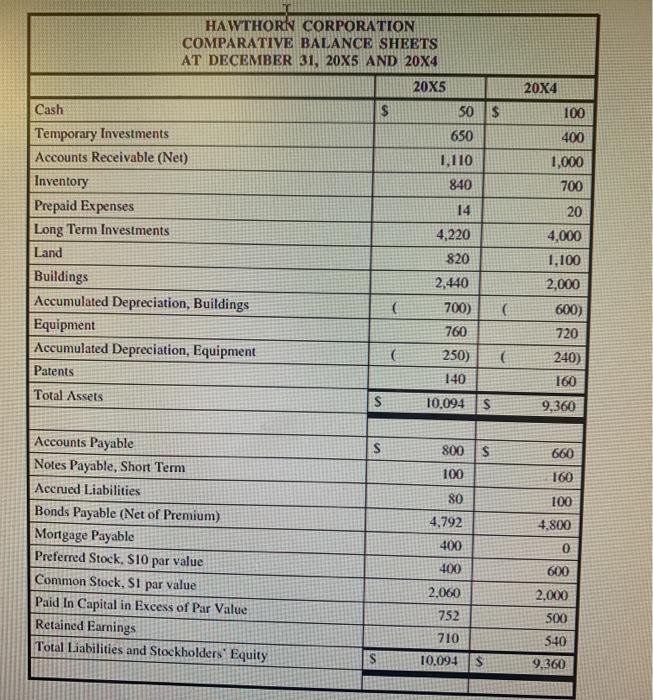

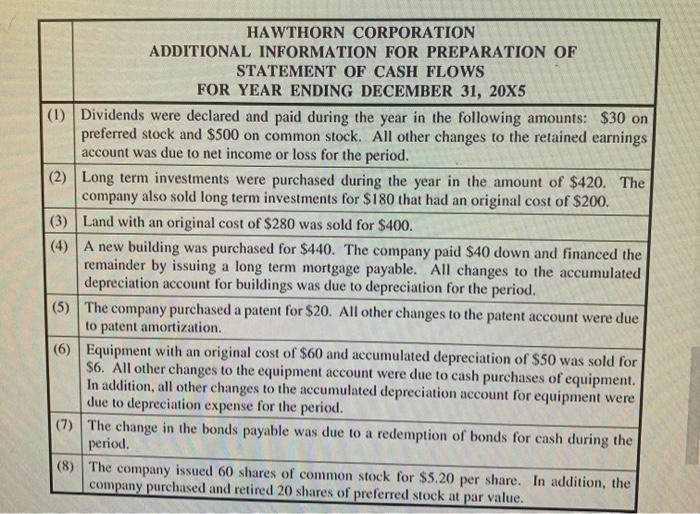

Hawthorn Corporation had the attached comparative balance sheets at December 31, 20X4 and 20X5. Additional information for 20X5 is also attached. REQUIRED: Prepare a statement of cash flows, in proper form, using the indirect method, for the year ending December 31, 20X5. Be sure to include a schedule of noncash investing and financing activities HAWTHORN CORPORATION COMPARATIVE BALANCE SHEETS AT DECEMBER 31, 20X5 AND 20X4 20X5 20X4 100 50 S 650 1,110 400 1,000 840 700 14 20 Cash Temporary Investments Accounts Receivable (Net) Inventory Prepaid Expenses Long Term Investments Land Buildings Accumulated Depreciation, Buildings Equipment Accumulated Depreciation, Equipment Patents 4,000 1,100 2,000 4,220 820 2,440 700) 760 250) 140 600) 720 240) 160 9,360 Total Assets S 10,094s s 800S 660 100 160 100 Accounts Payable Notes Payable, Short Term Accrued Liabilities Bonds Payable (Net of Premium) Mortgage Payable Preferred Stock. S10 par value Common Stock, SI par value Paid In Capital in Excess of Par Value Retained Earnings Total Liabilities and Stockholders' Equity 80 4,792 400 4.800 0 400 600 2,060 752 710 2,000 500 540 S 10.094 $ 9,360 HAWTHORN CORPORATION ADDITIONAL INFORMATION FOR PREPARATION OF STATEMENT OF CASH FLOWS FOR YEAR ENDING DECEMBER 31, 20X5 (1) Dividends were declared and paid during the year in the following amounts: $30 on preferred stock and $500 on common stock. All other changes to the retained earnings account was due to net income or loss for the period. (2) Long term investments were purchased during the year in the amount of $420. The company also sold long term investments for $180 that had an original cost of $200. (3) Land with an original cost of $280 was sold for $400. (4) A new building was purchased for $440. The company paid $40 down and financed the remainder by issuing a long term mortgage payable. All changes to the accumulated depreciation account for buildings was due to depreciation for the period. (5) The company purchased a patent for $20. All other changes to the patent account were due to patent amortization. (6) Equipment with an original cost of $60 and accumulated depreciation of $50 was sold for $6. All other changes to the equipment account were due to cash purchases of equipment. In addition, all other changes to the accumulated depreciation account for equipment were due to depreciation expense for the period. (7) The change in the bonds payable was due to a redemption of bonds for cash during the period. (8) The company issued 60 shares of common stock for $5.20 per share. In addition, the company purchased and retired 20 shares of preferred stock at par value