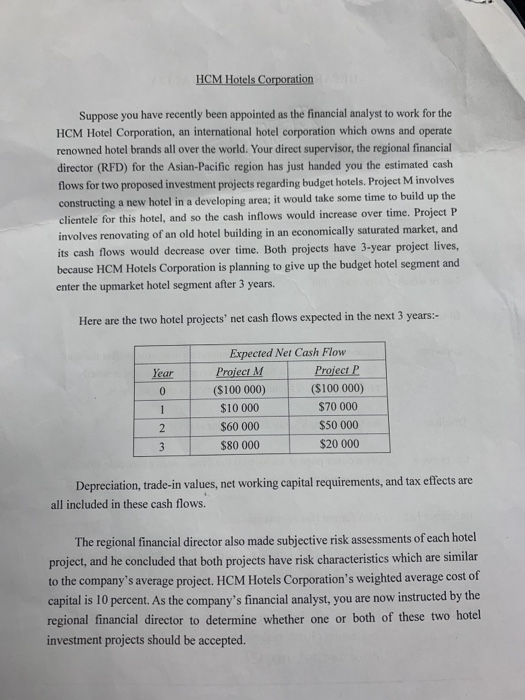

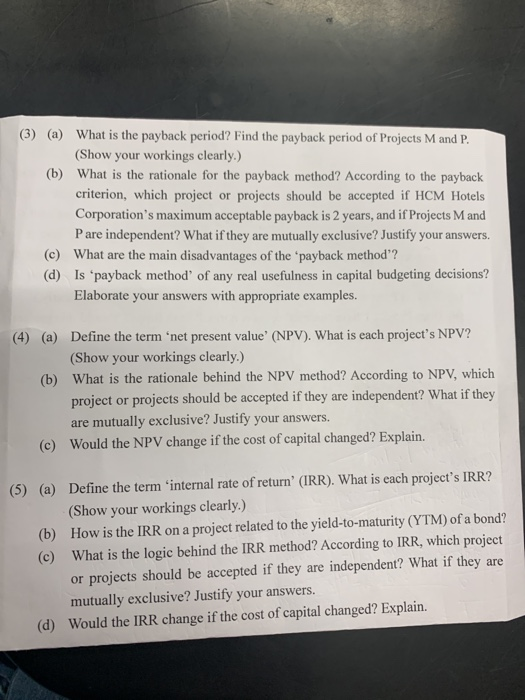

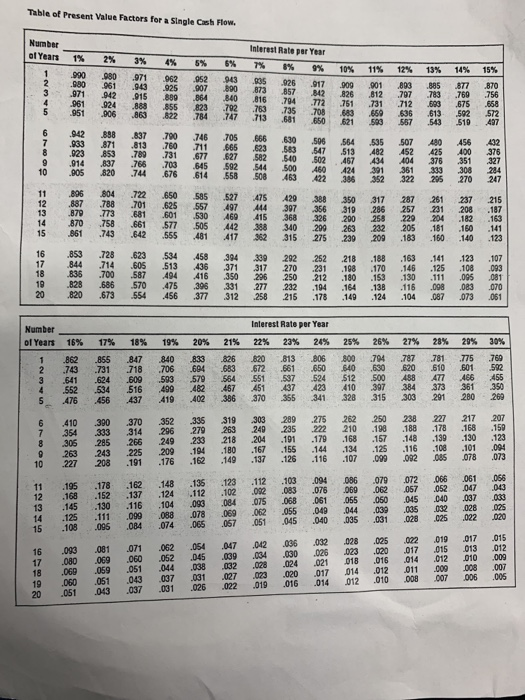

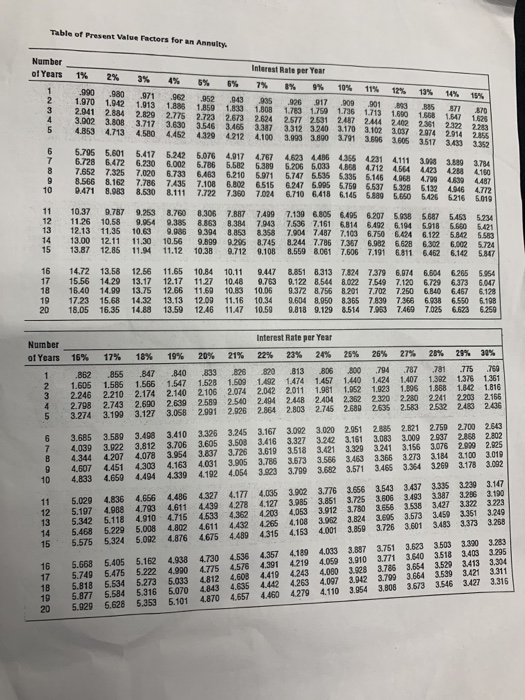

HCM Hotels Corporation Suppose you have recently been appointed as the financial analyst to work for the HCM Hotel Corporation, an international hotel corporation which owns and operate renowned hotel brands all over the world. Your direct supervisor, the regional financial director (RFD) for the Asian Pacific region has just handed you the estimated cash flows for two proposed investment projects regarding budget hotels Project M involves constructing a new hotel in a developing area; it would take some time to build up the clientele for this hotel, and so the cash inflows would increase over time. Project P involves renovating of an old hotel building in an economically saturated market, and its cash flows would decrease over time. Both projects have 3-year project lives, because HCM Hotels Corporation is planning to give up the budget hotel segment and enter the upmarket hotel segment after 3 years. Here are the two hotel projects' net cash flows expected in the next 3 years:- Year 0 Expected Net Cash Flow Project M Project P ($100 000) ($100 000) $10 000 $70 000 $60 000 $50 000 $80 000 $20 000 1 2 3 Depreciation, trade-in values, net working capital requirements, and tax effects are all included in these cash flows. The regional financial director also made subjective risk assessments of each hotel project, and he concluded that both projects have risk characteristics which are similar to the company's average project. HCM Hotels Corporation's weighted average cost of capital is 10 percent. As the company's financial analyst, you are now instructed by the regional financial director to determine whether one or both of these two hotel investment projects should be accepted. (3) (a) What is the payback period? Find the payback period of Projects M and P. (Show your workings clearly.) (b) What is the rationale for the payback method? According to the payback criterion, which project or projects should be accepted if HCM Hotels Corporation's maximum acceptable payback is 2 years, and if Projects M and Pare independent? What if they are mutually exclusive? Justify your answers. (c) What are the main disadvantages of the payback method"? (d) Is payback method of any real usefulness in capital budgeting decisions? Elaborate