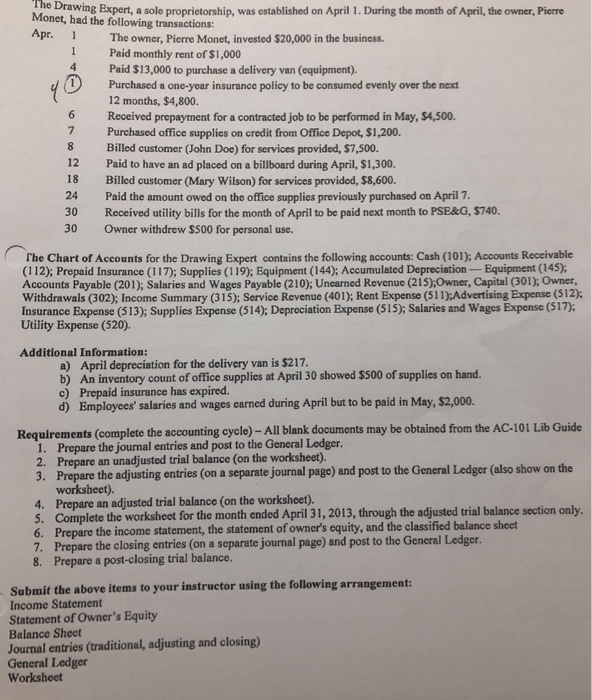

he Drawing Expert, a sole proprietorship, was established on April 1. During the month of April, the owner, Pierre Monet, had the following transactions: Apr. The owner, Pierre Monet, invested $20,000 in the business. 1 Paid monthly rent of $1,000 4 Paid S13,000 to purchase a delivery van (equipment). Purchased a one-year insurance policy to be consumed evenly over the next 12 months, $4,800. 6 Received prepayment for a contracted job to be performed in May, $4,500. 7 Purchased office supplies on credit from Office Depot, $1,200. 8 Billed customer (John Doe) for services provided, $7,500. 12 Paid to have an ad placed on a billboard during April, $1,300. 18 Billed customer (Mary Wilson) for services provided, $8,600. 24 Paid the amount owed on the office supplies previously purchased on April 7 30 Received utility bills for the month of April to be paid next month to PSE&G, $740. 30 Owner withdrew $500 for personal use. he Chart of Accounts for the Drawing Expert contains the following accounts: Cash 101); Accounts Receivable (112); Prepaid Insurance (117); Supplies (119); Equipment (144); Accumulated Depreciation -Equipment (145): Accounts Payable (201); Salaries and Wages Payable (210); Unearned Revenue (215);Owner, Capital (301); Owner, Withdrawals (302); Income Summary (315); Service Revenue (401); Rent Expense (511):Advertising Expense (512): Insurance Expense (513); Supplies Expense (514); Deprociation Expense (515); Salaries and Wages Expense (517 Utility Expense (520). Additional Information: April depreciation for the delivery van is $217. An inventory count of office supplies at April 30 showed $500 of supplies on hand. a) b) c) Prepaid insurance has expired. d) Employces' salaries and wages earned during April but to be paid in May, $2,000. Requirements (complete the accounting cycle)-All blank documents may be obtained from the AC-101 Lib Guide Prepare the journal entries and post to the General Ledger. 2. 1. Prepare an unadjusted trial balance (on the worksheet). 3. Prepare the adjusting entries (on a separate journal page) and post to the General Ledger (also show on the worksheet). 4. Prepare an adjusted trial balance (on the worksheet). 5. Complete the worksheet for the month ended April 31, 2013, through the adjusted trial balance section only 6. Prepare the income statement, the statement of owner's equity, and the classified balance sheet 7. Prepare the closing entries (on a separate journal page) and post to the General Ledger 8. Prepare a post-closing trial balance. Submit the above items to your instructor using the following arrangement: Income Statement Statement of Owner's Equity Balance Shect Journal entries (traditional, adjusting and closing) General Ledger Worksheet