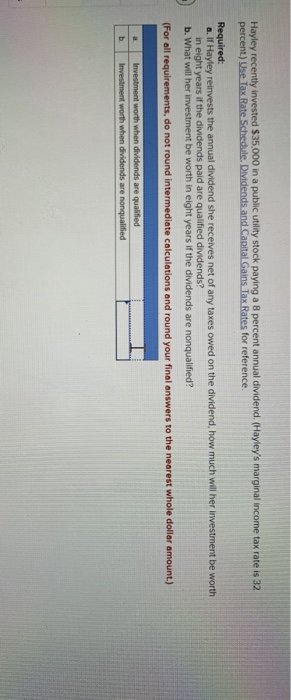

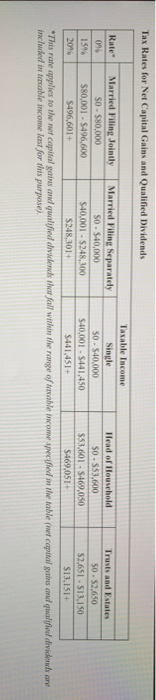

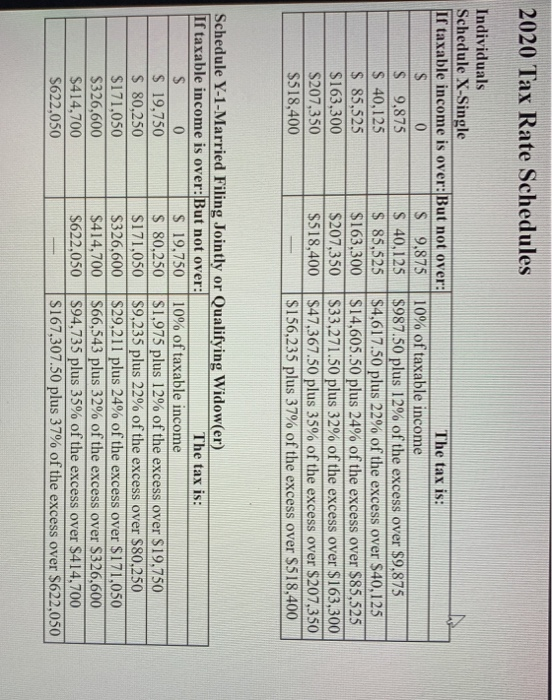

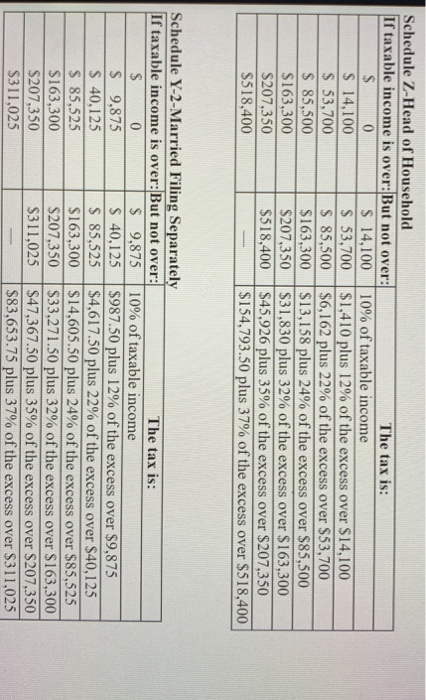

Hayley recently invested $35,000 in a public utility stock paying a 8 percent annual dividend. (Hayley's marginal income tax rate is 32 percent.) Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Required: a. If Hayley reinvests the annual dividend she receives net of any taxes owed on the dividend, how much will her investment be worth in eight years if the dividends paid are qualified dividends? b. What will her investment be worth in eight years if the dividends are nonqualified? (For all requirements, do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Investment worth when dividends are qualified Investment worth when dividends are nonqualified b Tax Rates for Net Capital Gains and Qualified Dividends Taxable income Rate Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 096 SOSNO,000 SO . $40,000 SO. $40,000 $0.553,600 $0.52.650 15% $80,001 - 5496,600 $40,001 - 5248,300 $40,001 - $441,450 553.601 - 5469,050 $2,651 - $13,150 20% S496,601+ S248,301+ $441,451 $469,051+ $13,151+ *This rate applies to the ser capital gains and qualified divided the fall within the range of taxable income specified in the table (nel capital gains and qualified dividends are included in fecable income last for this purpose), 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 S 9.875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9.875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19.750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80.250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over S326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 S 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 S 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income S 9.875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 S 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025