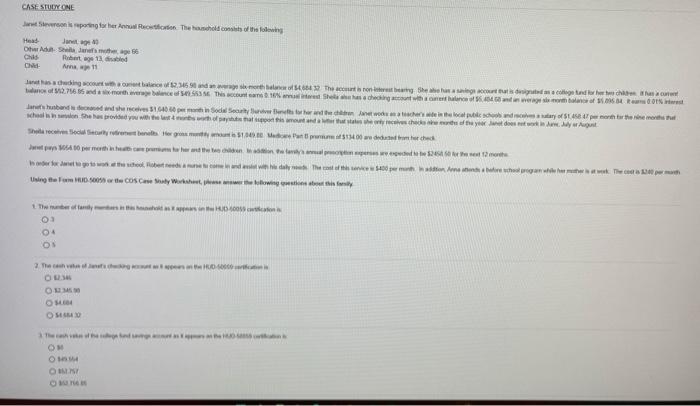

Head-

Janet, age 40

Other Adult- Sheila, Janet's mother, age 66

Child-

Robert, age 13, disabled

Child-

Anna, age 11

Janet has a checking account with a current balance of $2,345.98 and an average six-month balance of $4,684.32. The account is non-interest bearing. She also has a savings account that is designated as a college fund for her two children. It has a current

balance of $52,756.85 and a six-month average balance of $49,553.56. This account earns 0.16% annual interest. Sheila also has a checking account with a current balance of $5,484.68 and an average six-month balance of $5,895.84. It earns 0.01% interest

Janet's husband is deceased and she receives $1,640.60 per month in Social Security Survivor Benefits for her and the children. Janet works as a teacher's aide in the local public schools and receives a salary of $1,458.47 per month for the nine months that

school is in session. She has provided you with the last 4 months worth of paystubs that support this amount and a letter that states she only receives checks nine months of the year. Janet does not work in June, July or August

Sheila receives Social Security retirement benefits. Her gross monthly amount is $1,049.80. Medicare Part B premiums of $134.00 are deducted from her check.

Janet pays $654.00 per month in health care premiums for her and the two children. In addition, the family's annual prescription expenses are expected to be $2458.50 for the next 12 months

In order for Janet to go to work at the school, Robert needs a nurse to come in and assist with his daily needs. The cost of this service is $400 per month. In addition, Anna attends a before school program while her mother is at work. The cost is $240 per month.

Using the Form HUD.50059 or the COS Case Study Worksheet, please answer the following questions about this family.

