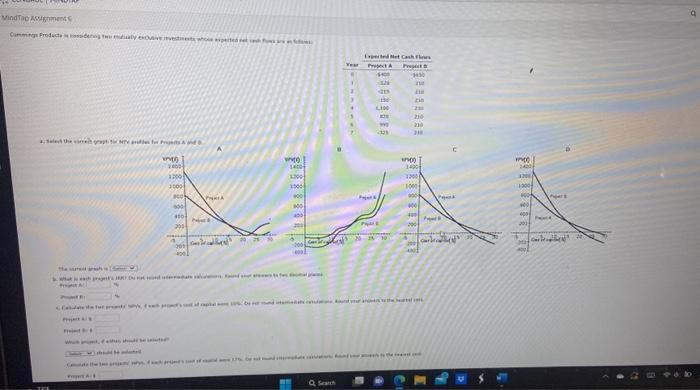

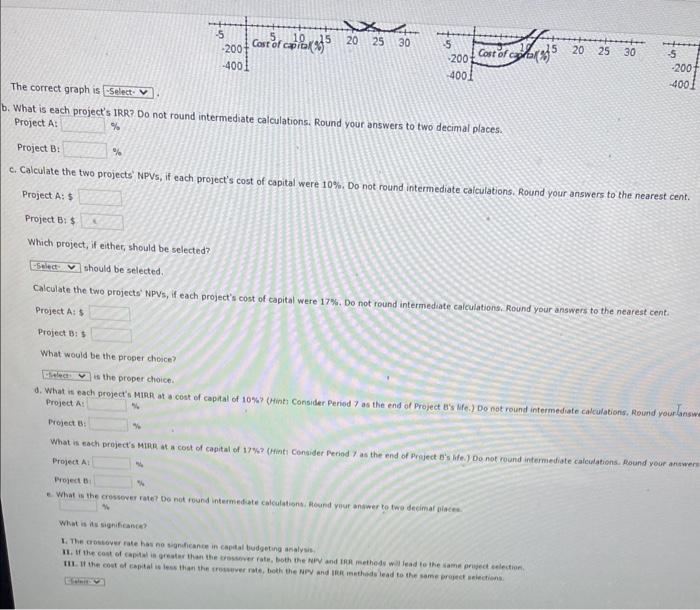

> he correct graph is What is each proiect's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: of Project B: Calculate the two projects' NPVs, if each project's cost of capital were 10%. Do not round intermediate caiculations. Round your answers to the nearest cent. Project A:$ Project B: $ Which project, if either, should be selected? should be selected. Calculate the two projects' NPVs, if each project's cost of capital were 17\%. Do not round intermediate caiculations. Round your answers to the nearest cent. Project A: 5 Project B: 5 What would be the proper choice? 4. What is sach the proper clioice. d. What is each orosect's Mirh at a cost of capalal of 10% ( Hints Consider Penied 7 as the end of Project Bs Mfe.) Do not round intermediate catculations, Round yourtansw Proj Project B: What is each project's MiRh at a cost of cabital of 17% ? (Hinti Consider Feriod 7 as the end of Preject D's life.) Do not round intermediate calcilations. Pound your answer Project A E. What is the mossover rate? What is at significance? 1. The coosiover fate has no signuficance in capial budgeting analyai. 11. If the cost of cap-ial in greater than the cascenter rate, both the Nor and tro methede will lead to the same geigect selection. > he correct graph is What is each proiect's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: of Project B: Calculate the two projects' NPVs, if each project's cost of capital were 10%. Do not round intermediate caiculations. Round your answers to the nearest cent. Project A:$ Project B: $ Which project, if either, should be selected? should be selected. Calculate the two projects' NPVs, if each project's cost of capital were 17\%. Do not round intermediate caiculations. Round your answers to the nearest cent. Project A: 5 Project B: 5 What would be the proper choice? 4. What is sach the proper clioice. d. What is each orosect's Mirh at a cost of capalal of 10% ( Hints Consider Penied 7 as the end of Project Bs Mfe.) Do not round intermediate catculations, Round yourtansw Proj Project B: What is each project's MiRh at a cost of cabital of 17% ? (Hinti Consider Feriod 7 as the end of Preject D's life.) Do not round intermediate calcilations. Pound your answer Project A E. What is the mossover rate? What is at significance? 1. The coosiover fate has no signuficance in capial budgeting analyai. 11. If the cost of cap-ial in greater than the cascenter rate, both the Nor and tro methede will lead to the same geigect selection