Question

HCCC Bhd granted 5,000 share options to each of its 15 new-appointed managers on 1 July 2019. The share options will vest on 30

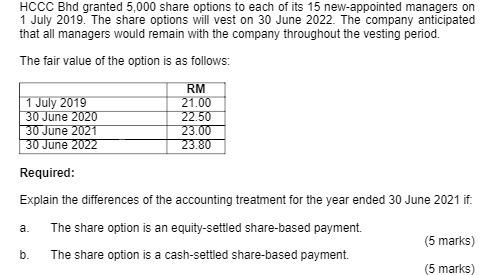

HCCC Bhd granted 5,000 share options to each of its 15 new-appointed managers on 1 July 2019. The share options will vest on 30 June 2022. The company anticipated that all managers would remain with the company throughout the vesting period. The fair value of the option is as follows: 1 July 2019 30 June 2020 30 June 2021 30 June 2022 RM 21.00 22.50 23.00 23.80 Required: Explain the differences of the accounting treatment for the year ended 30 June 2021 if: a. The share option is an equity-settled share-based payment. The share option is a cash-settled share-based payment. b. (5 marks) (5 marks)

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App