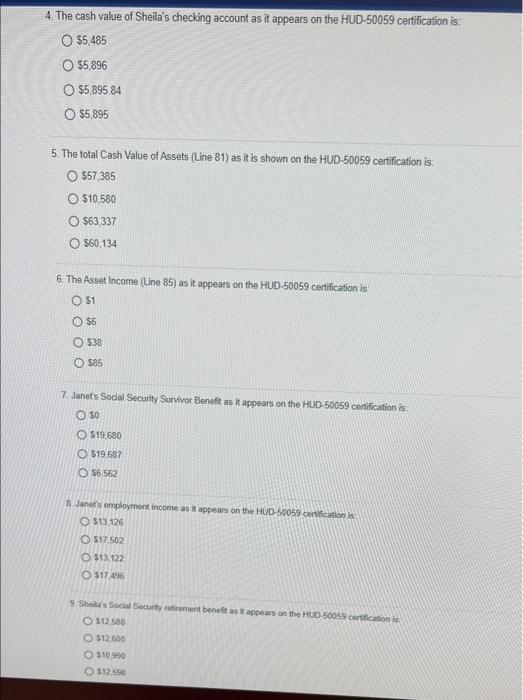

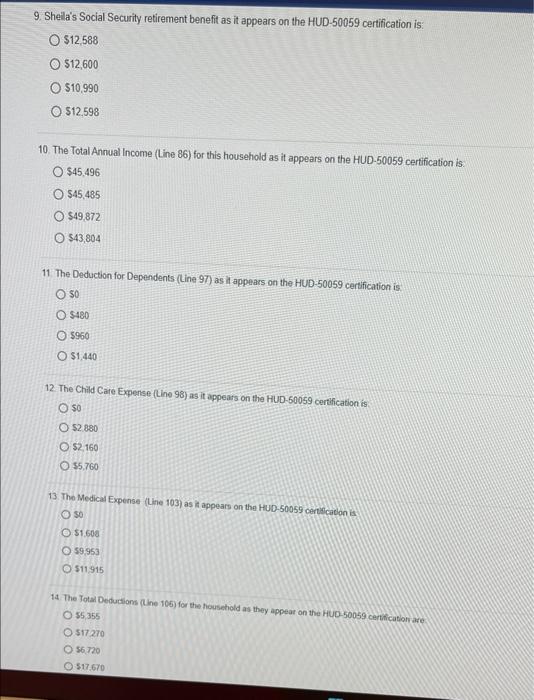

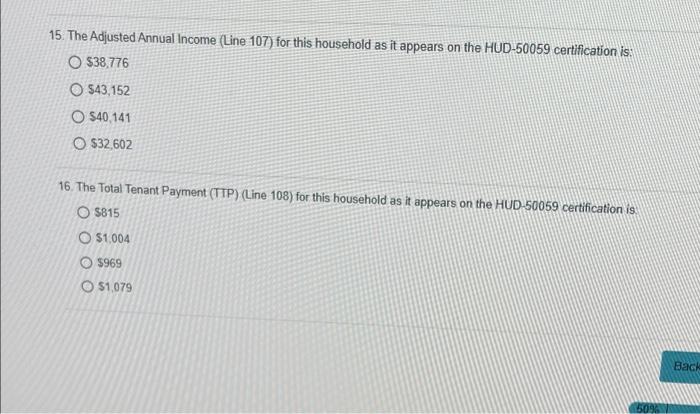

CASE STUDY ONE Severons porn for her to The hold cons of the following Head Jan Oh Ada Smith Chi Robert 11. CN Ana 11 nascing 12.34590 and were the courth roning the helligence dos 12.76666 and hence of this count and he was a checking on a 6.604 dagen af 10 RON Jane's husband and here 1.640 in Social Securities and the watches tein the local polo tary of State or the most who she has provide you with a sportul de yer dem August She recesso il bells grown 1400 reddetto che Jan 10 per month when the westerno werden wys het, het dhe punon fomented with the per Using them the COS CS Worshow they 1. The only the 03 O4 ON ROS OM OM OSO ON OS OM OM 4. The cash value of Sheila's checking account as it appears on the HUD-50059 certification is O 55,485 O $5,896 $5,895.84 O $5,895 5. The total Cash Value of Assets (Line 81) as it is shown on the HUD-50059 certification is $57,385 510.580 O $63,337 560,134 6. The Asset Income (Line 85) as it appears on the HUD-50059 certification is $1 $6 538 585 7 Janet's Social Security Survivor Benefit as it appears on the HUD-50059 certification is 50 $19.680 519 687 56,562 8 Janet's employment income as it appears on the HUD 50059 certification is 513.126 O $17.502 O $13,122 517 496 9. Sheila's Social Security rement benefit as it appears on the HUD-50059 certifications O 512588 512.600 510,950 512.598 9. Sheila's Social Security retirement benefit as it appears on the HUD-50059 certification is $12,588 $12,600 $10.990 512,598 10 The Total Annual Income (Line 86) for this household as it appears on the HUD-50059 certification is O $45.496 $45,485 $49.872 $43,804 11 The Deduction for Dependents (Line 97) as it appears on the HUD-50059 certification is 50 $180 5960 O $1.440 12. The Child Care Expense (Line 98) as it appears on the HUD-50059 certification is O 50 O 52 880 O S2 160 55.760 13 The Medical Expense (Line 103) as it appears on the HUD-50059 certification is 50 51.600 59,953 O $11.915 14. The Total Deductions (Line 105) for the household as they appear on the HUD-50059 certification are 55 355 O 517270 56 720 517670 15. The Adjusted Annual Income (Line 107) for this household as it appears on the HUD-50059 certification is: O $38.776 O 543,152 O $40 141 O $32,602 16. The Total Tenant Payment (TTP) (Line 108) for this household as it appears on the HUD-50059 certification is O $815 O $1,004 $969 O $1,079 Back 5096 CASE STUDY ONE Severons porn for her to The hold cons of the following Head Jan Oh Ada Smith Chi Robert 11. CN Ana 11 nascing 12.34590 and were the courth roning the helligence dos 12.76666 and hence of this count and he was a checking on a 6.604 dagen af 10 RON Jane's husband and here 1.640 in Social Securities and the watches tein the local polo tary of State or the most who she has provide you with a sportul de yer dem August She recesso il bells grown 1400 reddetto che Jan 10 per month when the westerno werden wys het, het dhe punon fomented with the per Using them the COS CS Worshow they 1. The only the 03 O4 ON ROS OM OM OSO ON OS OM OM 4. The cash value of Sheila's checking account as it appears on the HUD-50059 certification is O 55,485 O $5,896 $5,895.84 O $5,895 5. The total Cash Value of Assets (Line 81) as it is shown on the HUD-50059 certification is $57,385 510.580 O $63,337 560,134 6. The Asset Income (Line 85) as it appears on the HUD-50059 certification is $1 $6 538 585 7 Janet's Social Security Survivor Benefit as it appears on the HUD-50059 certification is 50 $19.680 519 687 56,562 8 Janet's employment income as it appears on the HUD 50059 certification is 513.126 O $17.502 O $13,122 517 496 9. Sheila's Social Security rement benefit as it appears on the HUD-50059 certifications O 512588 512.600 510,950 512.598 9. Sheila's Social Security retirement benefit as it appears on the HUD-50059 certification is $12,588 $12,600 $10.990 512,598 10 The Total Annual Income (Line 86) for this household as it appears on the HUD-50059 certification is O $45.496 $45,485 $49.872 $43,804 11 The Deduction for Dependents (Line 97) as it appears on the HUD-50059 certification is 50 $180 5960 O $1.440 12. The Child Care Expense (Line 98) as it appears on the HUD-50059 certification is O 50 O 52 880 O S2 160 55.760 13 The Medical Expense (Line 103) as it appears on the HUD-50059 certification is 50 51.600 59,953 O $11.915 14. The Total Deductions (Line 105) for the household as they appear on the HUD-50059 certification are 55 355 O 517270 56 720 517670 15. The Adjusted Annual Income (Line 107) for this household as it appears on the HUD-50059 certification is: O $38.776 O 543,152 O $40 141 O $32,602 16. The Total Tenant Payment (TTP) (Line 108) for this household as it appears on the HUD-50059 certification is O $815 O $1,004 $969 O $1,079 Back 5096