Question

he Stellar Retailing Company uses the allowance method to account for uncollectible accounts. In the past, when the firm was smaller, the direct write-off method

he Stellar Retailing Company uses the allowance method to account for uncollectible accounts. In the past, when the firm was smaller, the direct write-off method was used. But now, following a considerable increase in credit sales, the firm has also experienced an increase in bad debts. The firm is able to use past information about uncollectibles to justify the use of the allowance method. For the most recent year (2012), the firm has developed the following data for analysis.

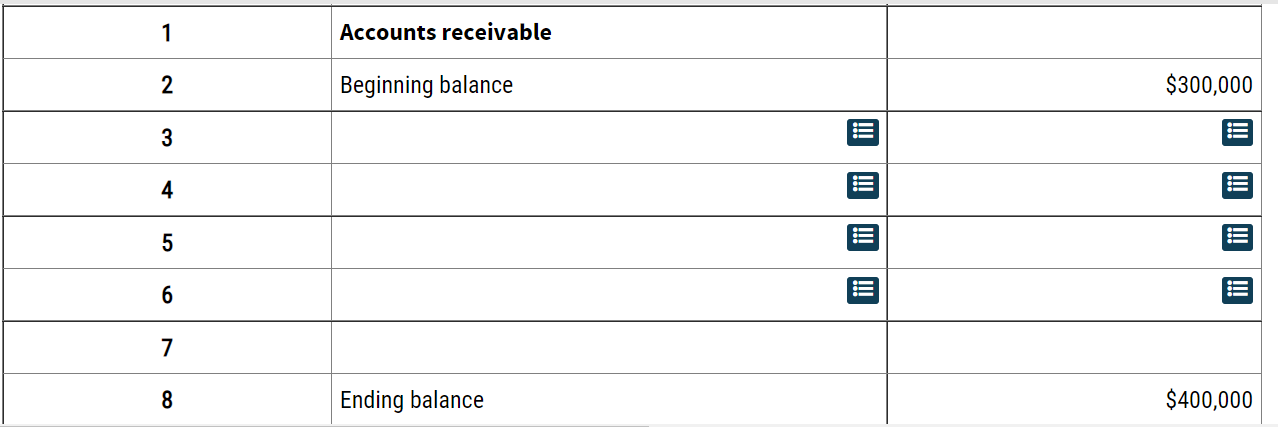

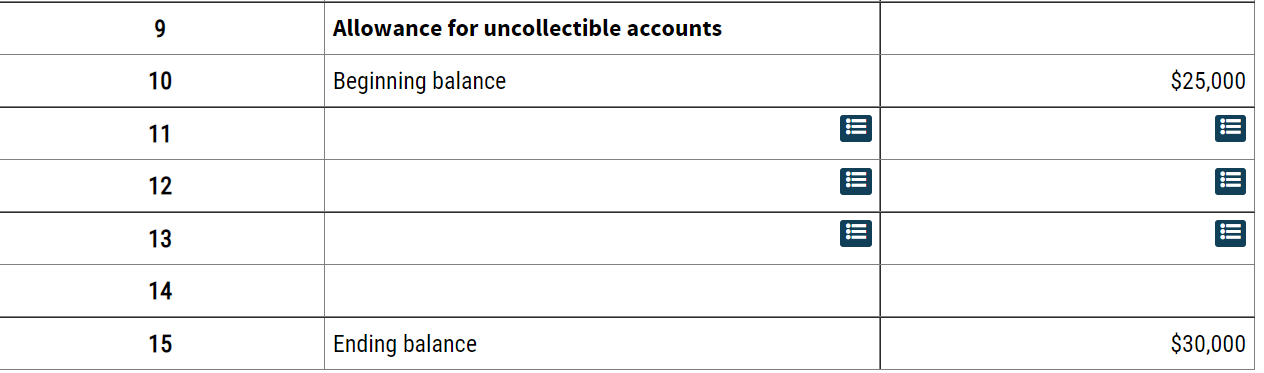

Data from the December 31, 2011 Stellar Retailing Company balance sheet follow:

Accounts receivable $300,000 Allowance for uncollectible accounts 25,000 Data for 2011 Credit sales $3,800,000 Cash sales 500,000 Sales returns and allowances (granted before customer remittance) 450,000 Accounts written off 100,000 Collections on accounts written off in 2011 8,000 Ending balance, accounts receivable 400,000 Ending balance, allowance for uncollectible accounts 30,000 Using the information above, provide the details that would have been posted to the following accounts during 2012. Enter the appropriate account titles in column A by clicking the associated cell and selecting the desired account titles from the list provided. Account titles may be used any number of times or not at all. In the same manner select and enter the appropriate amounts in column B. Use negative values to indicate the amount is subtracted from the account total.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started