your answers with appropriate examples. (4) (a) Define the term 'net present value' (NPV). What is each project's NPV? (Show your workings clearly.) (b) What is the rationale behind the NPV method? According to NPV, which project or projects should be accepted if they are independent? What if they are mutually exclusive? Justify your answers. (c) Would the NPV change if the cost of capital changed? Explain. (5) (a) Define the term 'internal rate of return' (IRR). What is each project's IRR? (Show your workings clearly.) (b) How is the IRR on a project related to the yield-to-maturity (YTM) of a bond? (c) What is the logic behind the IRR method? According to IRR, which project or projects should be accepted if they are independent? What if they are mutually exclusive? Justify your answers. (d) Would the IRR change if the cost of capital changed? Explain. 3 15. | www % 124 5 | 24h 9 Interest Rate par Year 17 Interest Rate per Year 5% Table of Present Value Factors for a Single Cash Flow | 1619 | 1 Number of Years Number of Years 16% man A - the to - - HHBUB Table of Present Value Pactors for an Annuity Number of Years 1.913 1 2 3 4 5 6 7 8 10 Interest Rate per Year 1% 2% 3% 5% 6% 7% 8% 9% 10% 11% .990 12% .980 13% 14%. .971 15% 962 1.970 .952 .943 995 1.942 .926 1.888 917 1.859 .900 301 1.808 885 2.041 2.884 2.829 1.783 1.750 M77 870 1.736 1713 1690 1.668 1547 2.775 2.723 2.673 3.002 3.808 3.717 3.630 3.546 2.624 2.577 2531 2.487 244 24022561 2.322 1.626 2.23 4.853 4.713 3.466 3.387 3.312 3240 3.170 3.102 3.037 2074 2914 4,500 4.452 4.329 4212 4.100 2855 3.993 3.800 3.741 3.506 3.5053517 3.433 3.352 5.796 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.356 4.231 4.111 6.728 6.472 6.230 3.098 3.8893.784 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4564 4423 4.258 4150 7.652 7.325 7.020 6.733 6.463 6.210 5.971 57475.536 5.335 5.146 4.968 4.799 4.839 4.487 8.566 8. 1627.786 7.4357.100 6.000 6.515 6.247 5.995 6.750 5.537 6.328 5.132 4.946 4.772 0.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 526 5216 5.019 10.37 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.806 6.495 6.207 5.938 6.687 5.453 5.234 11.26 10.58 9.964 0.