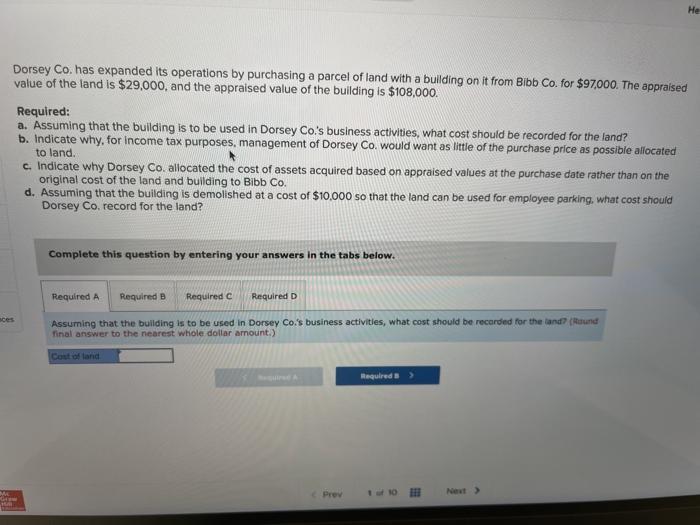

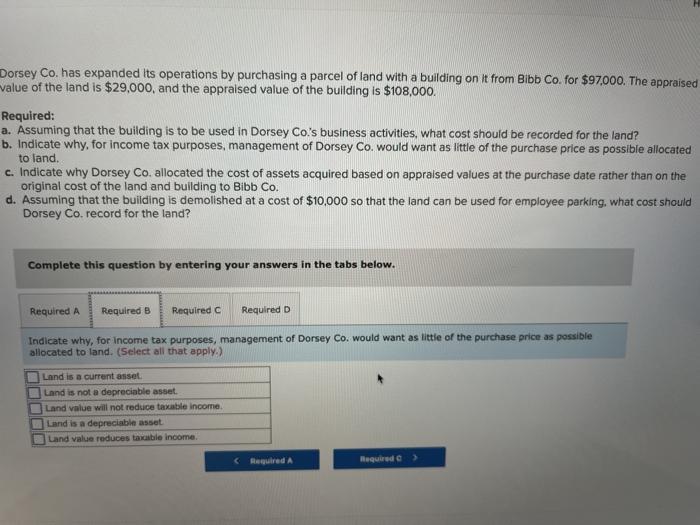

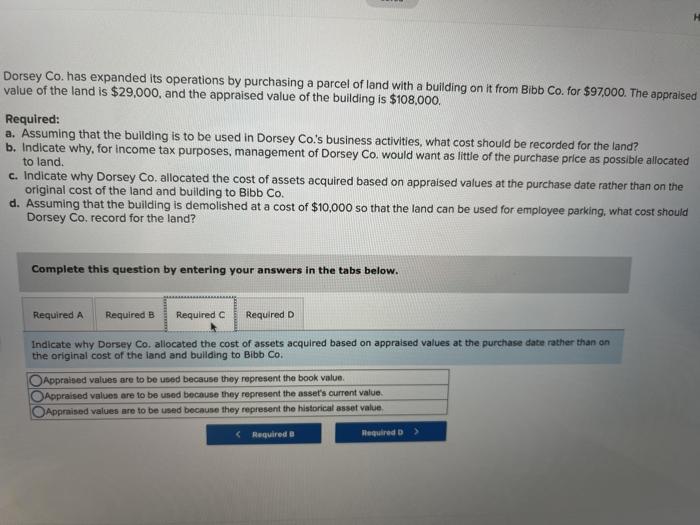

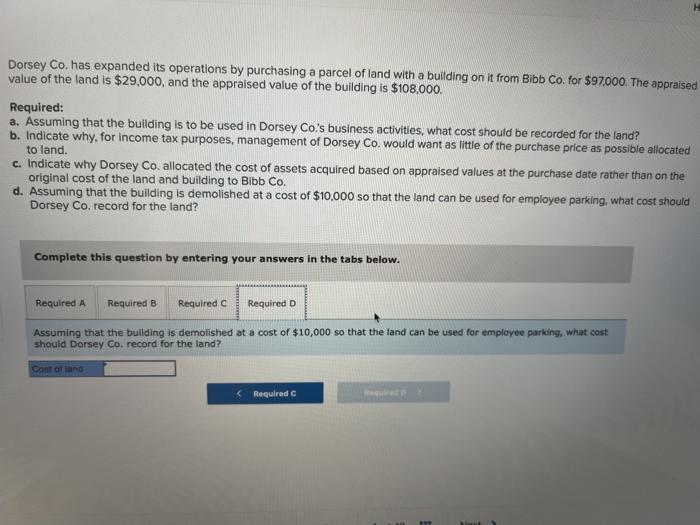

He Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $97,000. The appraised value of the land is $29,000, and the appraised value of the building is $108,000. Required: a. Assuming that the building is to be used in Dorsey Co.'s business activities, what cost should be recorded for the land? b. Indicate why, for income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land. c. Indicate why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. d. Assuming that the building is demolished at a cost of $10,000 so that the land can be used for employee parking, what cost should Dorsey Co, record for the land? Complete this question by entering your answers in the tabs below. aces Required A Required B Required C Required D Assuming that the bullding is to be used in Dorsey Co.'s business activities, what cost should be recorded for the land? (Round final answer to the nearest whole dollar amount.) Cost of land Required > M Newt Prev 110 Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $97.000. The appraised value of the land is $29,000, and the appraised value of the building is $108,000. Required: a. Assuming that the building is to be used in Dorsey Co.'s business activities, what cost should be recorded for the land? b. Indicate why, for income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land. c. Indicate why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. d. Assuming that the building is demolished at a cost of $10,000 so that the land can be used for employee parking, what cost should Dorsey Co. record for the land? Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Indicate why, for Income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land. (Select all that apply.) LLLL Land is a current asset Land is not a depreciable asset. Land value will not reduce taxable income. Land is a depreciable asset Land value reduces taxable income. Required A Required > Dorsey Co. has expanded its operations by purchasing a parcel of land with a building on it from Bibb Co. for $97,000. The appraised value of the land is $29.000, and the appraised value of the building is $108,000. Required: a. Assuming that the building is to be used in Dorsey Cois business activities, what cost should be recorded for the land? b. Indicate why, for income tax purposes, management of Dorsey Co. would want as little of the purchase price as possible allocated to land. c. Indicate why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. d. Assuming that the building is demolished at a cost of $10,000 so that the land can be used for employee parking, what cost should Dorsey Co. record for the land? Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Indicate why Dorsey Co. allocated the cost of assets acquired based on appraised values at the purchase date rather than on the original cost of the land and building to Bibb Co. O Appraised values are to be used because they represent the book value. Appraised values are to be used because they represent the asset's current value Appraised values are to be used because they represent the historical asset value