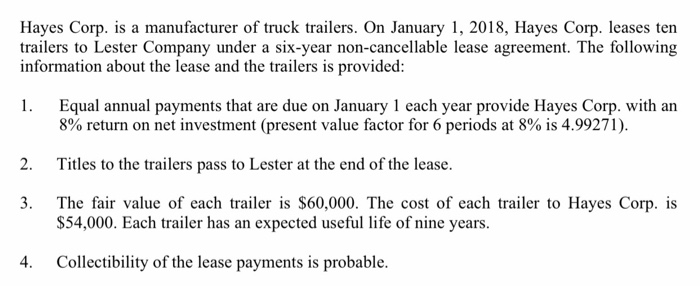

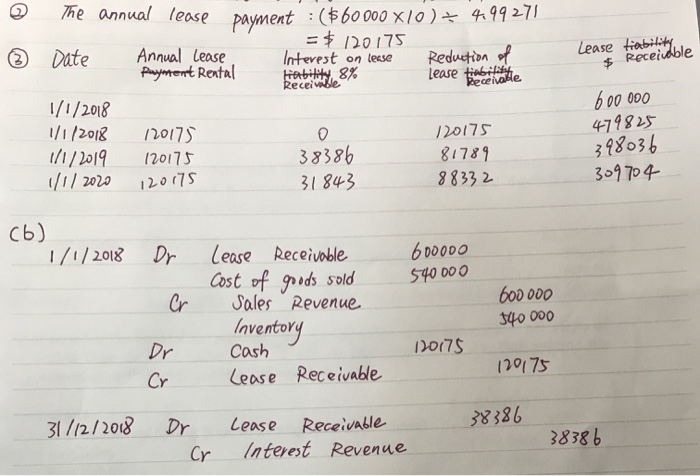

Hayes Corp. is a manufacturer of truck trailers. On January 1, 2018, Hayes Corp. leases ten trailers to Lester Company under a six-year non-cancellable lease agreement. The following information about the lease and the trailers is provided: 1. Equal annual payments that are due on January 1 each year provide Hayes Corp. with an 8% return on net investment (present value factor for 6 periods at 8% is 4.99271). 2. Titles to the trailers pass to Lester at the end of the lease. 3. The fair value of each trailer is $60,000. The cost of each trailer to Hayes Corp. is $54,000. Each trailer has an expected useful life of nine years. 4. Collectibility of the lease payments is probable. (c) Explain the accounting implication of guaranteed residual value, expected residual value and actual residual value on the book of lessee on the last day of the lease term when the asset is transferred back to the lessor. (d) Explain the accounting implication of guaranteed residual value, expected residual value and actual residual value on the book of lessor on the last day of the lease term when the asset is transferred back to the lessor. Lease fiability Receitble me annual lease payment :($60 000 X10) = 499271 = $ 120175 Date Annual lease Interest on lease Reduction of Payment Rental lease fee mitte 1/1/2018 1/1/2018 120175 120175 1/1/2019 120175 38386 81789 1/1/2020 120175 31843 88332 600 000 479825 398036 309704 (6) 1/1/2018 Dr 600000 540000 Lease Receivable Cost of goods sold Sales Revenue Inventory 600 000 340 000 Cash 10175 Lease Receivable 120175 38386 31/12/2018 Dr Cr Lease Receivable Interest Revenue 38386 Hayes Corp. is a manufacturer of truck trailers. On January 1, 2018, Hayes Corp. leases ten trailers to Lester Company under a six-year non-cancellable lease agreement. The following information about the lease and the trailers is provided: 1. Equal annual payments that are due on January 1 each year provide Hayes Corp. with an 8% return on net investment (present value factor for 6 periods at 8% is 4.99271). 2. Titles to the trailers pass to Lester at the end of the lease. 3. The fair value of each trailer is $60,000. The cost of each trailer to Hayes Corp. is $54,000. Each trailer has an expected useful life of nine years. 4. Collectibility of the lease payments is probable. (c) Explain the accounting implication of guaranteed residual value, expected residual value and actual residual value on the book of lessee on the last day of the lease term when the asset is transferred back to the lessor. (d) Explain the accounting implication of guaranteed residual value, expected residual value and actual residual value on the book of lessor on the last day of the lease term when the asset is transferred back to the lessor. Lease fiability Receitble me annual lease payment :($60 000 X10) = 499271 = $ 120175 Date Annual lease Interest on lease Reduction of Payment Rental lease fee mitte 1/1/2018 1/1/2018 120175 120175 1/1/2019 120175 38386 81789 1/1/2020 120175 31843 88332 600 000 479825 398036 309704 (6) 1/1/2018 Dr 600000 540000 Lease Receivable Cost of goods sold Sales Revenue Inventory 600 000 340 000 Cash 10175 Lease Receivable 120175 38386 31/12/2018 Dr Cr Lease Receivable Interest Revenue 38386