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 12.13 11.35 10.6 9.90 9.394 8.853 8.358 7.904 7407 7.103 6.750 6.424 6.122 5.842 5.583 13.00 12.11 11.30 10.56 9.899 9.296 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 13.87 12.86 11.94 11.12 10.38 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 14.72 13.58 12.56 11.65 10.84 10.11 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 15.56 14.29 13.17 12.17 11.27 10.48 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 16.40 14.09 13.75 12.66 11.60 10.83 10.06 9.372 8.7568.201 7.702 7.250 6.840 6.467 6.128 1723 15.68 14.32 13.13 12.09 11.16 10.34 9.604 8.950 8.365 7.8397.366 6.938 6.550 6.198 18.05 16.35 14.88 13.50 12.46 6.259 11.47 10.59 9.818 9.129 8.514 7.953 7.469 7.025 6.623 11 12 13 14 15 16 17 18 19 20 Number of Years .855 .847 1 2 3 4 5 Interest Rate per Year 15% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30% .862 .840 .833 .813 .806 800 .794 .787 .781 .775 759 1.606 1.585 1.566 1.547 1.528 1.509 1.482 1474 1.457 1.440 1.424 1.407 1.392 1.376 1361 2.246 2.210 2.174 2.140 2106 2.074 2.042 2.011 1.981 1.952 1.923 1.896 1.888 1.842 1.816 2.798 2.743 2.600 2.639 2.589 2.540 2.494 2.448 2.404 2.362 2320 2.280 2241 2203 2.165 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.680 2635 2.583 2.532 2483 2.436 3.685 3.589 3.498 3.410 3,326 3.245 3.167 3.092 3.020 2.951 2.885 2.821 2.750 2700 2.643 4.039 3.022 3.812 3.706 3.605 3.508 3.416 3.327 3.2423.161 3.0833.009 2.937 2.858 2.802 4.344 4207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 3.241 3.156 3.076 2.999 2.925 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 3.366 3.273 3.184 3,100 3.019 4.833 4.650 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 3.465 3.364 3.269 3.178 3.002 6 B 9 10 11 12 13 14 15 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 3.543 3.437 3.335 3.239 3.147 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 3.606 3.493 3.387 3.296 3.190 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 3.656 3.538 3.427 3.322 3223 5.468 5.229 5.008 4.802 4.611 4432 4.265 4.108 3.962 3.824 3.695 3.573 3.459 3.361 3.249 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.850 3.726 3.601 3.483 3.373 3.268 5.668 5.405 5.1624.938 4.730 4.536 4.357 4.189 4.033 3.887 3.751 3.623 3.503 3.390 3.263 5.749 5.475 5.222 4.990 4.775 4576 4.391 4.219 4.050 3.010 3.771 3.640 3.518 3.403 3.295 5.818 5.534 5.273 5.033 4.812 4.600 4.419 4243 4.060 3.928 3.786 3.654 3.529 3.413 3.304 5.877 5.584 5.316 5.070 4.635 4.442 4.263 4.097 3.942 3.799 3.664 3.639 3.421 3.311 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 3.808 3.673 3.546 3.427 3.316 16 17 1B 10 20 4.843