Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hdb (0) Payment at a time. Subject to availability of the fund, the payment may be made at a time. Journal entry : Retiring Partner's

hdb

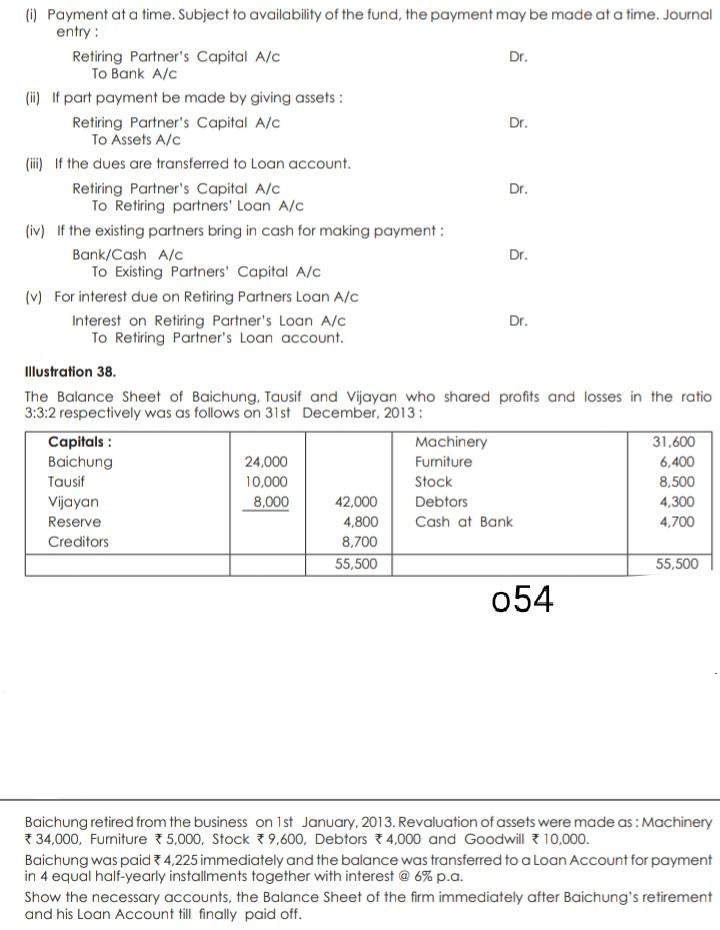

(0) Payment at a time. Subject to availability of the fund, the payment may be made at a time. Journal entry : Retiring Partner's Capital A/C Dr. To Bank A/C (ii) If part payment be made by giving assets : Retiring Partner's Capital Alc Dr. To Assets A/C () If the dues are transferred to Loan account. Retiring Partner's Capital A/C Dr. To Retiring partners' Loan A/C (iv) If the existing partners bring in cash for making payment: Bank/Cash A/C Dr. To Existing Partners' Capital A/C (For interest due on Retiring Partners Loan A/C Interest on Retiring Partner's Loan A/C Dr. To Retiring Partner's Loan account. Illustration 38. The Balance sheet of Baichung. Tausif and Vijayan who shared profits and losses in the ratio 3:3:2 respectively was as follows on 31st December, 2013: Capitals : Machinery 31,600 Baichung 24,000 Furniture 6,400 Tausif 10,000 Stock 8,500 Vijayan 8,000 42,000 Debtors 4,300 Reserve 4,800 Cash at Bank 4,700 Creditors 8,700 55,500 55,500 054 Baichung retired from the business on 1st January, 2013. Revaluation of assets were made as: Machinery 34,000, Furniture 5,000, Stock * 9,600. Debtors 4,000 and Goodwill * 10,000. Baichung was paid 34,225 immediately and the balance was transferred to a Loan Account for payment in 4 equal half-yearly installments together with interest @ 6% p.a. Show the necessary accounts, the Balance Sheet of the firm immediately after Baichung's retirement and his Loan Account till finally paid offStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started